NEW WORKING PAPER: This study analyzes the effects of US partisan conflict and US-China political relation news shocks on the oil market. A shock to partisan conflict leads to a drop in the political relations news index, a decrease in oil demand, and an increase in oil prices. When the political relations news index rises, it significantly reduces oil demand and prices, with only minor effects on oil supply. The study also finds that negative political news shocks have a more significant impact on the oil market compared to positive news shocks, leading to lower oil prices and demand. These findings suggest important policy considerations for managing the impacts of political news on the oil market.

In political science, two theories explain the causal links between the US partisan conflict and US-China geopolitical relations.

The first is the threat-unity theory, described in Schwartz and Tierney (2024). In the threat-unity theory, the emergence of an external threat will reduce the degree of domestic polarization. In particular, the external threat could be the emergence of China as an economic superpower, that contests the current international economic order led by the US. In reaction, this external threat may act as a unifying force that reduces the degree of partisan disagreement.

Threat-unity theory: Rise in US-China tensions → Reduction in Political disagreement in the US due to a rally around the flag effect.

The second theory describes a causality from political disagreement to political tensions between the US and China. This second theory, described in Borg (2024), explains how the tensions with China can increase the polarization between US politicians. We call this theory the scapegoat theory. This view is well illustrated by the rhetoric of Donald Trump about the rise of China. During the 2016 presidential campaign, Trump has used the relation with China as one of the main topics to mobilize voters.

Scapegoat theory: Rise in Political disagreement in the US → Rise in US-China tensions to win the election in the US.

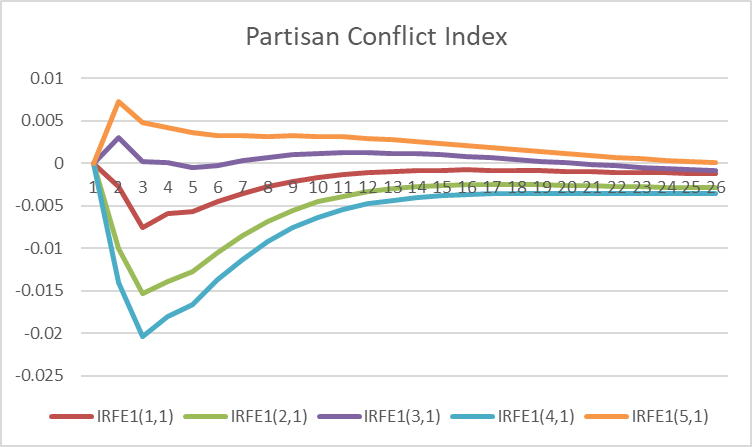

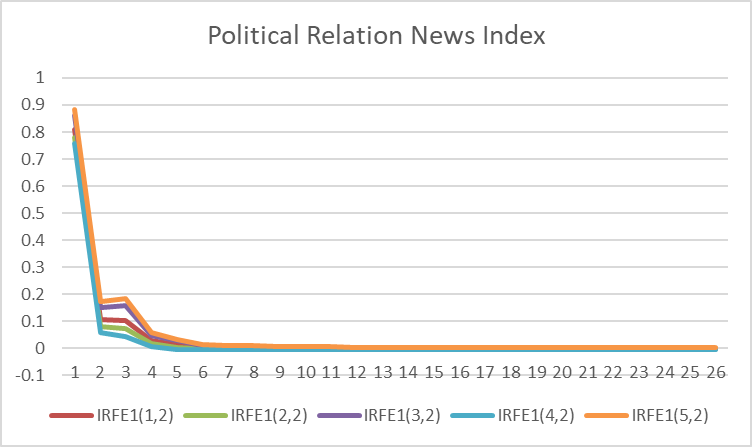

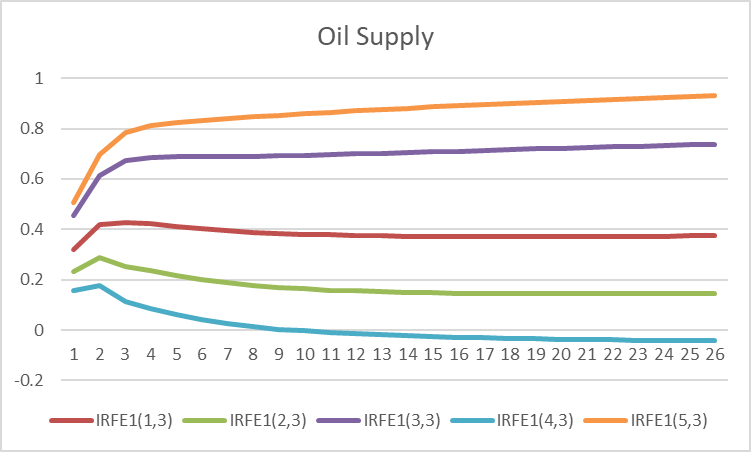

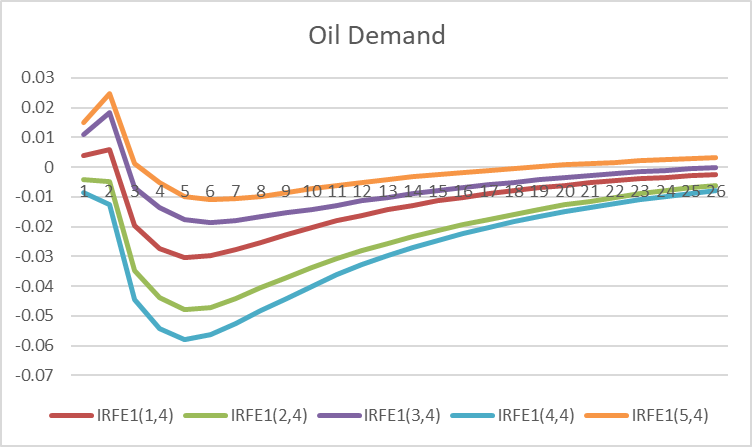

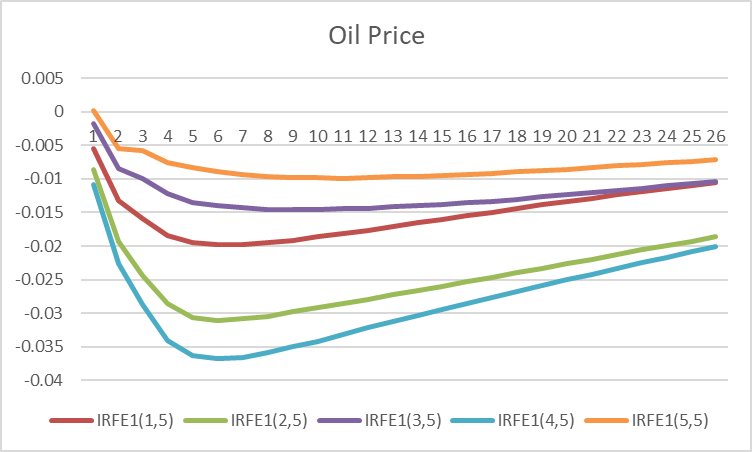

In Figure 3 of the paper, we made a shock on the US-China relation news index (see Cai et al., 2022; Mignon and Saadaoui, 2024). The second variable in the ordering. An improvement of the relation between US reduce the partisan disagreement in the US. Global oil supply increases in the short run. Oil demand and price decreases during several months:

You are welcome to download, share, or comment on the following working paper:

- Cai, Y., Saadaoui, J., & Uddin, G. S. (2024). US Partisan Conflict, Sino-US Political Relation News, and Oil Market Dynamics. Available at SSRN 4868418.