Very honored to contribute my eighth guest blog post on Econbrowser, written with Laurent Ferrara. I am deeply grateful to Menzie Chinn. Remarks and comments are welcome, as always: https://econbrowser.com/.

The other posts are available here: https://econbrowser.com/JamelSaadaoui.

From the blog:

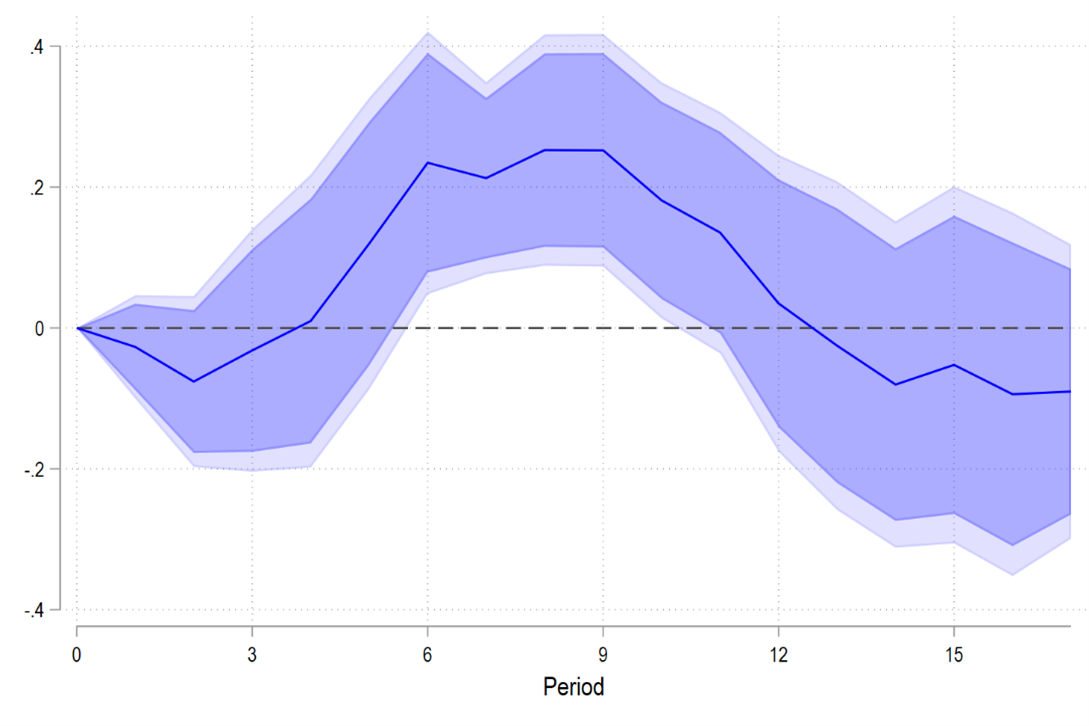

Based on this estimated geopolitical shock, IRFs can be computed using the Local Projection methodology. The IRF of inflation to a one standard-deviation shock (about 1.5) is presented in Figure 3. The maximum impact of about 0.25pp is reached after 2 years (8 quarters). Interestingly, there are no clear significant effects during the first year after the shock. A possible explanation is that negative demand effects are counter-balanced by increasing imported inflation.

Source: authors’ computations

In policy terms, the future evolution of consumer prices will depend on the amplitude of a possible structural shock estimated by the geopolitical index from Bondarenko et al. Let’s assume that the amplitude is as large as the one observed during the war in Iraq, that is a value of 5.5 in 2003q1 (see Figure 2), representing about 3.7 times the standard deviation of the shock. Such a geopolitical event would likely generate a surplus of inflation of about 3.7*0.25=0.93pp after 8 quarters. If we translate the quarterly profile into annual figures, this would shift upward inflation in 2027 to about 2.5%, adding thus inflationary pressures to the baseline scenario for France (1.8% in 2027 according to Banque de France).

2 Comments

This is an exceptionally timely and well-structured analysis. The author effectively moves beyond the standard monetary policy discourse to anchor France’s inflation trajectory within the tangible, and often volatile, realm of geopolitics. The focus on energy (via LNG competition and Arctic routes) and critical materials for the green transition is particularly astute, as these are the pressure points where political tensions translate directly into price volatility.

The argument that France/EU might face a “double squeeze”—competing for resources in Asia while managing regional instability in its own neighborhood—is a compelling and sobering framework. It raises a crucial question about strategic resilience: can industrial and trade policies adapt quickly enough to these shifting geopolitical undercurrents to mitigate inflationary shocks?

One area for potential further exploration is the secondary effect of defense and security spending. As tensions rise, could increased European defense budgets, while necessary, add to aggregate demand and inflationary pressures in specific sectors? Thank you for a thought-provoking contribution that connects the dots between global strategy and household economics.

Those are very good points, Scott. I am more worried about supply chain disruption following the works in this branch of the literature, but demand risks can also play a role for the inflation dynamics in the future decade.