Recently, new research published in the Journal of International Economics shows that the Nickell bias affect panel local projections even when the lagged term for the dependent variable is not included in the estimates. I recently wrote a blog about the bias correction that they proposed. Their bias correction does not rely on instruments.

Regarding my own recent works, a natural application of this correction is my recent work on the fiscal consequences of climate vulnerability. I made a series of blogs about it. The latest version of the working paper is available here. What happens to the results in Figures 6 and 8 in the paper when I apply the split-panel jackknife (SPJ) correction.

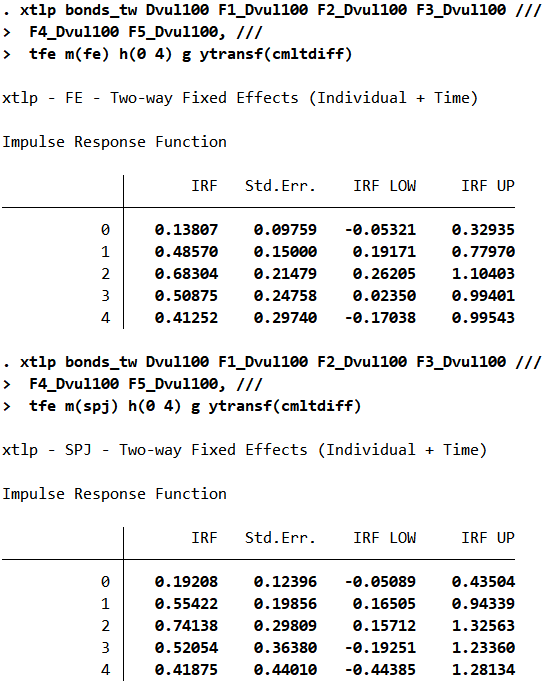

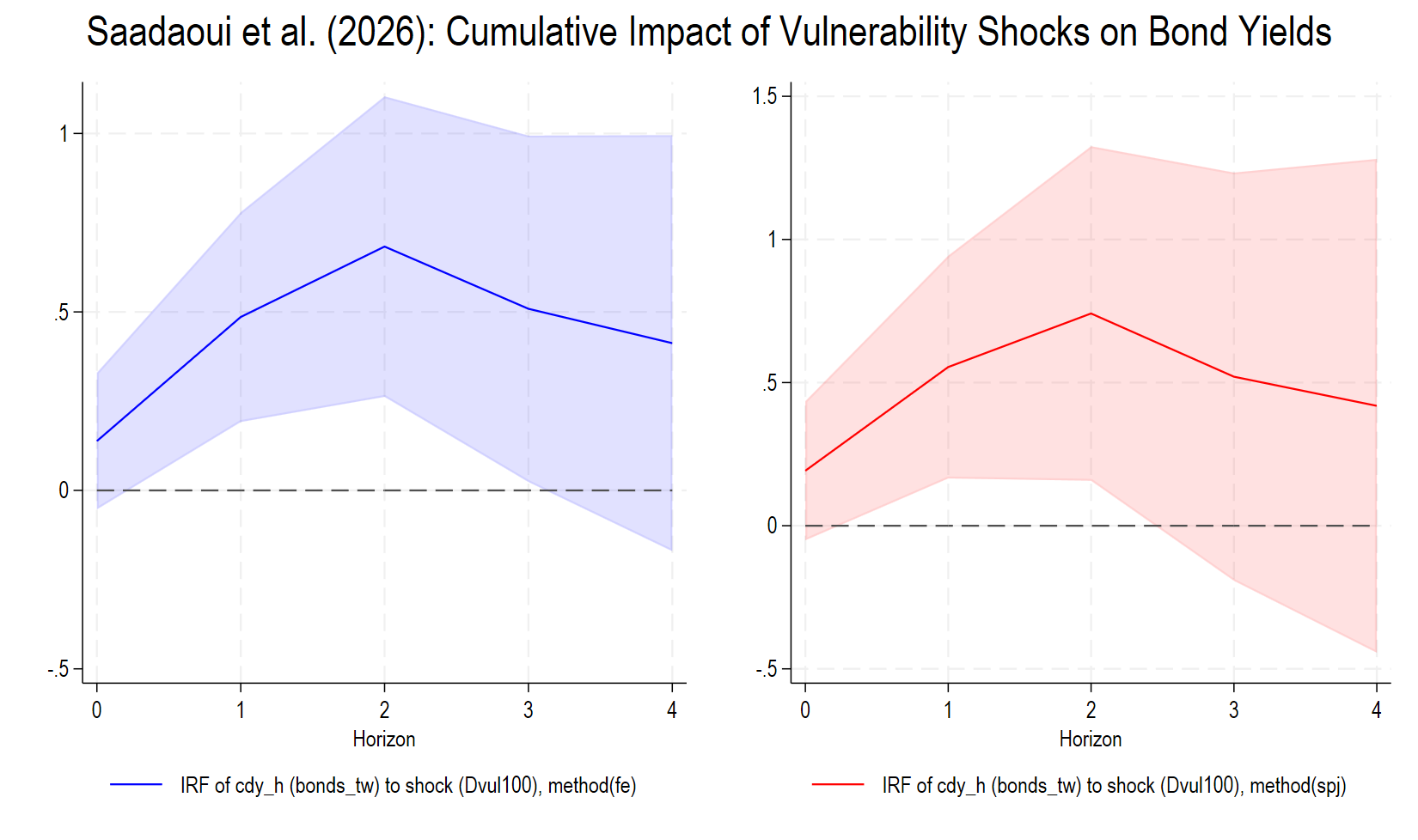

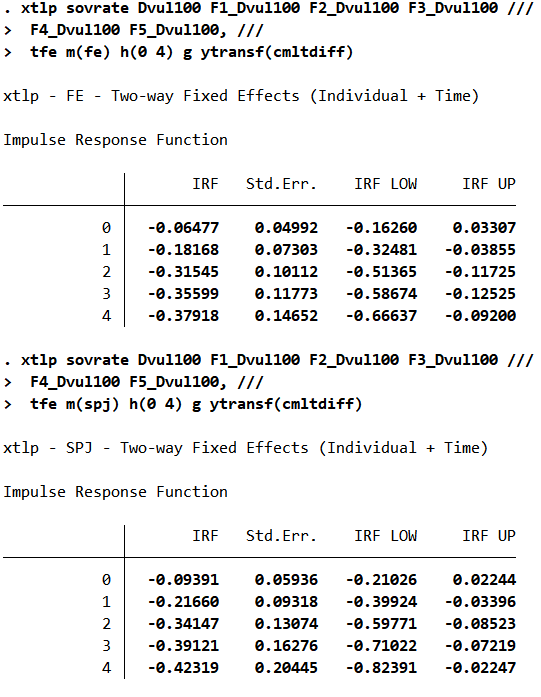

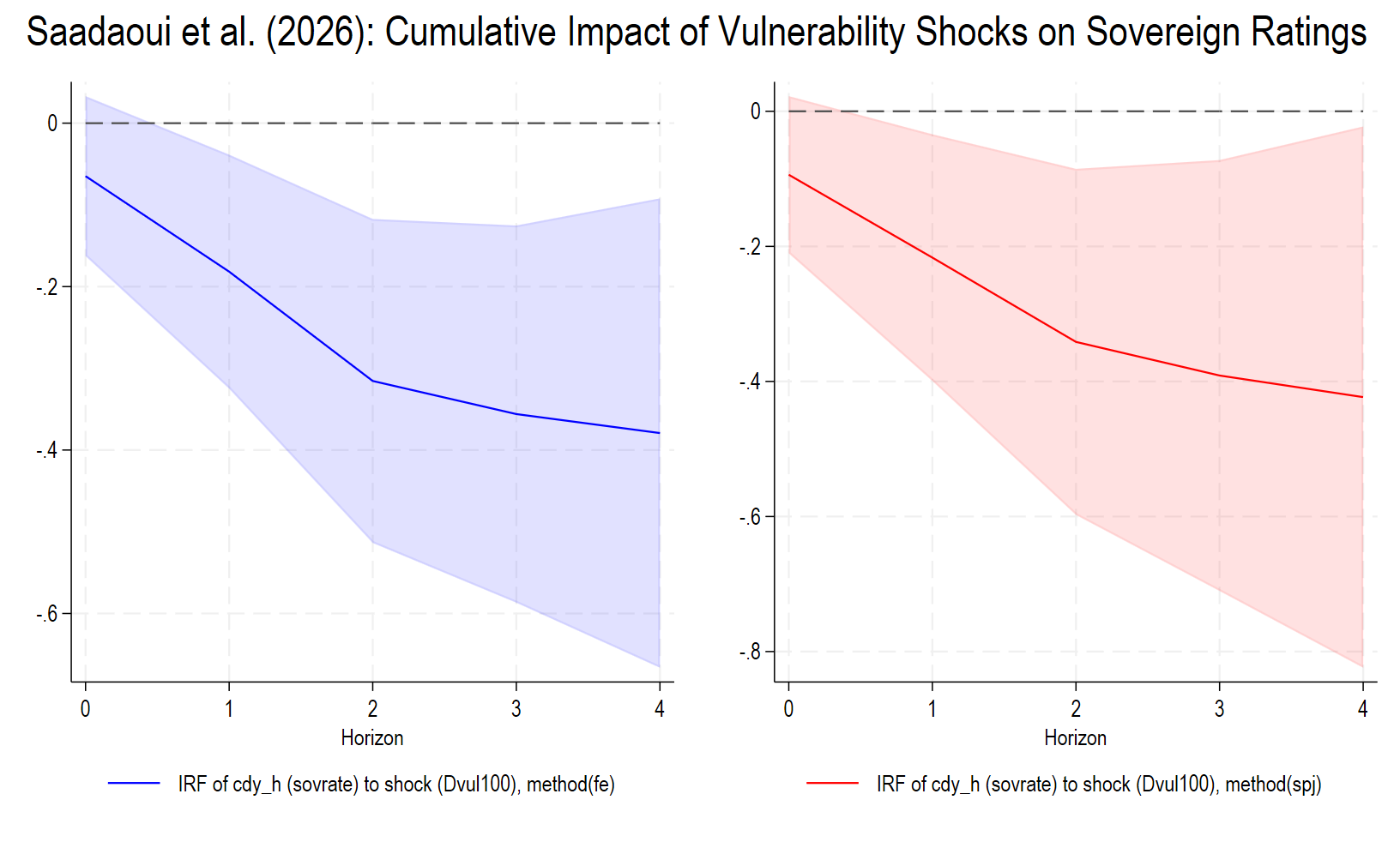

In the following, I use the same specifications as in Figures 6 and 8. Besides, I will look at the cumulative differences.

The tables and the figures above report the results for the panel local projections estimates without and with the SPJ correction. The results are line with those of the paper. The cumulative effect is stronger with the SPJ correction, reducing the attenuation bias. Climate vulnerability shocks increase the bond yields.

The tables and the figures above report the results for the panel local projections estimates without and with the SPJ correction. The results are line with those of the paper. The cumulative effect is stronger with the SPJ correction, reducing the attenuation bias. Climate vulnerability shocks deteriorates sovereign ratings.

I am also very happy to share that the paper has just been accepted in Energy Economics. That’s my first contribution in climate economics. You can quote the paper as follows:

Saadaoui, J., Beirne, J., Park, D., & Uddin, G. S. (2026). Impact of Climate Vulnerability on Fiscal Risk: Do Religious Tensions and Financial Development Matter? Accepted in Energy Economics.

**# This code has been written when I received the news that the paper has been accepted in Energy Economics

cls

* Set the directory and use the data from the paper

clear

cd C:\Users\jamel\Dropbox\Latex\PROJECTS\24-03-emft-adb-private\

cd manuscript\SI_EE\xtlp\

use data_EE.dta

* SPJ Local Projections - split-panel jackknife (SPJ)

net install xtlp, ///

from("https://raw.githubusercontent.com/shenshuuu/panel-local-projection-stata/main/") ///

replace

forvalues i = 1(1)5 {

gen F`i'_Dvul100 = F`i'.Dvul100

}

xtlp bonds_tw Dvul100 F1_Dvul100 F2_Dvul100 F3_Dvul100 ///

F4_Dvul100 F5_Dvul100, ///

tfe m(fe) h(0 4) g ytransf(cmltdiff)

xtlp bonds_tw Dvul100 F1_Dvul100 F2_Dvul100 F3_Dvul100 ///

F4_Dvul100 F5_Dvul100, ///

tfe m(spj) h(0 4) g ytransf(cmltdiff)

graph combine IRF_fe IRF_spj, name(Figure1, replace) title("Saadaoui et al. (2026): Cumulative Impact of Vulnerability Shocks on Bond Yields")

xtlp sovrate Dvul100 F1_Dvul100 F2_Dvul100 F3_Dvul100 ///

F4_Dvul100 F5_Dvul100, ///

tfe m(fe) h(0 4) g ytransf(cmltdiff)

xtlp sovrate Dvul100 F1_Dvul100 F2_Dvul100 F3_Dvul100 ///

F4_Dvul100 F5_Dvul100, ///

tfe m(spj) h(0 4) g ytransf(cmltdiff)

graph combine IRF_fe IRF_spj, name(Figure2, replace) title("Saadaoui et al. (2026): Cumulative Impact of Vulnerability Shocks on Sovereign Ratings")

****************************************************************The code above is reproduced in the sake of pedagogy and clarity. Comments and remarks are very welcome.