During the 4th Workshop on Financial Econometrics and Empirical Modeling of Financial Markets: New Challenges for Monetary Policy and Financial Markets that took place at the beginning of this week in Freiberg, I presented a recent paper, written with William Ginn, linking monetary policy and geopolitical risk shocks. Link to the paper on SSRN: https://lnkd.in/eEMYkz7h.

⭐⭐⭐ Key takeaways ⭐⭐⭐

▶️ The panel LP model demonstrates that the reaction of monetary policy depends on the time horizon, especially in the developed country group

▶️ Following a GPR shock, the central bank is more accommodative to limit the negative effects on consumer sentiment

▶️ In the medium term, the central bank is more interested in limiting inflation pressures, which may be due to second-round effects

▶️ The time-varying local projections confirm these findings for the Bank of England, the Bank of Canada, and the Bank of Israel

▶️ At both short- and medium-term horizons, significant instabilities are detected in the impulse response functions before the GFC when the oil prices were high, and during large-scale geopolitical events, like 9/11 or the London Bombings

▶️ Policymakers in charge of monetary policies are increasingly vigilant about developments in the geopolitical arena

Joscha Beckmann and Robert Czudaj made two excellent remarks on the effect of geopolitical shocks on consumer confidence and the relative impact of 9/11 in advanced and emerging economies.

So, with William, we decided to take a look at the impact of geopolitical shocks on consumer confidence in the US.

I took the series the University of Michigan: Consumer Sentiment (UMCSENT) series and the geopolitical risk series specific to the US (GPR_US).

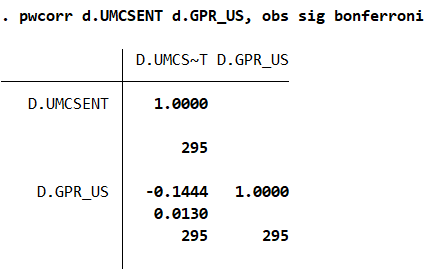

The correlation between a change in the GPR index and the consumer sentiment is negative and significant over a sample spanning the period from January 2000 to August 2024.

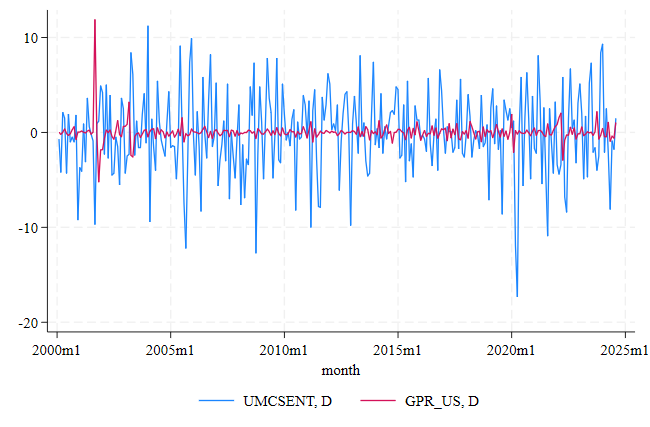

We can also take a look at the time series graph for the variation in the consumer sentiment index and the geopolitical risk index:

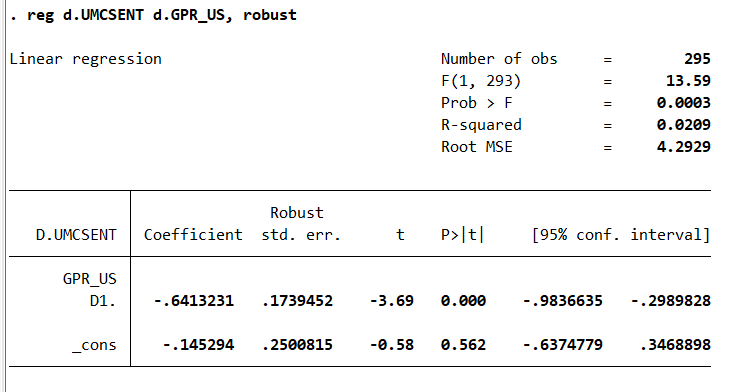

The univariate regressions over the sample confirm the correlation results:

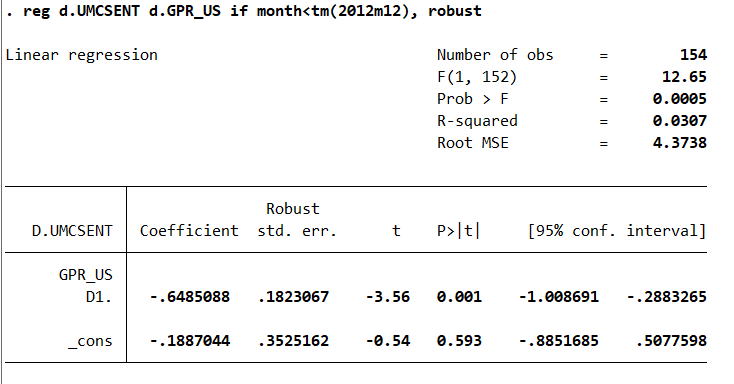

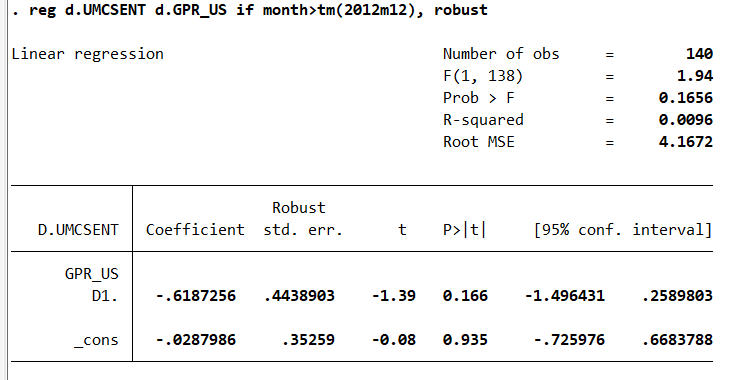

As underlined by Robert, the biggest shock in the sample is 9/11 so it may be worthwhile to cut the sample into roughly two equal parts:

In the second part of the sample, smaller shocks are observed, so the correlation is less significant, however, the coefficient is very stable around -.62 versus -.64.

These findings provide some validation to the consumer sentiment channel and reveal interesting nonlinearities. Consumer sentiment is negatively correlated to geopolitical risk shocks, especially when these shocks are large, like the 9/11 attacks.

As mentioned above, following a GPR shock, the central bank is more accommodative to limit the short-lived negative effects on consumer sentiment. These shocks are deflationary in the short run.