In my second SUERF policy brief, written with Joshua Aizenman, you will learn about how CESEE countries get back to the fast track:

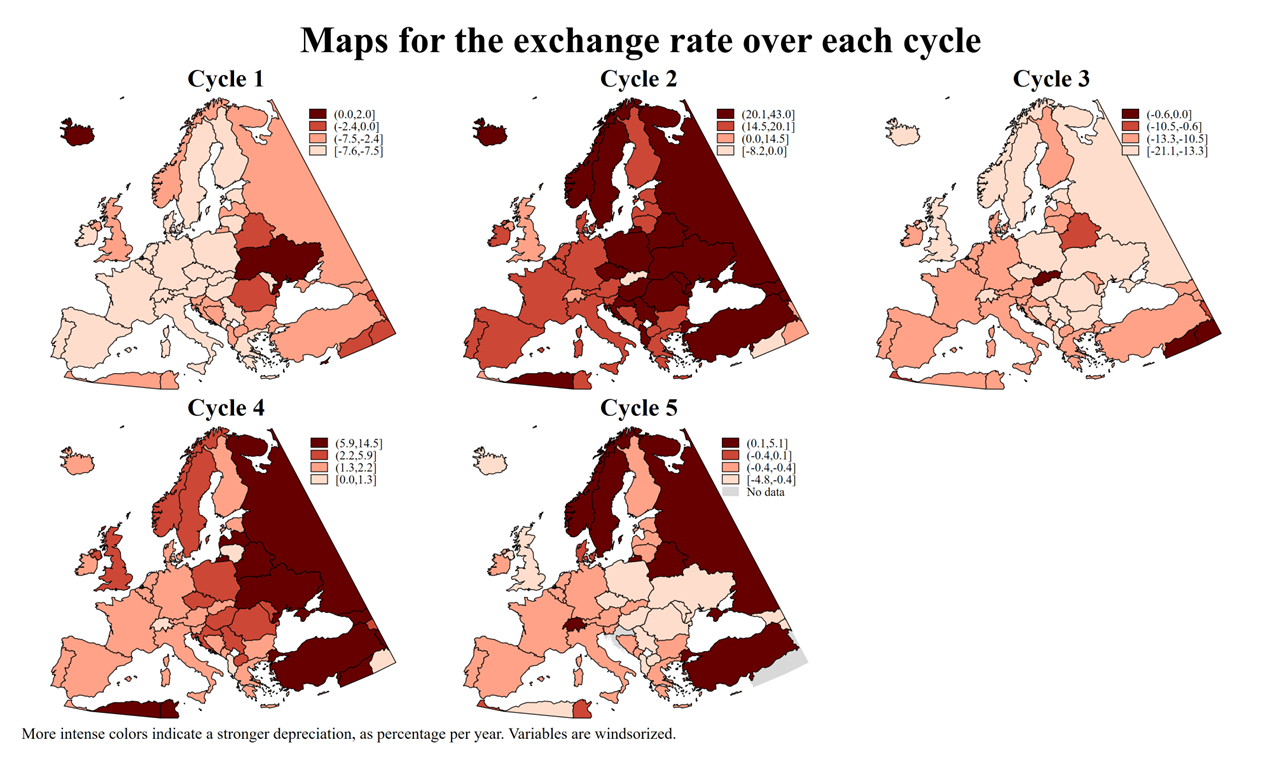

Our empirical results identify the main fundamental and institutional variables that enhance resilience; including efficient management of international reserves, current accounts, financial institutions, and other structural factors affecting the ability to deal with the spillover effects of the ECB’s and FED’s policies. We also validated that the US shadow Federal Funds rate strongly influences CESEE performance during ECB monetary cycles. Besides, the financial development and central bank independence have asymmetrical effects between easing and tightening cycles.

We conclude by noting that CESEE’s average ‘miracle’ growth during the 2000s does not guarantee future performance and will be challenged by growing headwinds associated with growing geopolitical challenges. The high-growth rates of CESEE countries were helped substantially by the generous European Union’s Cohesion Policy. The successful convergence of most CESEE countries and the geopolitical headwinds, impacting the EU and the ECB, may reduce future allocations to CESEE.

You can find the NBER version, the abstract, the keywords and the online appendix in an older post: