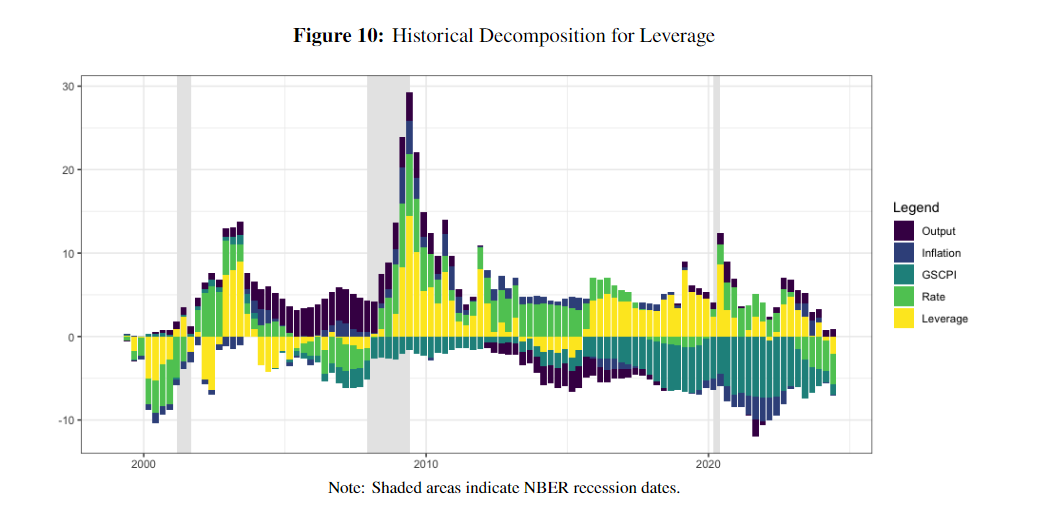

NEW WORKING PAPER: This study investigates the impact of supply disruptions on financial leverage (debt-equity ratio) in the U.S. economy from 1998:Q1 to 2024:Q1. The study employs a linear and non-linear Local Projections (LP) and Bayesian Vector Autoregression (BVAR) models to explore dynamic relationships. While the LP models reveal that a supply chain shock negatively affects leverage with statistically significant results, there is no evidence of state dependence. The BVAR model suggests that a supply chain shock is disruptive via a reduction (an increase) in output (inflation), accompanied by lower leverage.

You are welcome to download, share, or comment on the following working paper:

- William Ginn, Jamel Saadaoui (17 July 2024), Impact of Supply Chain Disruptions on Financial Leverage. SSRN Working Paper: 4892285.

1 Comment

[…] Impact of Supply Chain Disruptions on Financial Leverage […]