Last week, I noticed the publication of a new research in Energy Economics by Hakan Yilmazkuday: Geopolitical risks and energy uncertainty: Implications for global and domestic energy prices. Energy Economics, 107985. In his research, he shows that geopolitical risk shocks affect the energy uncertainty index introduced in: Dang, T. H. N., Nguyen, C. P., Lee, G. S., Nguyen, B. Q., & Le, T. T. (2023). Measuring the energy-related uncertainty index. Energy Economics, 124, 106817. This index can be downloaded here: www.policyuncertainty.com.

Besides, Yilmazkuday’s results indicate that “Shocks to global geopolitical risk have insignificant effects on global energy prices.” Basically, geopolitical risk shock only have indirect effects on the oil price. This echoes a discussion that I had with Vladimir Borgy during my short trip to the Banque de France, last week. Following a geopolitical risk shock, the central bank is very careful about the fluctuation and the uncertainty in the oil markets and its transmission to the domestic inflation.

I wanted to test this assumption for the impact of geopolitical risk specific to China on the oil price, using the data and the Stata codes of Mignon and Saadaoui (2024). The idea is to test the effects of geopolitical risk shocks on the oil price after controlling for the “Energy uncertainty index” of Dang et al. (2023). If the impulse response functions (IRF) cease to be significant after adjusting for the energy uncertainty, the geopolitical risk shock will only have indirect effects, which is perfectly acceptable and logical. If the IRF remains significant, then the geopolitical risk shock also have direct effects, that may transit through the expectations of firms and households.

For those interested in the coding aspect, you can refer to the following EconMacro blog:

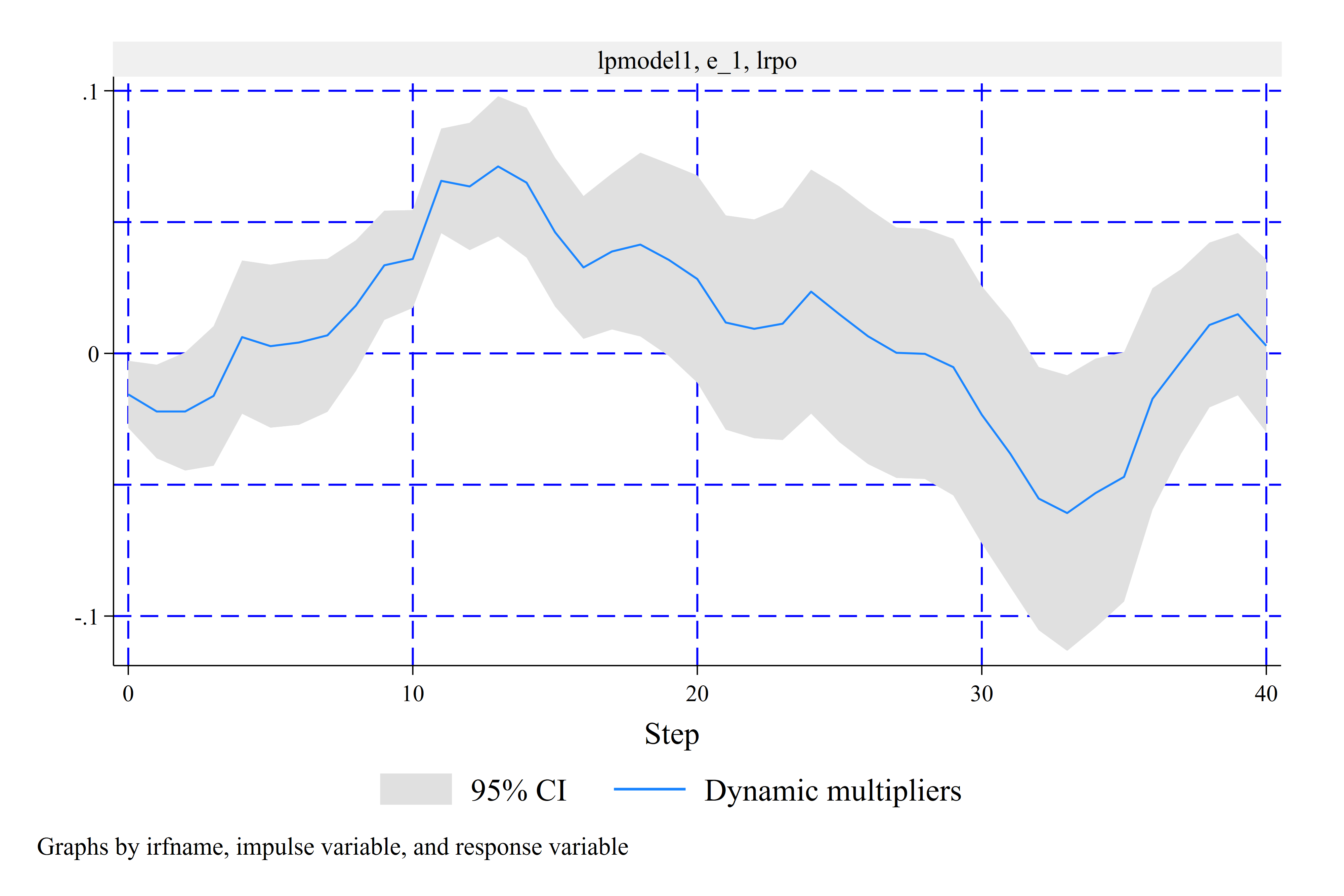

We use the same specification and lags as in the following article: Mignon, V., & Saadaoui, J. (2024): How do political tensions and geopolitical risks impact oil prices? Energy Economics, 129, 107219. In the local projections exercises, the results are very similar for the political relation index (PRI) after controlling for the Dang et al. (2023)’s energy uncertainty index (global and GDP weighted):

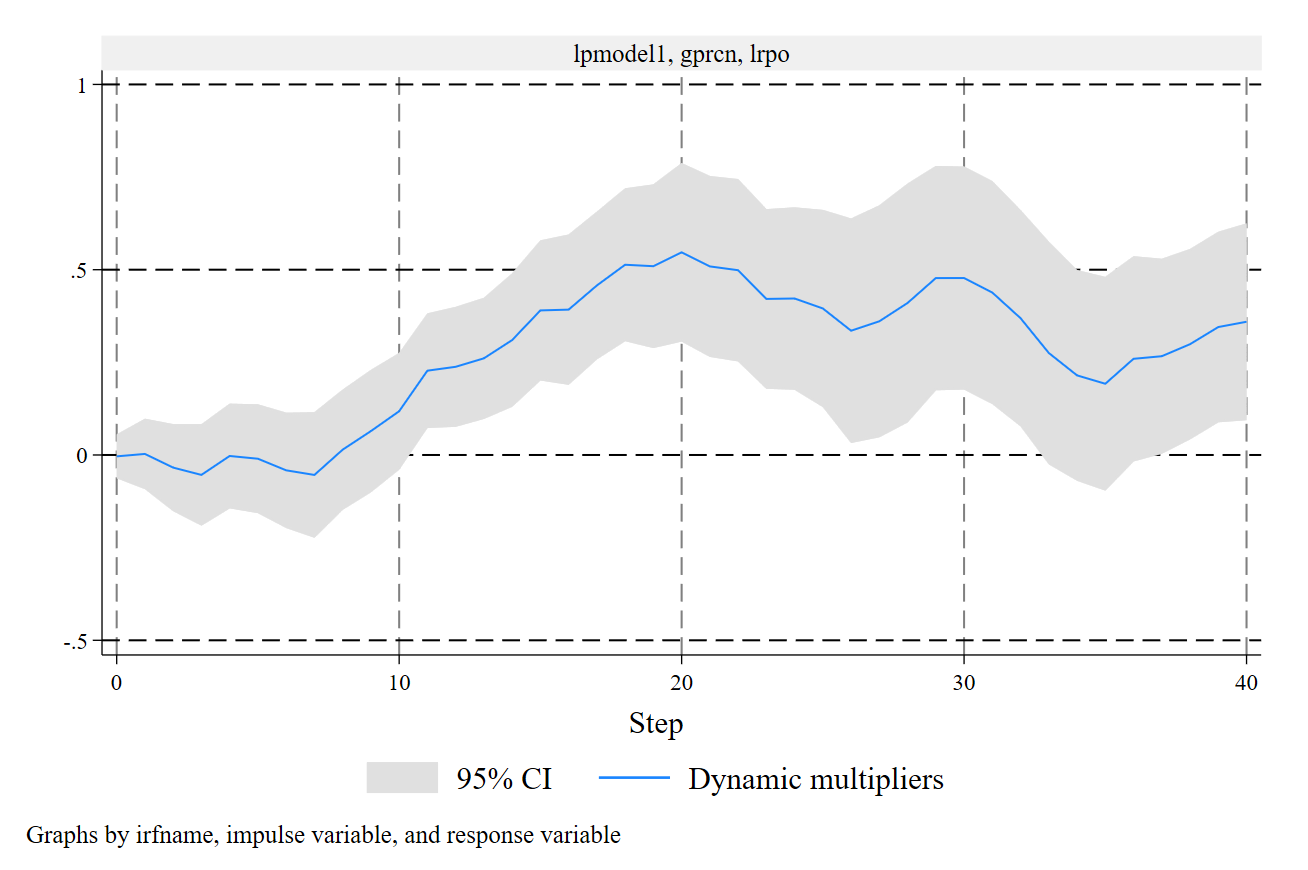

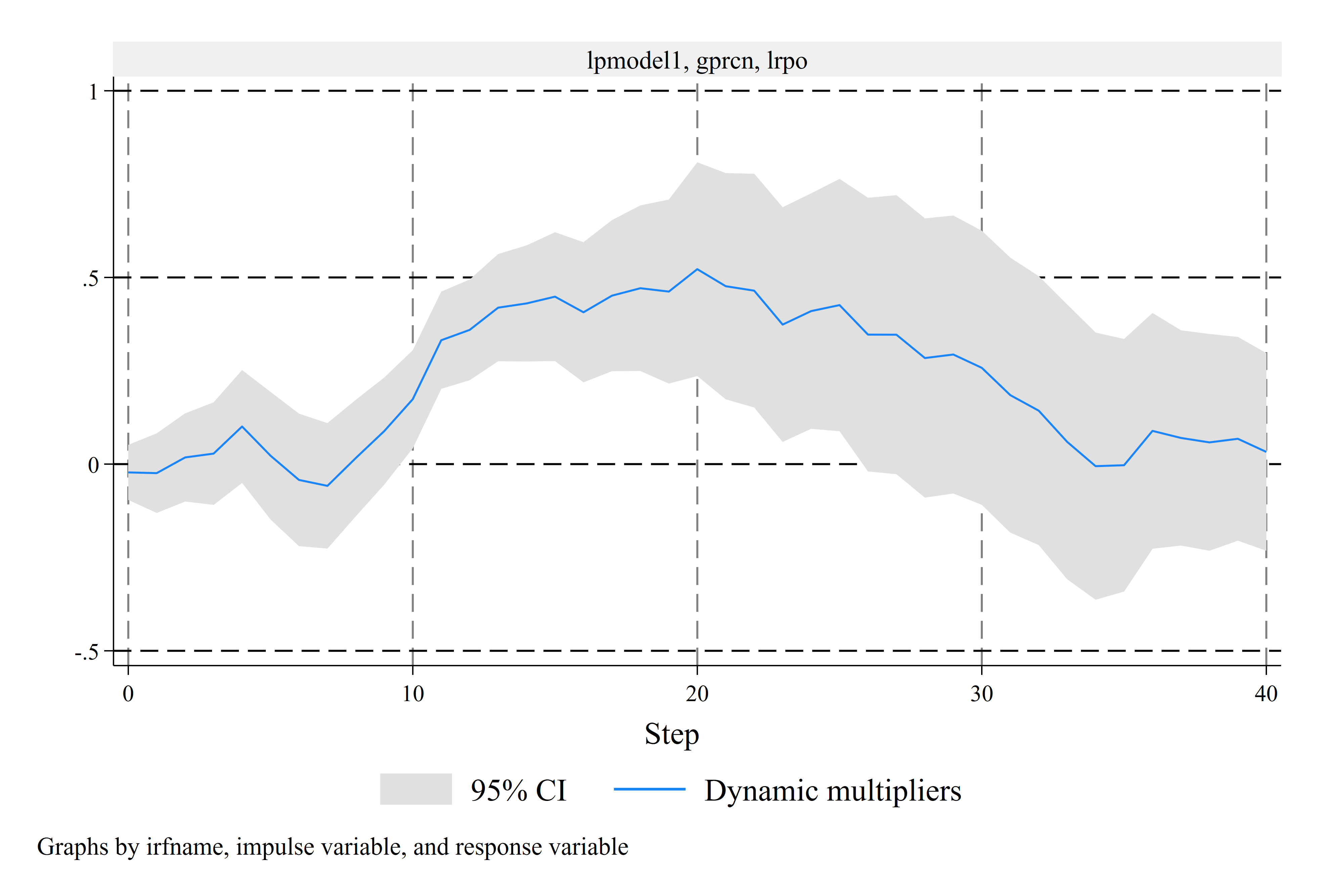

In the same way, the results are similar to those of Mignon and Saadaoui (2024) for the geopolitical risks (GPR) shocks specific to China after controlling for Dang et al. (2023)’s energy uncertainty index (global and GDP weighted):

Using the one-step approach for the GPR shocks specific to China without energy uncertainty:

Using the one-step approach for the GPR shocks specific to China with energy uncertainty:

Conclusion: these results indicate that shocks to geopolitical risk specific to China have significant effects on the oil prices, that may transit through the expectations of firms and households.