“Data! Data! Data!” he cried impatiently. “I can’t make bricks without clay.”

Sherlock Holmes.

The Adventure of the Copper Beeches, Sir Arthur Conan Doyle (1892).

In my previous post, I tried to explain in the simplest way Burgernomics. Here I reproduce the R code and the graphs used in the Big Mac Index made by the Economist.

For the July 2020 update, there are two source files (Comma-separated values format):

R Script for the results

# Generate data for the Big Mac Index

setwd("C:/Users/EconJamel/R/big-mac-data-2020-07")

library('tidyverse')

library('data.table')

library(dplyr)

library(magrittr)

library(ggplot2)

big_mac_countries = c('ARG', 'AUS', 'BRA', 'GBR', 'CAN', 'CHL', 'CHN', 'CZE', 'DNK',

'EGY', 'HKG', 'HUN', 'IDN', 'ISR', 'JPN', 'MYS', 'MEX', 'NZL',

'NOR', 'PER', 'PHL', 'POL', 'RUS', 'SAU', 'SGP', 'ZAF', 'KOR',

'SWE', 'CHE', 'TWN', 'THA', 'TUR', 'ARE', 'USA', 'COL', 'CRI',

'PAK', 'LKA', 'UKR', 'URY', 'IND', 'VNM', 'GTM', 'HND', #VNZ

'NIC', 'AZE', 'BHR', 'HRV', 'JOR', 'KWT', 'LBN', 'MDA', 'OMN',

'QAT', 'ROU', 'EUZ')

base_currencies = c('USD', 'EUR', 'GBP', 'JPY', 'CNY')

#NB: Venezuela removed.

# Data importation.

big_mac_data = fread('./source-data/big-mac-source-data.csv', na.strings = '#N/A',

# sort by date and then by country name, for easy reading;

# index on currency_code for faster joining

key = 'date,name', index = 'currency_code') %>%

# remove lines where the local price is missing

.[!is.na(local_price)]

tail(big_mac_data)

latest_date = big_mac_data$date %>% max

latest_date

# Raw index.

big_mac_data[, dollar_price := local_price / dollar_ex]

tail(big_mac_data)

big_mac_index = big_mac_data[

!is.na(dollar_price) & iso_a3 %in% big_mac_countries

,.(date, iso_a3, currency_code, name, local_price, dollar_ex, dollar_price)]

for(currency in base_currencies) {

big_mac_index[

,

(currency) := dollar_price / .SD[currency_code == currency]$dollar_price - 1,

by=date

]

}

big_mac_index[, (base_currencies) := lapply(.SD, round, 3L), .SDcols=base_currencies]

tail(big_mac_index)

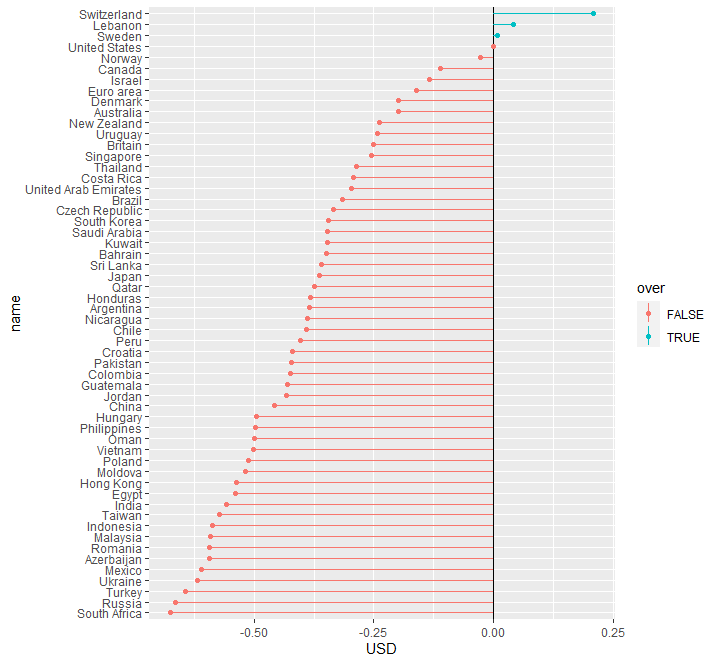

to_plot = big_mac_index[date == latest_date]

to_plot$name = factor(to_plot$name, levels=to_plot$name[order(to_plot$USD)])

ggplot(to_plot[, over := USD > 0], aes(x=name, y=USD, color=over)) +

geom_hline(yintercept = 0) +

geom_linerange(aes(ymin=0, ymax=USD)) +

geom_point() +

coord_flip()

fwrite(big_mac_index, './output-data/big-mac-raw-index.csv')

# GDP-adjusted index.

big_mac_gdp_data = big_mac_data[GDP_dollar > 0]

regression_countries = c('ARG', 'AUS', 'BRA', 'GBR', 'CAN', 'CHL', 'CHN', 'CZE', 'DNK',

'EGY', 'EUZ', 'HKG', 'HUN', 'IDN', 'ISR', 'JPN', 'MYS', 'MEX',

'NZL', 'NOR', 'PER', 'PHL', 'POL', 'RUS', 'SAU', 'SGP', 'ZAF',

'KOR', 'SWE', 'CHE', 'TWN', 'THA', 'TUR', 'USA', 'COL', 'PAK',

'IND', 'AUT', 'BEL', 'NLD', 'FIN', 'FRA', 'DEU', 'IRL', 'ITA',

'PRT', 'ESP', 'GRC', 'EST')

big_mac_gdp_data = big_mac_gdp_data[iso_a3 %in% regression_countries]

head(big_mac_gdp_data)

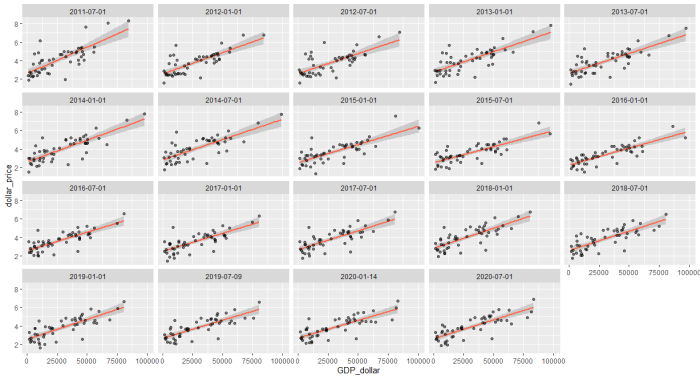

ggplot(big_mac_gdp_data, aes(x=GDP_dollar, y=dollar_price)) +

facet_wrap(~date) +

geom_smooth(method = lm, color='tomato') +

geom_point(alpha=0.5)big_mac_gdp_data[,adj_price := lm(dollar_price ~ GDP_dollar)$fitted.values, by=date]

tail(big_mac_gdp_data)

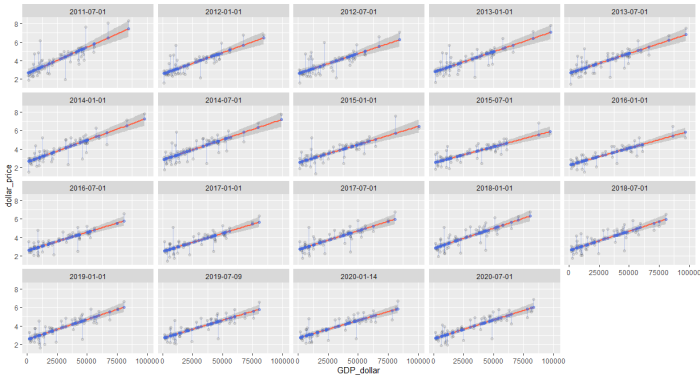

ggplot(big_mac_gdp_data, aes(x=GDP_dollar, y=dollar_price)) +

facet_wrap(~date) +

geom_smooth(method = lm, color='tomato') +

geom_linerange(aes(ymin=dollar_price, ymax=adj_price), color='royalblue', alpha=0.3) +

geom_point(alpha=0.1) +

geom_point(aes(y=adj_price), color='royalblue', alpha=0.5)big_mac_adj_index = big_mac_gdp_data[

!is.na(dollar_price) & iso_a3 %in% big_mac_countries

,.(date, iso_a3, currency_code, name, local_price, dollar_ex, dollar_price, GDP_dollar, adj_price)]

for(currency in base_currencies) {

big_mac_adj_index[

,

(currency) := (dollar_price / adj_price) /

.SD[currency_code == currency, dollar_price / adj_price] - 1,

by=date

]

}

big_mac_adj_index[, (base_currencies) := lapply(.SD, round, 3L), .SDcols=base_currencies]

tail(big_mac_index)

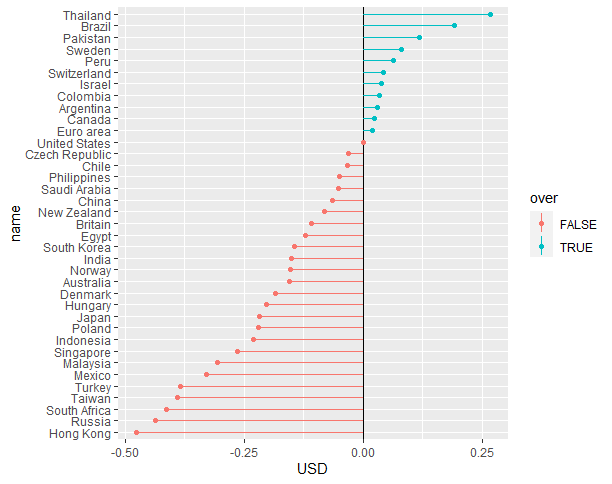

to_plot = big_mac_adj_index[date == latest_date]

to_plot$name = factor(to_plot$name, levels=to_plot$name[order(to_plot$USD)])

ggplot(to_plot[, over := USD > 0], aes(x=name, y=USD, color=over)) +

geom_hline(yintercept = 0) +

geom_linerange(aes(ymin=0, ymax=USD)) +

geom_point() +

coord_flip()

fwrite(big_mac_adj_index, './output-data/big-mac-adjusted-index.csv')

big_mac_full_index = merge(big_mac_index, big_mac_adj_index,

by=c('date', 'iso_a3', 'currency_code', 'name', 'local_price', 'dollar_ex', 'dollar_price'),

suffixes=c('_raw', '_adjusted'),

all.x=TRUE

)

fwrite(big_mac_full_index, './output-data/big-mac-full-index.csv')R Script for exporting to Excel

# This script generates the Excel file for download

install.packages("devtools")

devtools::install_github("kassambara/r2excel")

library('r2excel')

library('magrittr')

library('data.table')

setwd("C:/Users/EconJamel/R/big-mac-data-2020-07")

data = fread('./output-data/big-mac-full-index.csv') %>%

.[, .(

Country = name,

iso_a3,

currency_code,

local_price,

dollar_ex,

dollar_price,

dollar_ppp = dollar_ex * dollar_price / .SD[currency_code == 'USD']$dollar_price,

GDP_dollar,

dollar_valuation = USD_raw * 100,

euro_valuation = EUR_raw * 100,

sterling_valuation = GBP_raw * 100,

yen_valuation = JPY_raw * 100,

yuan_valuation = CNY_raw * 100,

dollar_adj_valuation = USD_adjusted * 100,

euro_adj_valuation = EUR_adjusted * 100,

sterling_adj_valuation = GBP_adjusted * 100,

yen_adj_valuation = JPY_adjusted * 100,

yuan_adj_valuation = CNY_adjusted * 100

), by=date]

dates = data$date %>% unique

wb = createWorkbook(type='xls')

for(sheetDate in sort(dates, decreasing = T)) {

dateStr = sheetDate %>% strftime(format='%b%Y')

sheet = createSheet(wb, sheetName = dateStr)

xlsx.addTable(wb, sheet, data[date == sheetDate, -1], row.names=FALSE, startCol=1)

}

saveWorkbook(wb, paste0('./output-data/big-mac-',max(dates),'.xls'))I get the following file that gather all the previous results:

3 Comments

Hi All,

I am running the Big Mac index code and consistently get the attached error! I am new to R and not sure what I am doing wrong as I have copied the code as is and only changed the location of where R should read the CSV from as it is saved on my laptop.

[]

Would really appreciate any assistance. I am very interested in the Big Mac index from an economics point of view

Thanks for your interest, I made a newer version of the R code here: big-mac-data-2020-07.zip

[…] Burgernomics: R codes and datasets July 20, 2020 […]