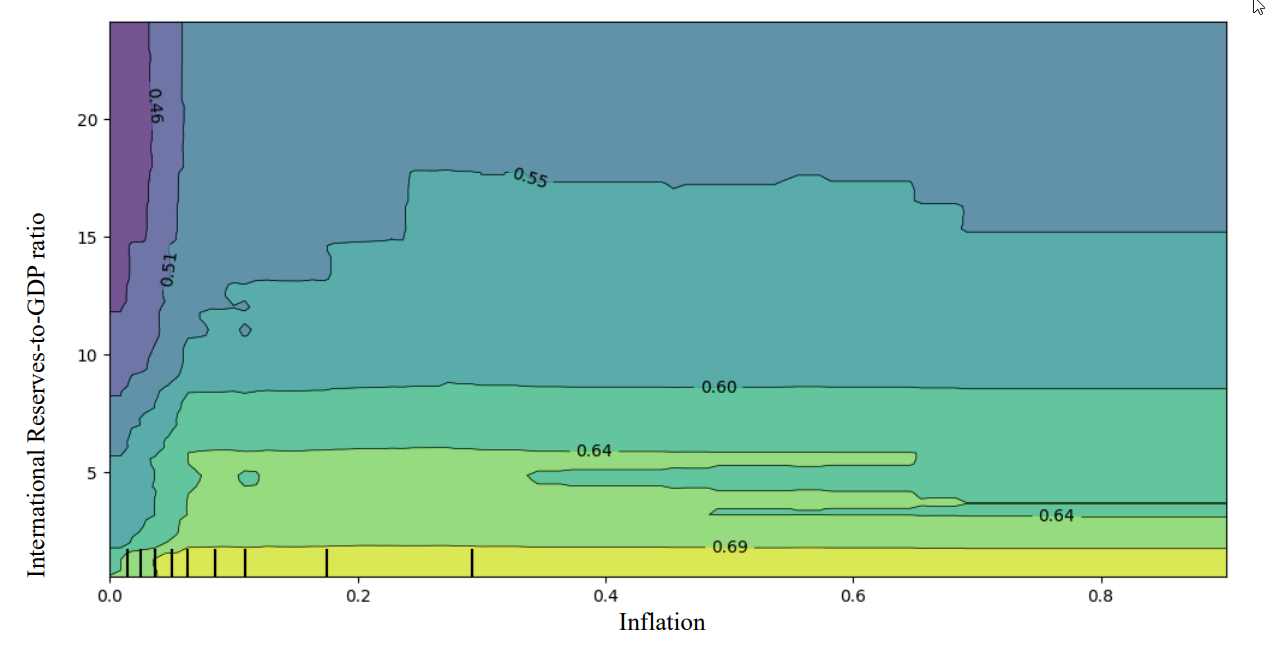

NEW WORKING PAPER: This study aims to predict currency, banking, and debt crises using a dataset of 184 crisis events and 2896 non-crisis cases from 79 countries (1970-2017). We tested eight machine learning methods: Logistic Regression, KNN, SVM, Random Forest, Balanced Random Forest, Balanced Bagging Classifier, Easy Ensemble Classifier, and Gradient Boosted Trees. The Balanced Random Forest had the best performance with a 72.91% balanced accuracy, predicting 149 out of 184 crises accurately. To address machine learning’s black-box issue, we used Variable Importance Measure (VIM) and Partial Dependence Plots (PDP). International reserve holdings, inflation rate, and current account balance were key predictors. Depleting international reserves at varying inflation levels signals impending crises, supporting the buffer effects of international reserves.

You are welcome to download, share, or comment on the following working paper:

- Papadimitriou, T., Gogas, P., Sofianos, E., Giannakis, N, & Saadaoui, J. (2025). Do International Reserve Holdings Still Predict Economic Crises? Insights from Recent Machine Learning Techniques. Available at SSRN 5237256.

Note: increasing the level of reserves from 0 to 20% brings a buffer effect of around 18% on the crisis probability (from 64% to 46%). This effect is still here for very high levels of inflation, but reduced to 14% (from 69% to 55%). In addition, please note as underlined by Periklis Gogas, the resulting PDPs are the average of all 79 countries where we have many developing countries that are prone to crises; the decision boundary or threshold to forecast a crisis is not necessarily 50% to achieve our 72.91% accuracy. It may go very high, i.e., 80%. We forecast 3 major types of crises together. The crisis trigger operator is “or” not “and” between the 3 types of crises. So the total probability is additive, i.e., you have a 15% average chance of each crisis, altogether adding up to 45%.

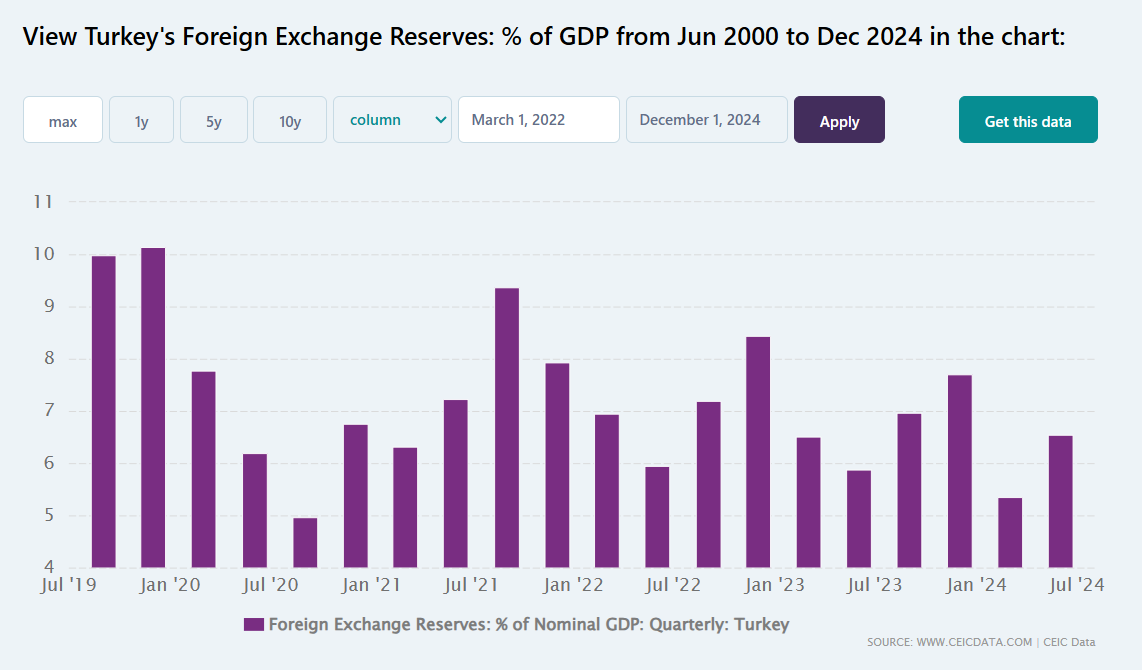

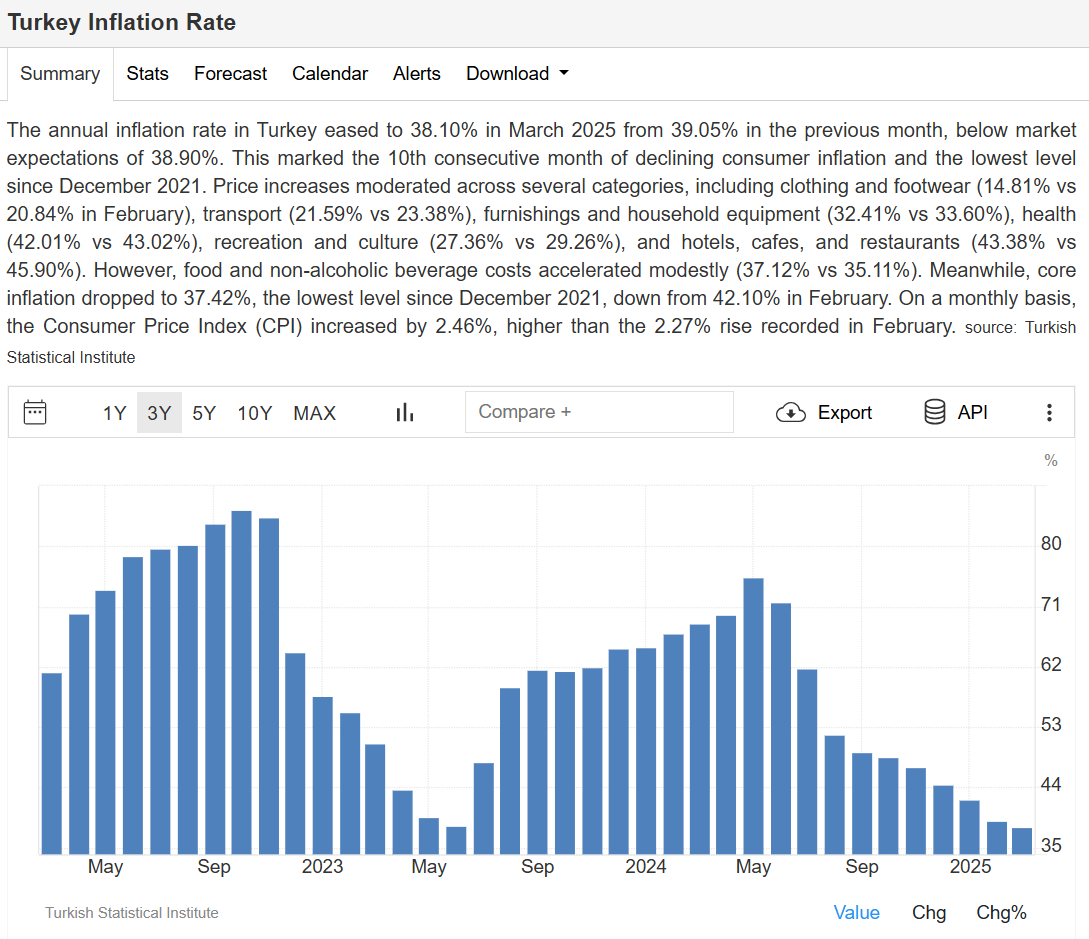

This may illustrate the case of some countries like Turkey with high inflation rates and high-holdings of international reserves. The reduction of international reserve holdings from 10 to 5 percent as observed during the past five years increases the probability of a crisis (debt, currency, or bank crises) of around 14 percent (from 55% to 69%):