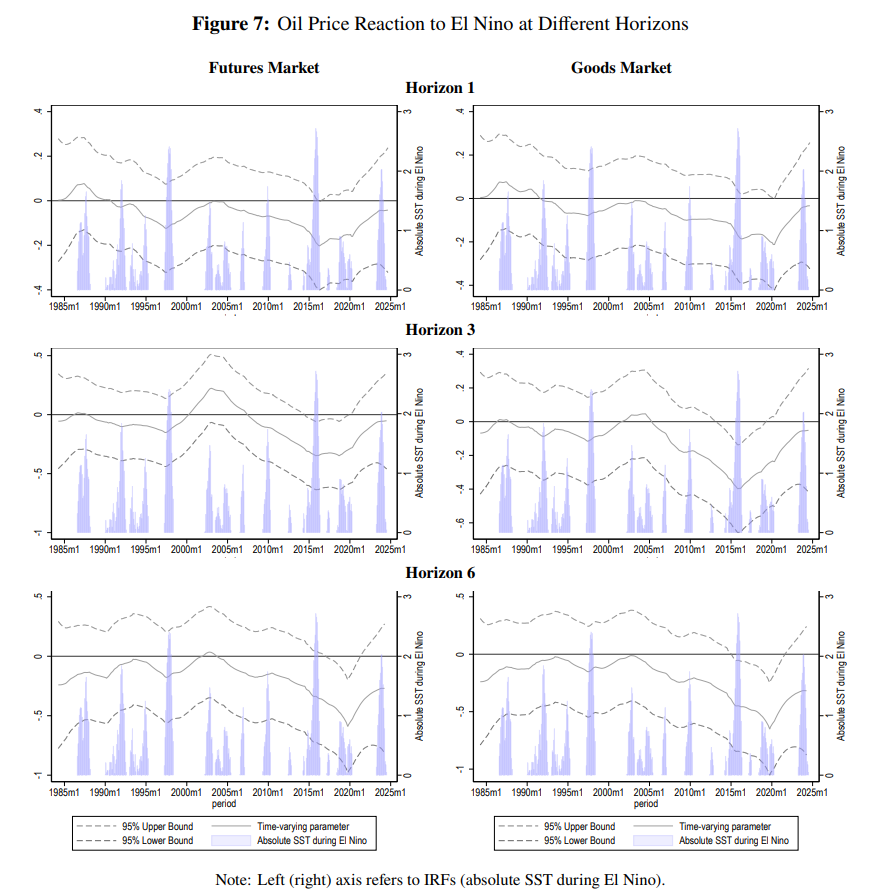

NEW WORKING PAPER: This paper examines the impact of El Niño-Southern Oscillation (ENSO) shocks on U.S. oil futures and goods market prices from 1983:03 to 2024:10 via the Time-Varying Parameter Local Projections (TVP-LP) model. By allowing impulse responses to evolve over time, we capture dynamic shifts in the oil market’s sensitivity to El Niño and La Niña events across different time horizons. Our findings reveal an asymmetric response, where El Niño shocks exhibit a negative effect on oil futures and goods market prices, while La Niña shocks—especially extreme ones—lead to persistent upward price pressures. The effect becomes more pronounced at horizons within 12 months, indicating delayed transmission mechanisms through supply chain disruptions and changes in global energy demand. Additionally, the response intensifies in extreme ENSO episodes, highlighting non-linearities in climate-driven oil price fluctuations.

You are welcome to download, share, or comment on the following working paper:

- Gallegati, M., and Ginn, W., Saadaoui, J., and Solomou, S., and Tian, K., How does ENSO impact U.S. Oil Spot and Future Prices? (September 30, 2025). Available at SSRN: 5549860.