After a series of blogs where I explained the functioning of the DBnomics package: www.jamelsaadaoui.com

I will show how to directly download the Vulnerability Index built by the ND-GAIN: https://gain.nd.edu/

**# Import the data

dbnomics import, provider(ND_GAIN) ///

dataset(vulnerability) clear

rename value VUL

destring VUL, replace force

split series_name, parse(–)

encode series_name2, generate(cn)

*keep cn country period VUL

order cn country period VUL

kountry country, from(iso3c) to(imfn) m

list cn country _IMFN_ MARKER ///

if period == 2020 & MARKER == 0

drop if MARKER == 0

drop NAMES_STD MARKER

rename _IMFN_ imfcode

order cn country imfcode period

keep cn country imfcode period VUL

drop if imfcode==.

xtset imfcode period

xtdes

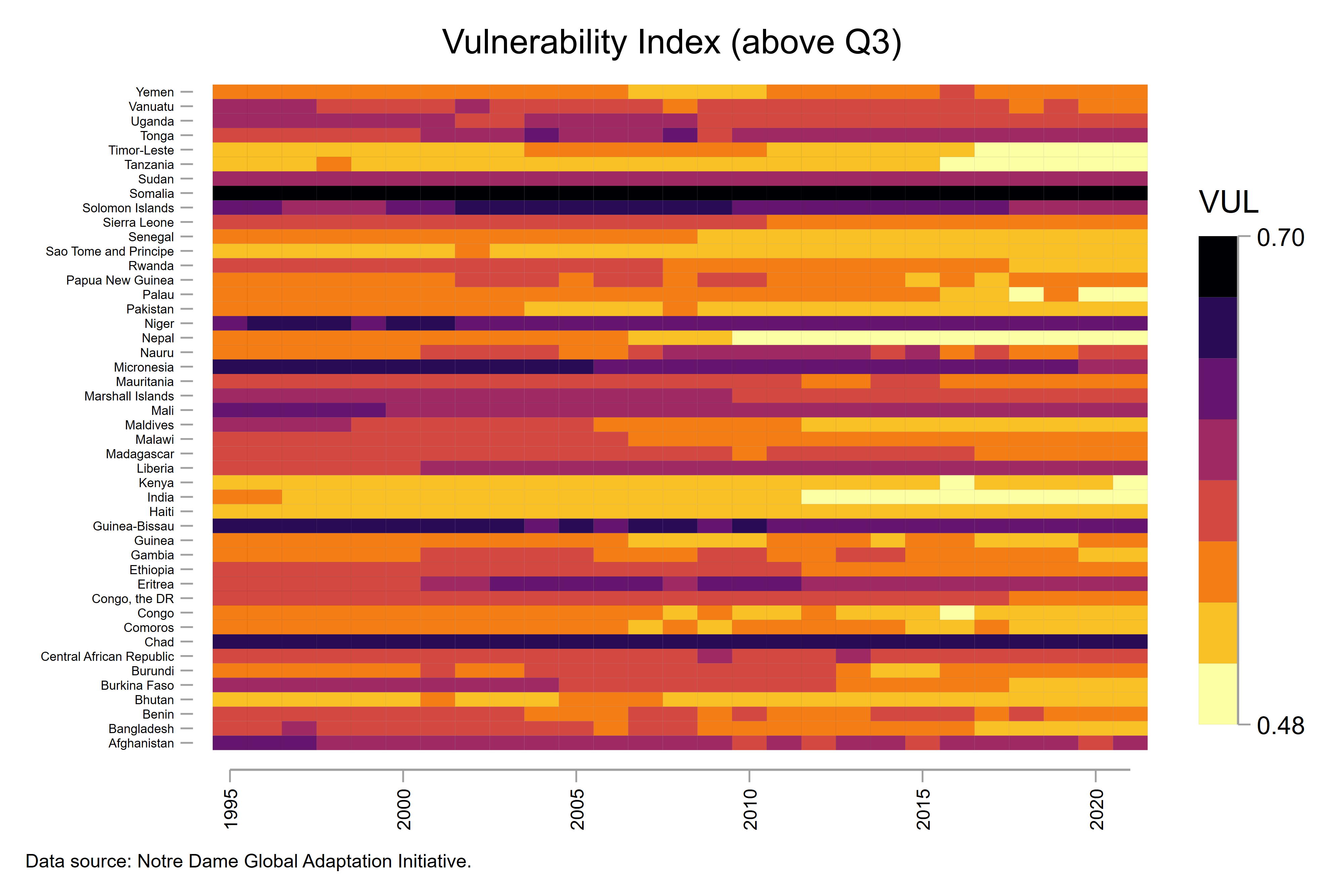

save VUL_ND.dta, replaceNow, I will build on the Medium blog written by Asjad Naqvi and use Ben Jann’s package heatplot for the highly vulnerable countries

**# Heat map

encode country, generate(CN)

*** install the packages

ssc install heatplot, replace

help heatplot // see for the documentation and examples

sum VUL, detail

format VUL %4.2f

by imfcode: egen mean_VUL = mean(VUL)

drop if mean_VUL< .5174853

summ period

local x1 = `r(min)'

local x2 = `r(max)'

heatplot VUL i.cn period if mean_VUL> .5174853 , ///

yscale(noline) ///

ylabel(, nogrid labsize(*0.5)) ///

xlabel(`x1'(5)`x2', labsize(*0.75) angle(vertical) nogrid) ///

color(inferno, reverse) ///

levels(8) ///

ramp(right space(14) format(%4.2f)) ///

p(lcolor(black%10) lwidth(*0.1)) ///

ytitle("") ///

xtitle("", size(vsmall)) ///

xdiscrete name(vulQ3, replace) ///

title("Vulnerability Index (above Q3)") ///

note("Data source: Notre Dame Global Adaptation Initiative.", ///

size(vsmall))

4 Comments

[…] Today, I will focus on the economic risk rating component. In particular, I will take a closer look at the inflation risk variable. In their methodology note, they mention that inflation risk is computed as a score for the estimated annual inflation rate (the unweighted average of the Consumer Price Index) calculated as a percentage change. If annual inflation is below 2 percent, the score is 10 (best); between 19.0 and 21.9 percent, the score is 5; and if the annual inflation rate is above 130 percent, the score is 0 (the worst). See below the heat maps for the inflation risk below the first quartile (the code is available at the end of this blog, see this post). […]

[…] Feeling the Heat: Heatmaps for Vulnerability Scores Explaining the Infrastructure Vulnerability Score for the Russia Federation […]

[…] Feeling the Heat: Heatmaps for Vulnerability Scores […]

[…] Feeling the Heat: Heatmaps for Vulnerability Scores […]