After a series of blogs on the GDELT data, let me show you how to use the GDELT API to follow and watch the French Debt situation in real time. You can the following request to get the data:

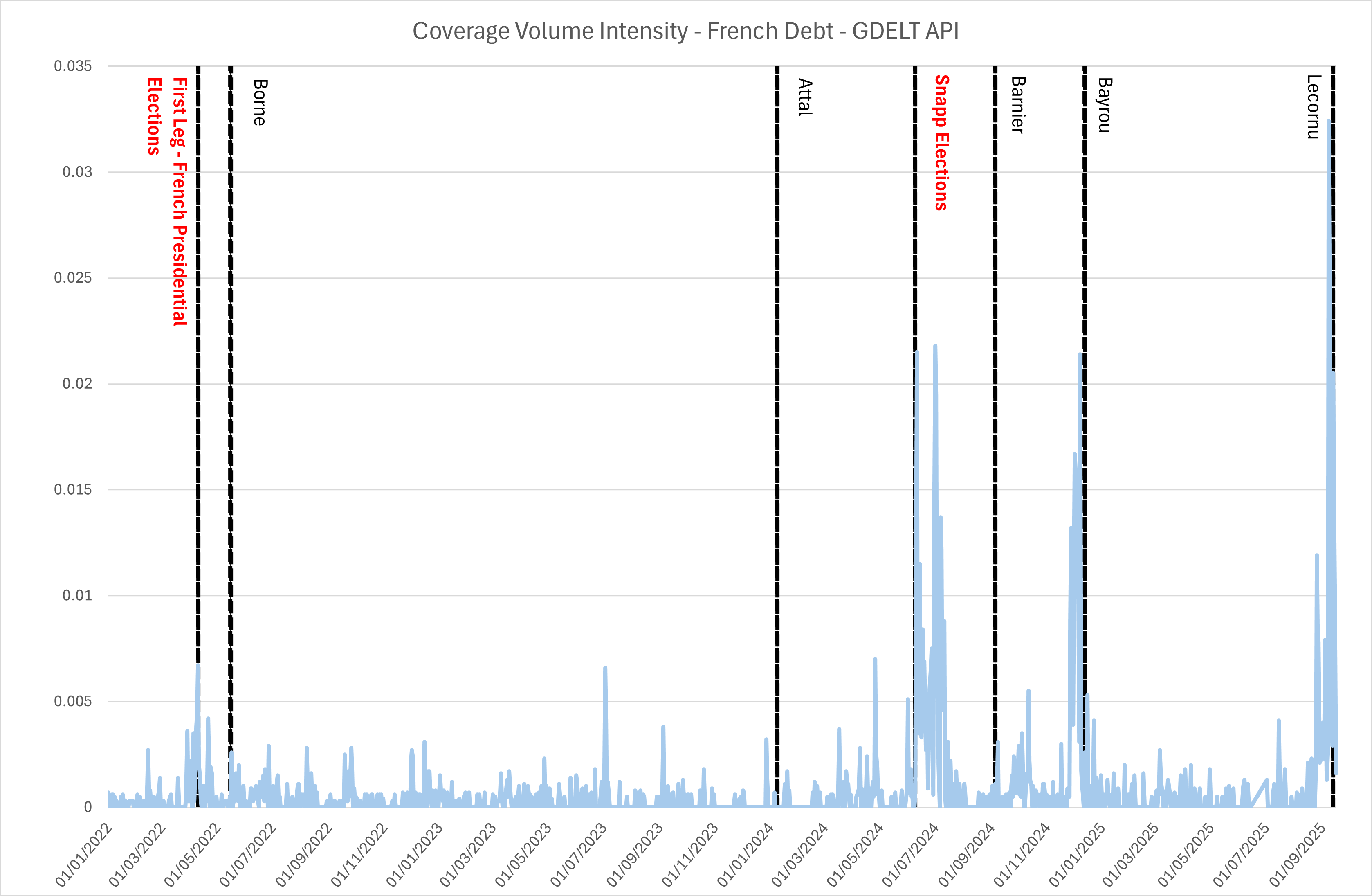

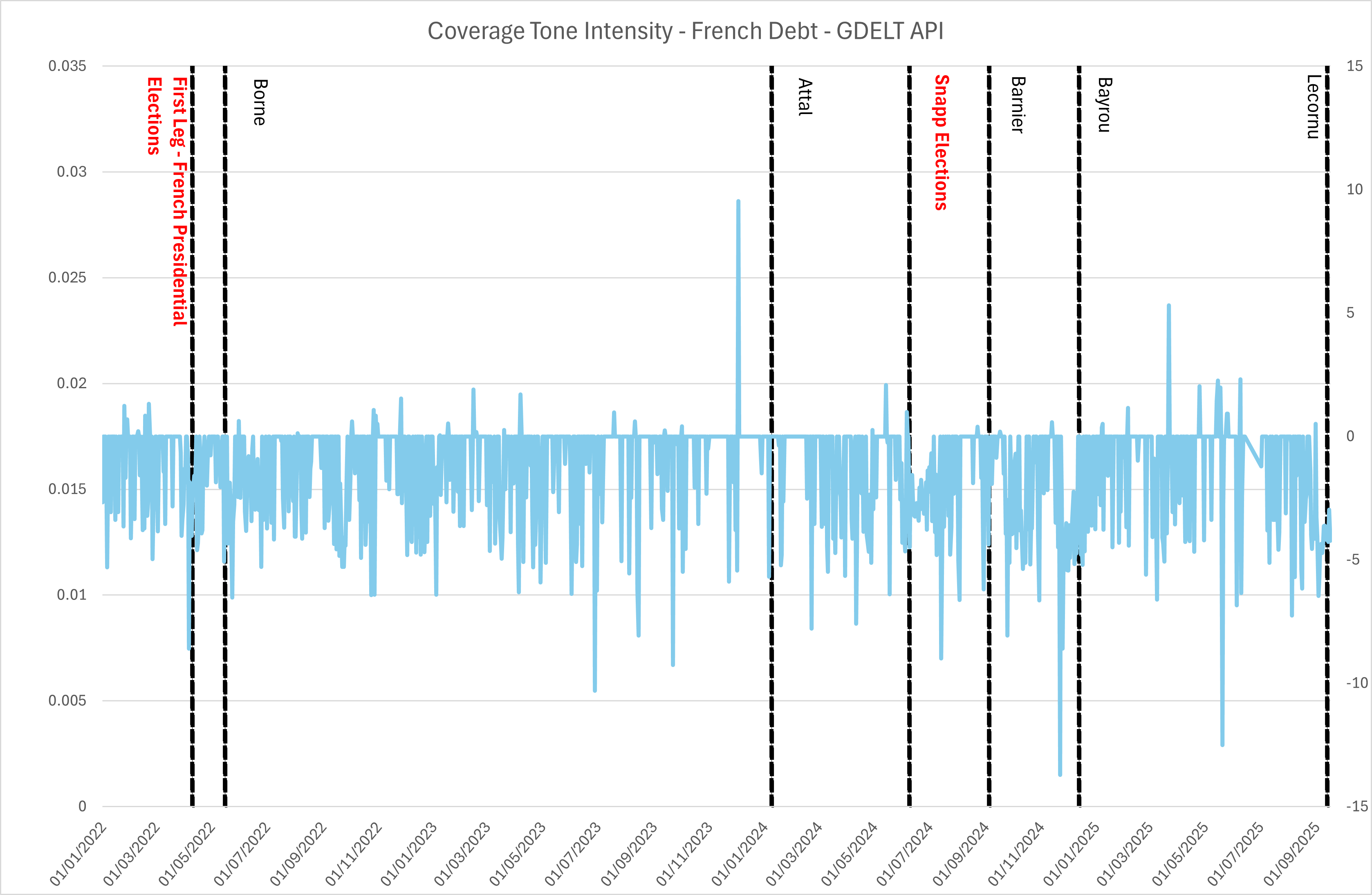

The figure above, built with the GDELT API, tracks media coverage intensity related to French debt since 2022. Coverage volume is a useful proxy for stress and attention in financial markets: when headlines spike, it usually reflects heightened investor concern about sovereign sustainability, fiscal credibility, or broader political uncertainty.

Reading the Timeline

The blue bars capture moments when French debt coverage suddenly surged. Overlaying the main political events makes the dynamics clear:

- 2022 Presidential Elections already placed public debt under scrutiny, but the peaks remained modest compared to later episodes.

- Under Prime Minister Borne, coverage intensity was relatively subdued, suggesting that markets were not yet pricing debt sustainability risks into political uncertainty.

- By contrast, during the Attal and Barnier phases, and especially around the announcement of snap elections, we observe major spikes. This is where markets started linking debt dynamics with the political cycle more directly.

- Later mentions tied to Bayrou and Lecornu coincide with renewed debates on fiscal policy and European fiscal rules.

The pattern is telling: French debt enters the spotlight not in quiet policy times, but when political leadership is contested and fiscal strategies are questioned.

Macro Implications

Two lessons stand out:

1. Debt attention is cyclical, not continuous. Media intensity surges when fiscal sustainability becomes politicized—typically during elections, coalition shifts, or abrupt changes in leadership. This mirrors what we know from the sovereign bond literature: markets are sensitive to signals of political fragmentation and uncertainty about fiscal rules.

2. France is no longer in a low-attention equilibrium. Compared with 2022, the period 2024–2025 shows that fiscal concerns are moving closer to the center of the political debate. Coverage intensity has climbed higher, and with greater frequency. This indicates that sovereign debt is now an open field for political contestation—and therefore for market stress.

Looking Ahead

The French case underlines a broader point in the Euro Area: sovereign debt tensions are endogenous to politics. The next round of fiscal rules implementation at the European level will coincide with renewed electoral cycles, leaving investors watching both the spread with Germany and the domestic political noise.

The data is available below: