This research has been motivated by two lines of criticism about equilibrium exchange rates, the first one bears on the uncertainties surrounding the measurement of equilibrium exchange rates and, the second one relates to the idea that one peculiar model of equilibrium exchange rate is better than the others.

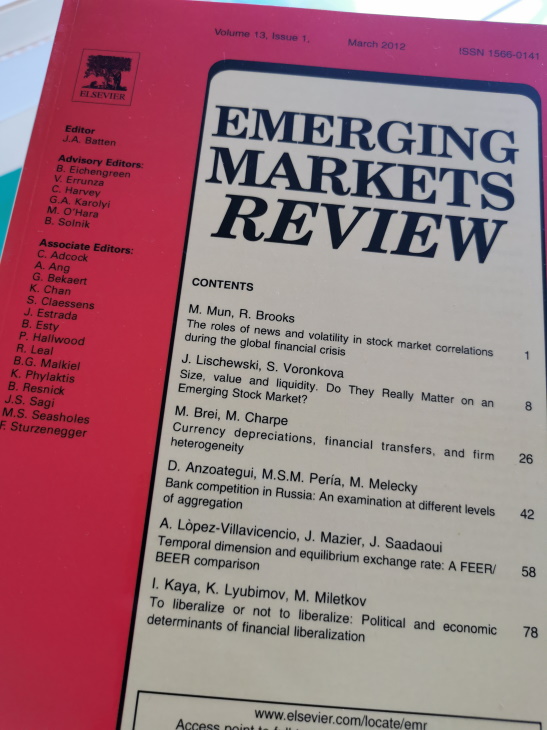

Abstract. This paper investigates the temporal links between two models of equilibrium exchange rate, namely the behavioral and the fundamental approaches. Our results show that, even though in the long-run they are closely related, important differences are observed for some countries and/or some periods. Contrary to previous contributions, we analyze the factors that explain this disconnection. We outline structural changes in matter of competitiveness, the dynamics of foreign assets and valuation effects as explanations. This novel evidence is important if the two approaches for assessing misalignments are used for policy decisions such as setting tariffs to cope with the “currency war.”

1 Comment

[…] postTemporal Dimension and Equilibrium Exchange ratesNewer postUnknown […]