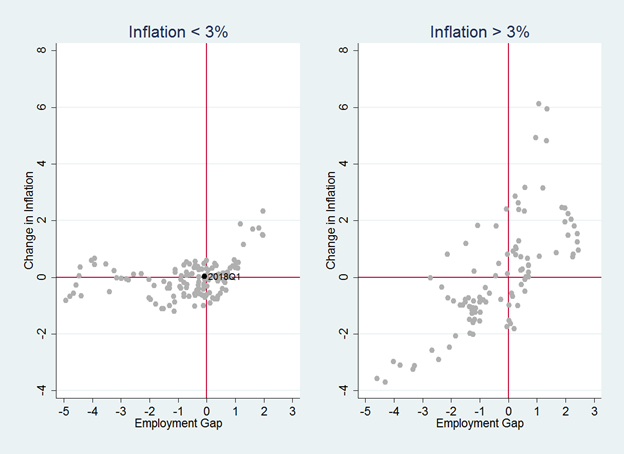

Downward wage and price rigidity matters only when overall inflation is very low.

Joseph E. Gagnon (2018).

As the US unemployment rate continues to drift down to levels not seen in decades, many observers point to relatively low wage and price inflation as evidence that the Phillips curve is dead. Yet inflation is behaving exactly as the Phillips curve — which shows the inverse relationship between the inflation rate and the unemployment rate — would predict. The decline in the US unemployment rate is too recent and too small to have caused any significant rise in inflation to date. Inflation is likely to pick up over the course of this year and next, albeit with a considerable degree of uncertainty.

These nonlinear effects could be due to downward rigidity. When wages and prices grow slowly, economic slack does not affect the inflation dynamics. Firms and workers resist to supplementary downward inflation pressures as prices and wages are already sluggish.

Still No Inflation Puzzle by Joseph E. Gagnon. Real Economic Issue Watch for more analysis on latest economic news from the Peterson Institute for International Economics.

1 Comment

[…] of the seminal contribution made by Fisher in his article of 1926. Indeed, nowadays, there are many interrogations about the true nature of this relationship. Some observers argue that the functional form of this […]