A recent Bank of England working paper by Simon Lloyd and Ed Manuel suggests using a one-step approach with appropriate controls in the LP estimations.

“[…] this two-step ‘shock-first’ approach can be problematic for identification and inference relative to a one-step procedure which simply adds appropriate controls directly in the outcome regression.“

“More generally, one and two-step estimates can differ due to omitted-variable bias in the latter when additional controls are included in the second stage or when employing non-OLS estimators.“

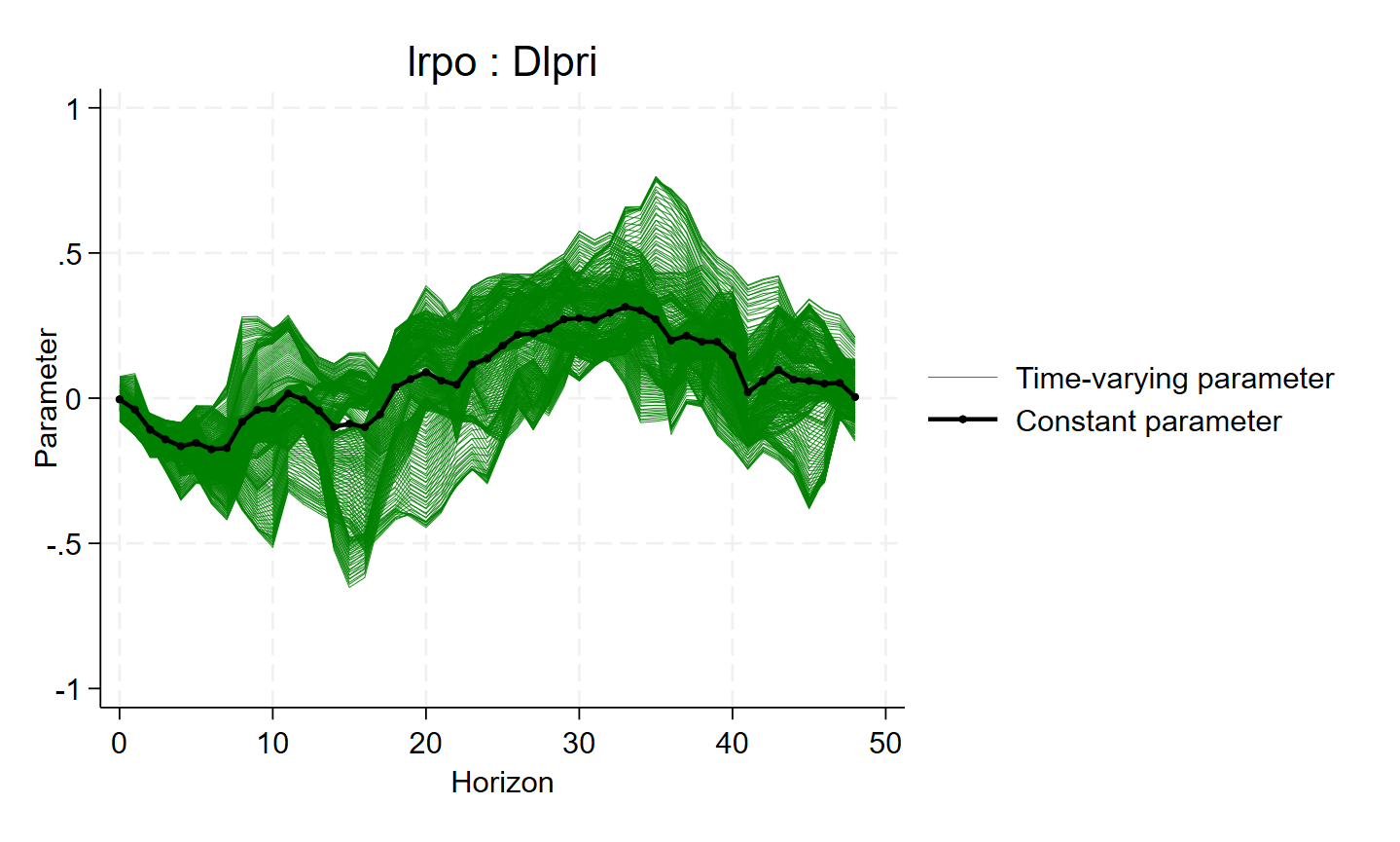

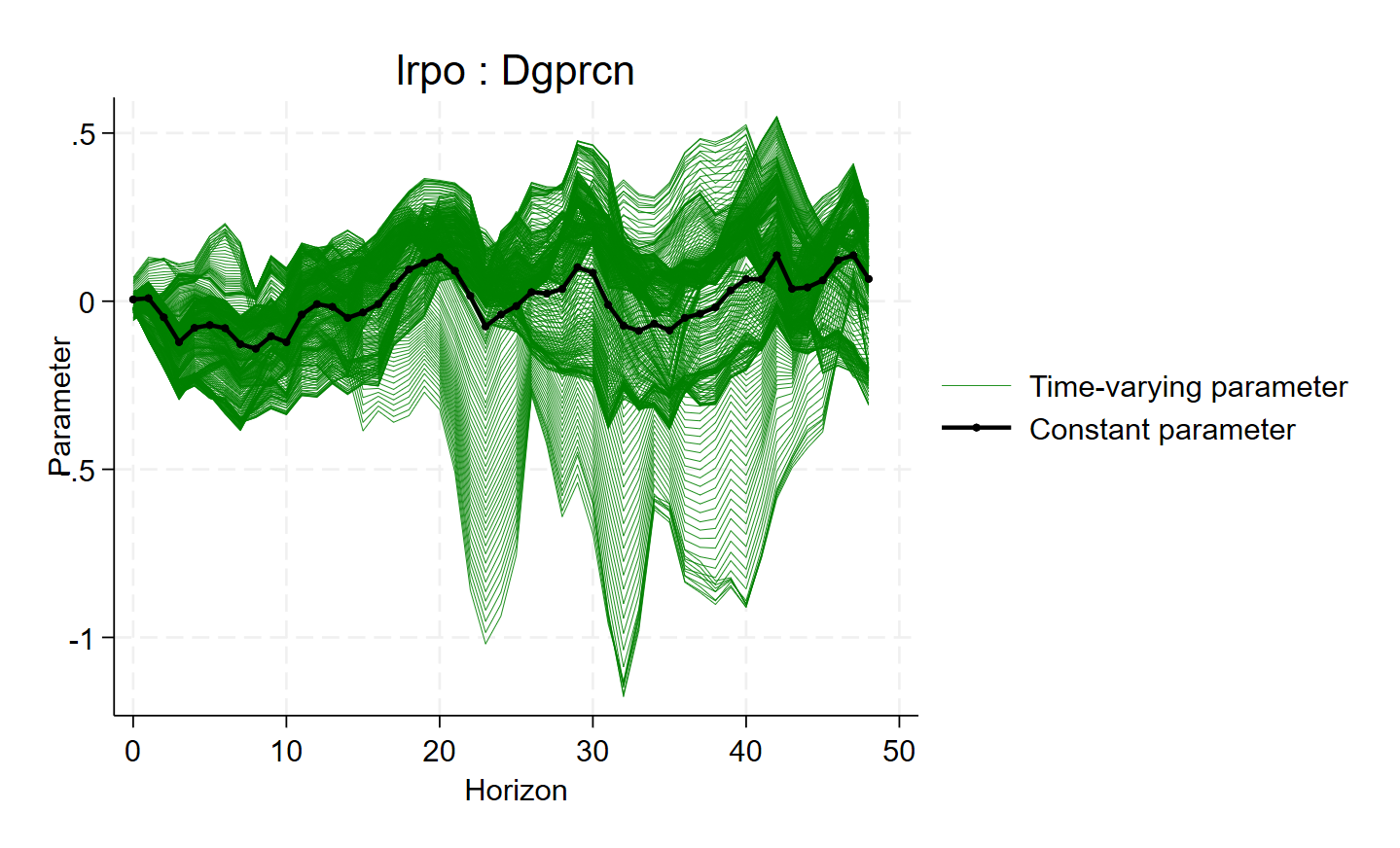

I ran some tests with a recent WP of mine, to compare the 2-step and the 1-step approaches, and my results are robust. The dynamics between the two approaches are very similar. Instead of using the identified shocks, I used the variation ( \Delta ) of the political tensions and the geopolitical risks variables, successively:

Jamel Saadaoui (10 August 2024), The Impact of Political Tensions and Geopolitical Risks on Oil Prices in Unstable Environments. SSRN Working Paper 4921791, see this old post with the results of the two-step approach: