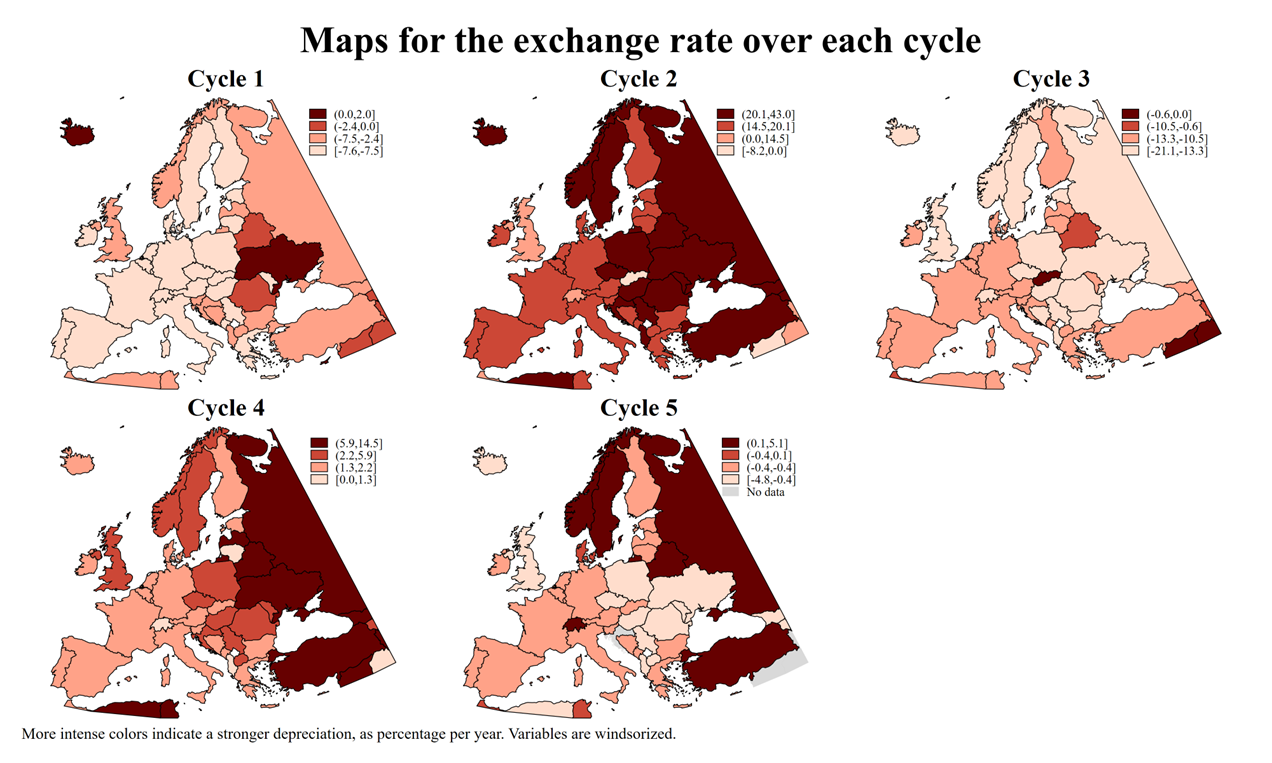

NEW WORKING PAPER: We investigate the resilience of CESEE countries during ECB monetary cycles after the entrance of ten countries to the EU in 2004. Undeniably, these countries have experienced a ‘miracle’ growth during the 2000s decade. However, several obstacles appeared following the global financial crisis and the euro crisis. In many CESEE countries, the quality of institutions has stalled, or even worse, has known a deterioration. Our investigation examines how fundamental and institutional variables influence cross-country resilience regarding exchange rates, interest rates, stock prices, inflation, and growth during the subsequent monetary cycles. Specifically, we focus on five ECB tightening and easing cycles observed during 2005-2023. Cross-sectional regressions reveal that limiting inflation, active management of precautionary buffers of international reserves, current account surpluses, better financial development, and institution quality are important predictors of resilience in the next cycle. The panel regressions show that the US shadow rate strongly influences resilience during the ECB monetary cycles. Besides, various asymmetries are discovered for current account balances, international reserves, and fuel import shares during tightening cycles. Panel quantile regressions detect asymmetries along the distribution of the dependent variables for financial development, central bank independence, and the inflation rate preceding the cycles. These findings may provide guidelines that are useful for returning to the trajectory observed before the euro crisis by identifying the main fundamental and institutional variables that enhance the resilience of CESEE.

You are welcome to download, share, or comment on the following working paper:

- Joshua Aizenman, Jamel Saadaoui (2024), The Resilience of Central, Eastern and Southeastern Europe (CESEE) Countries During ECB’s Monetary Cycles. NBER Working Paper Series, 32957, https://www.nber.org/papers/w32957.

1 Comment

[…] The Resilience of Central, Eastern and Southeastern Europe (CESEE) Countries During ECB’s Monetary… […]