During the 4th CINSC / 2025 conference in Edinburgh, I presented my joint research written with Joshua Aizenman:

Aizenman, J., & Saadaoui, J. (2024). How Institutions Interact with Exchange Rates After the 2024 US Presidential Election: New High-Frequency Evidence (No. w33193). National Bureau of Economic Research. SSRN link: 5023372.

We claim that “Due to the nature of the shock, we can infer that the market expects that the new US administration will be more favorable or at least more neutral vis-à-vis countries with political regimes that are less cautious about several dimensions of institutional development, like the respect of property rights, the central bank independence, the transparency of monetary and fiscal policy, democratic accountability of the economic policy decisions and so on.“

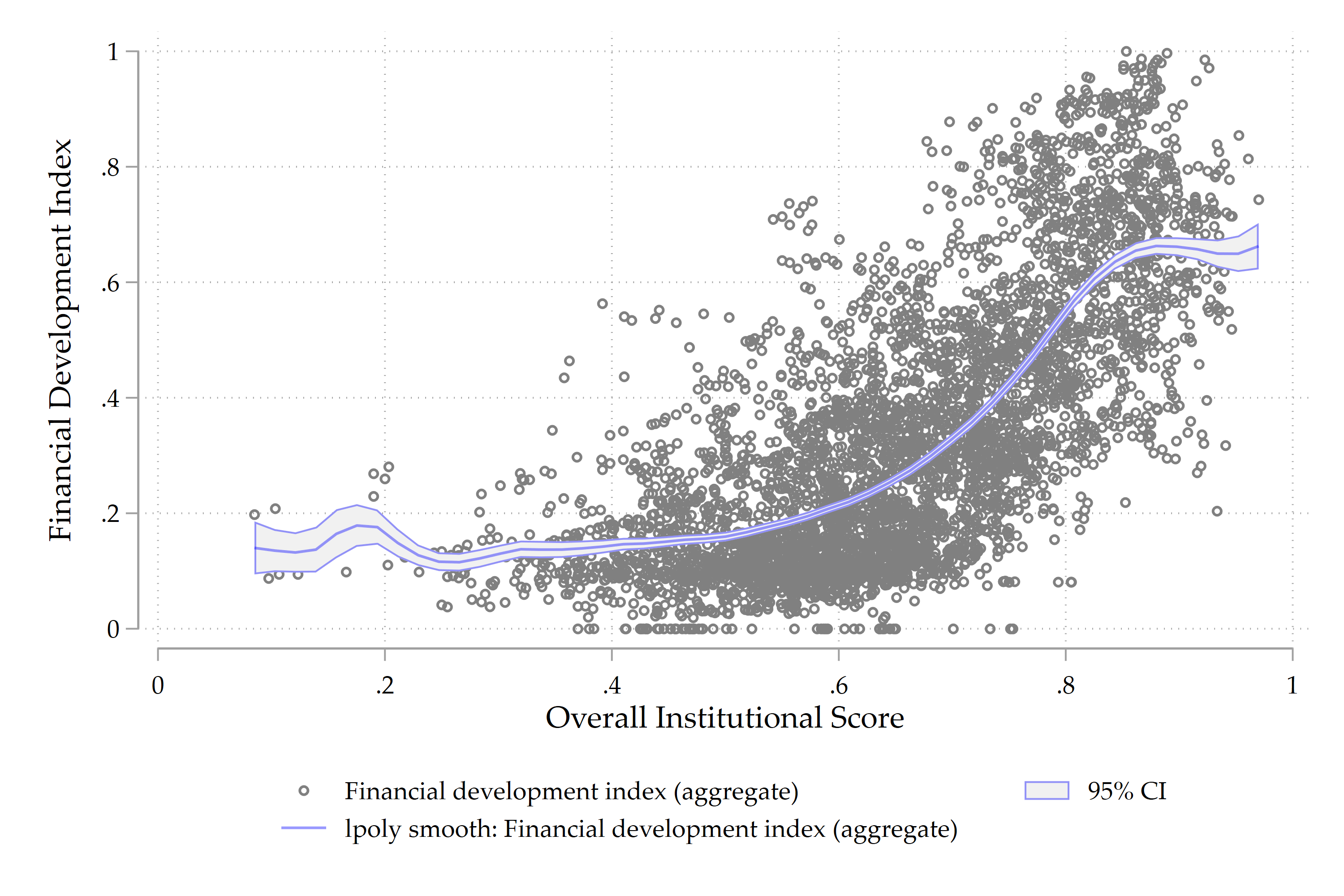

Our discussant Milan Vyskrabka from ECB made a very interesting remark about the fact that the currency pairs that depreciates the most are also the most liquid currencies. That is a very relevant point, and it drove me to think about a discussion that I had with Hiro Ito at the French-Japanese conference in Marseilles. He told me that a fundamental driver of financial development is the development of good institutions. In fact, you cannot come with a good example of a country that has weak institutions and, at the same time, developed financial markets accompanied by a liquid currency market.

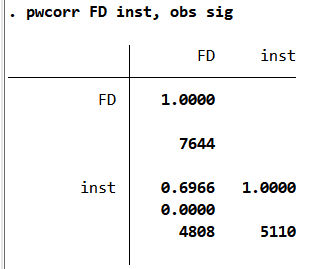

Using data from a previous project and inspired by the book of Martin Paldam on The Grand Pattern of Development and the Transition of Institutions, I will use kernel regressions to show the transition between two steady states. The first steady state is the weak institutions/low financial development state. The second steady state is the strong institutions/high financial development state. For a sample of 4808 and 132 countries from 1984 to 2022, we have for the following correlation:

We have the following results confirming the transition between the two steady states and the upper left part of the Figure is empty:

To conclude, let me add a Stata code snippet to replicate the Figure:

twoway ///

scatter FD inst, mcolor(gray) || ///

lpolyci FD inst, lcolor(blue%40) legend(pos(6) col(2)) ///

name(FDL, replace) yti("Financial Development Index") ///

xti("Overall Institutional Score")

graph export FDL.png, as(png) width(3000) replace