Macroeconomics maintains a set of very useful “intuitions” that provide insights into very complex phenomena. Slack periods follow downturns, markets subsequently adjust after shocks, and openness leads to resilience. Intuitions are benchmarks. They are not a priori truths. Their relevance to facts has been most important to their development.

Increasingly, my works, with some collaborations I have engaged in recently, aim to identify when these mechanisms perform well, when they start to falter, and why. Correspondingly, this blog identifies the key contributions I have made to the literature regarding crises and recovery, political tensions, geopolitical risk, or external adjustment, might be seen to provide a narrative that seeks to place the classical macroeconomic mechanisms in context with a world characterized by institutional diversity and geopolitical fragmentation.

Rethinking Crisis-Recovery Dynamics

A key contribution within this research program is the paper: “Global Shocks, Institutional Development, and Trade Restrictions: What Can We Learn from Crises and Recoveries from 1990 to 2022?” (with Joshua Aizenman, Hiro Ito, Donghyun Park, and Gazi Salah Uddin), and was published in the Journal of International Money and Finance.

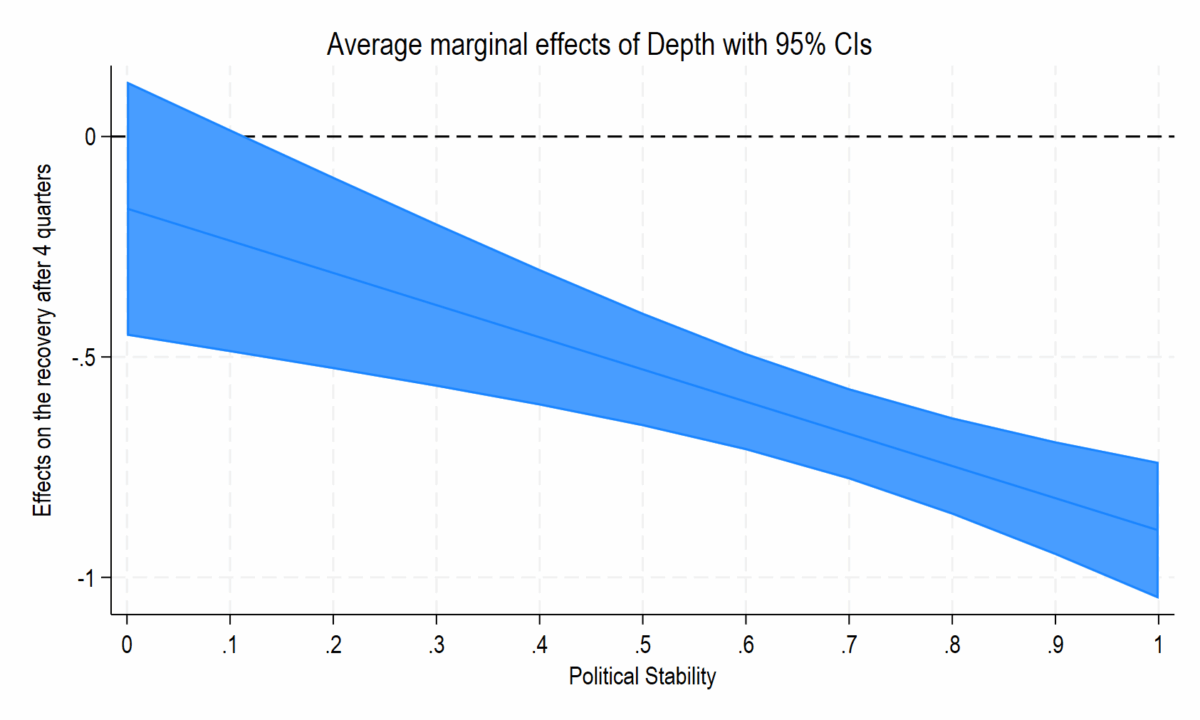

Using a large panel of crisis-and-recovery observations over the period 1990-2022, the paper returns to the conventional wisdom often linked to Friedman’s plucking model: a deeper recession should be associated with a stronger recovery.

This critical finding is intended to be nuanced rather than straightforward. Note that the process of plucking is indeed present in an industry characterized by an established institutional setting and easy trade policies. Nonetheless, this relationship is significantly weakened and could be diminished to zero in an economic environment characterized by weak institutions and rigid trade policies.

Instead of dismissing the plucking hypothesis, this study demonstrates that the empirical validity is conditional. Adding such complexity to the macroeconomic viewpoint is that the nature of crises may be characterized as temporary deviations for certain institutional frameworks while turning points for others.

DOI: j.jimonfin.2025.103504 in Open Access.

Political Tensions & Economic Performances in Europe

A complementary approach is derived from the European Journal of Political Economy’s special issue, “Geopolitical Risks, Political Tensions, and the European Economy” (with Amélie Barbier-Gauchard and Jan-Egbert Sturm). This special issue was published in the European Journal of Political Economy.

In this series of articles, geopolitical tensions are being introduced into macroeconomic analysis in a very explicit manner. Contrary to the ad hoc formulation of political risk as a transitory or exogenous shock, the implications of political tensions on macroeconomic performance are discussed.

Crucially, however, the magnitude and durability of these impacts depend on institutional resilience and policies. This result reinforces a message that permeates the research agenda, namely, geopolitical conditions are not peripherals of macro adjustment, but conditioning variables instead.

DOI: j.ejpoleco.2025.102644.

Geopolitical Risks & Commodity Markets

A related body of research focuses on the role of geopolitical risk in commodity market settings.

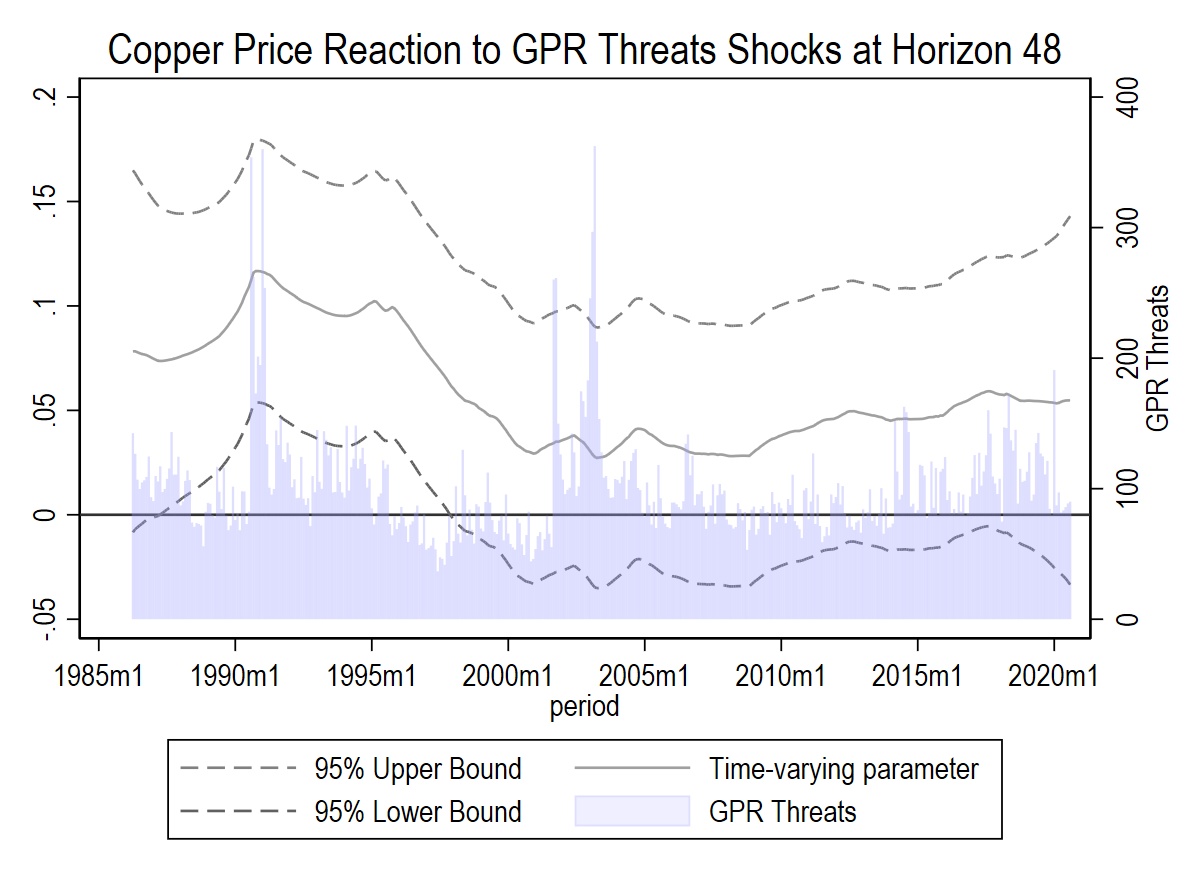

The paper: “Ensuring the Security of the Clean Energy Transition: Examining the Impact of Geopolitical Risk on the Price of Critical Minerals” (with Russell Smyth and Joaquin Vespignani) appeared in Energy Economics,

It generalizes the analysis from the traditional oil market to strategic factors that are crucial for the transition in the energy sector. The concept of geopolitical risks in concentrated markets with limited opportunities for substitution impacts both the level and structure of prices.

This complemented the previous article on: “How Do Political Tensions and Geopolitical Risks Affect Oil Prices?” (with Valérie Mignon), also published in Energy Economics, which models oil price reactions to geopolitical shocks.

Taken together, these papers indicate that geopolitical risk should be viewed more as a structural adjustment barrier rather than a traditional uncertainty shock.

DOI for the first paper: j.eneco.2025.108195 in Open Access.

DOI for the second paper: j.eneco.2023.107219.

GitHub for replication: https://github.com/JamelSaadaoui/.

Bilateral Political Relations and External Adjustment

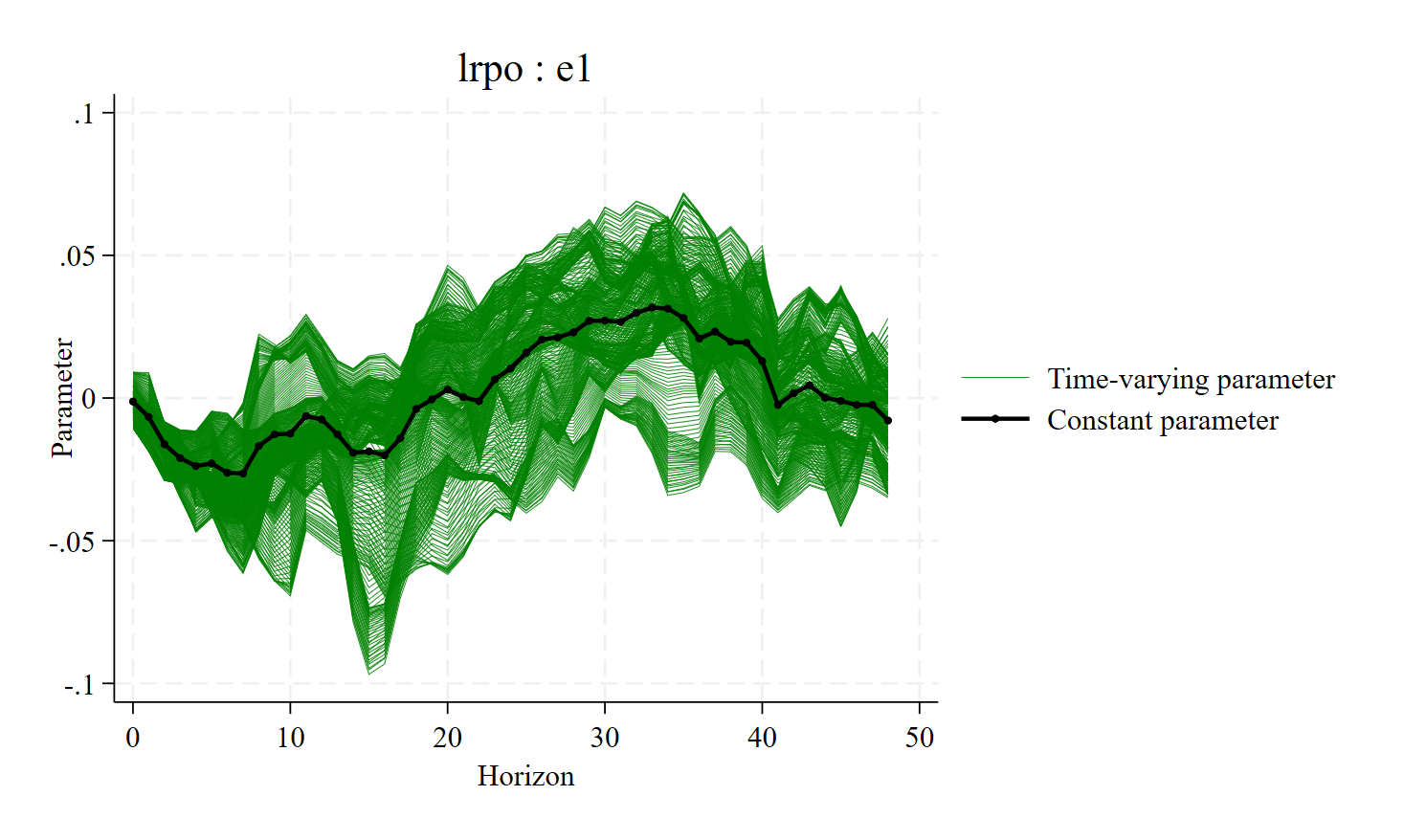

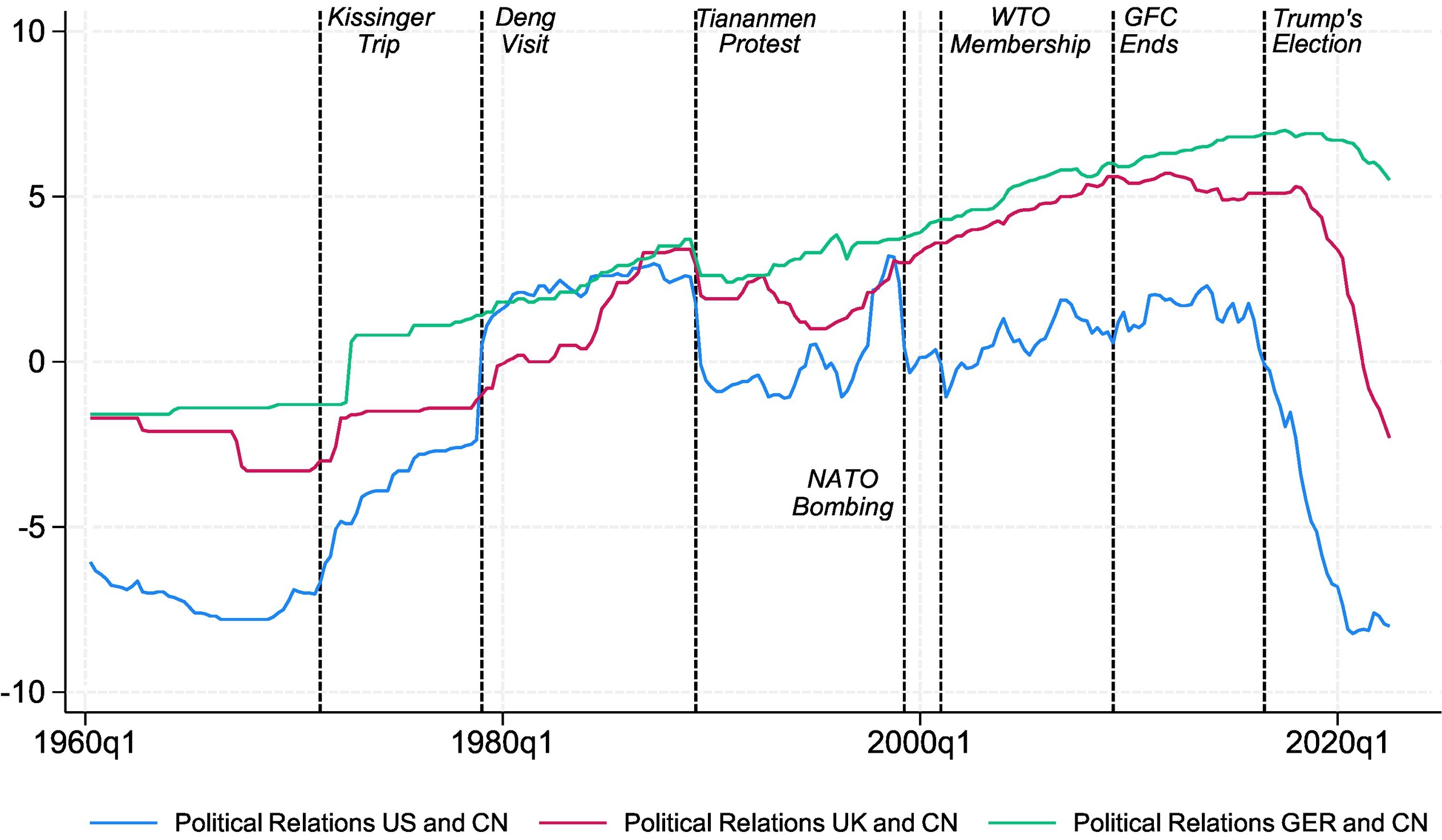

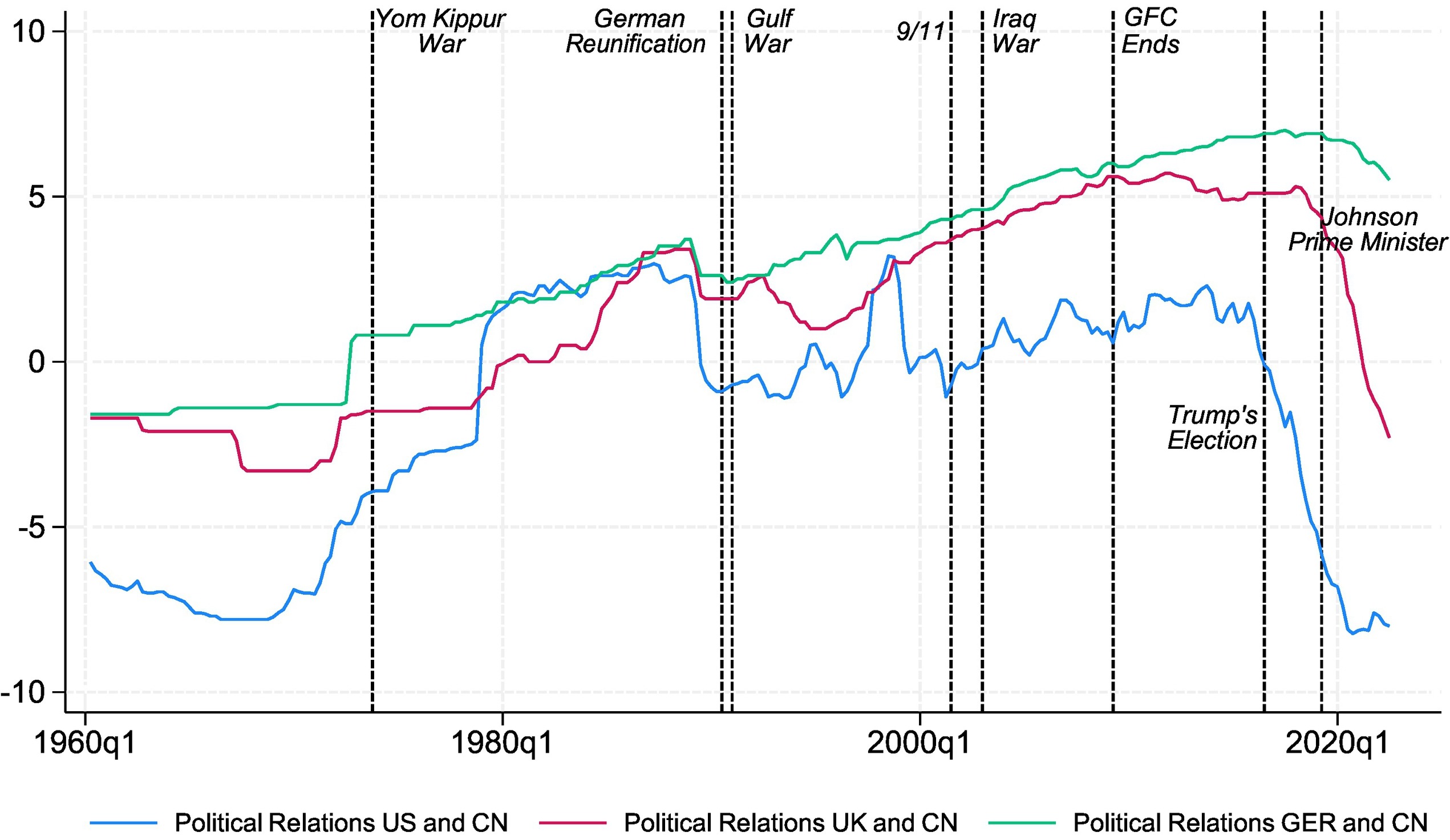

A flagship contribution within this research program is the paper: “On the Time-Varying Impact of China’s Bilateral Political Relations on Its Trading Partners: ‘Doux Commerce’ or ‘Trade Follows the Flag’?” (with António Afonso, and Valérie Mignon) and was published in China Economic Review.

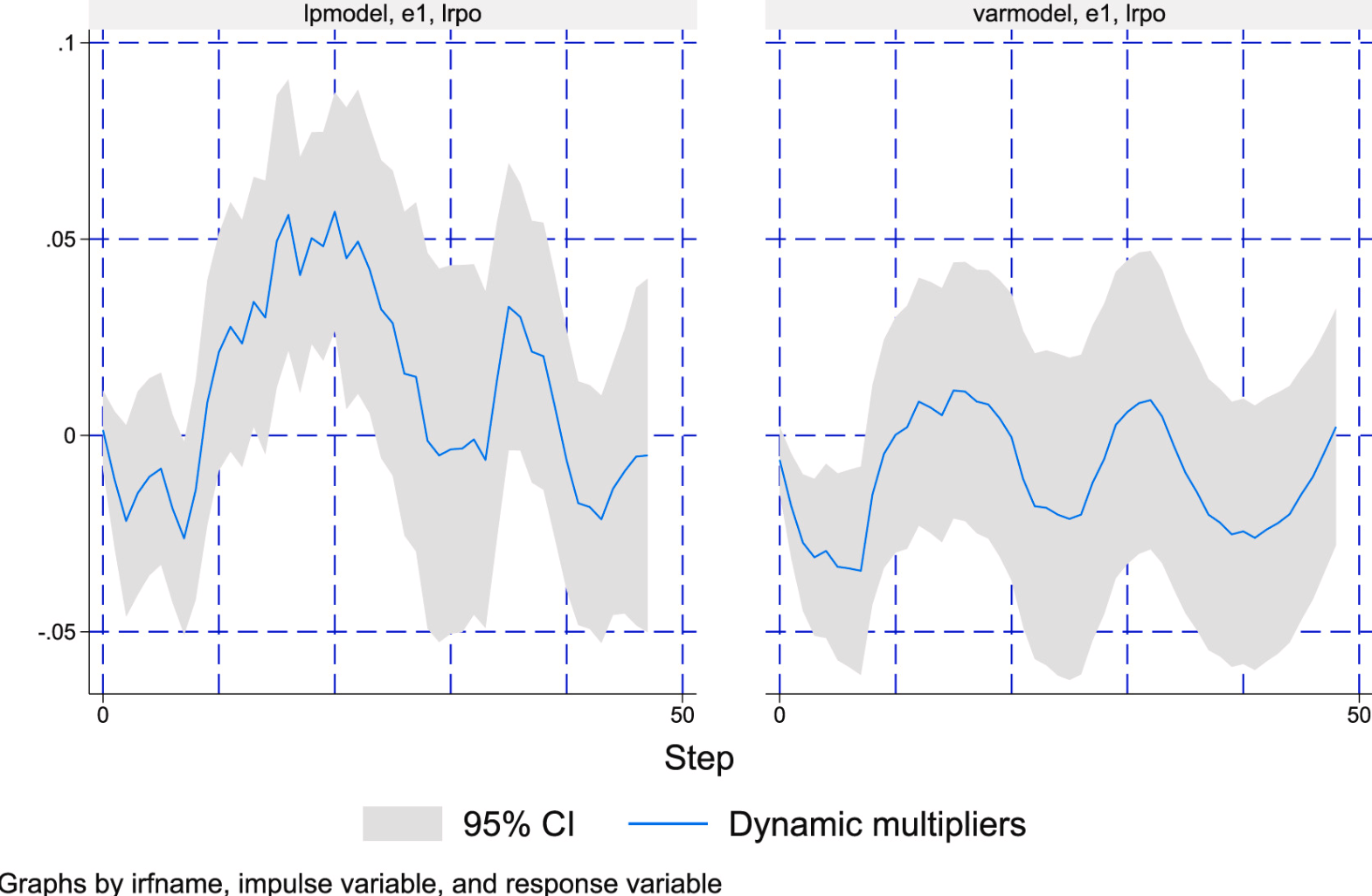

Using a long quarterly dataset covering 1960Q1-2022Q4, the paper examines how China’s bilateral political relations with three major trading partners, namely, the United States, Germany, and the United Kingdom, affect current account balances and exchange rate dynamics. We challenge the “doux commerce” hypothesis of Montesquieu.

The analysis relies on a lag-augmented VAR framework combined with time-varying Granger causality tests, allowing the strength and direction of political-macroeconomic linkages to evolve. The results show that bilateral political relations with China play a significant role in explaining external adjustment, lending empirical support to the “trade follows the flag” view. However, these effects are not uniform over time or across partners. The causal links are persistent in the case of Germany, while they are time-varying for the United States and the United Kingdom, reflecting changing geopolitical environments.

DOI: j.chieco.2024.102184.

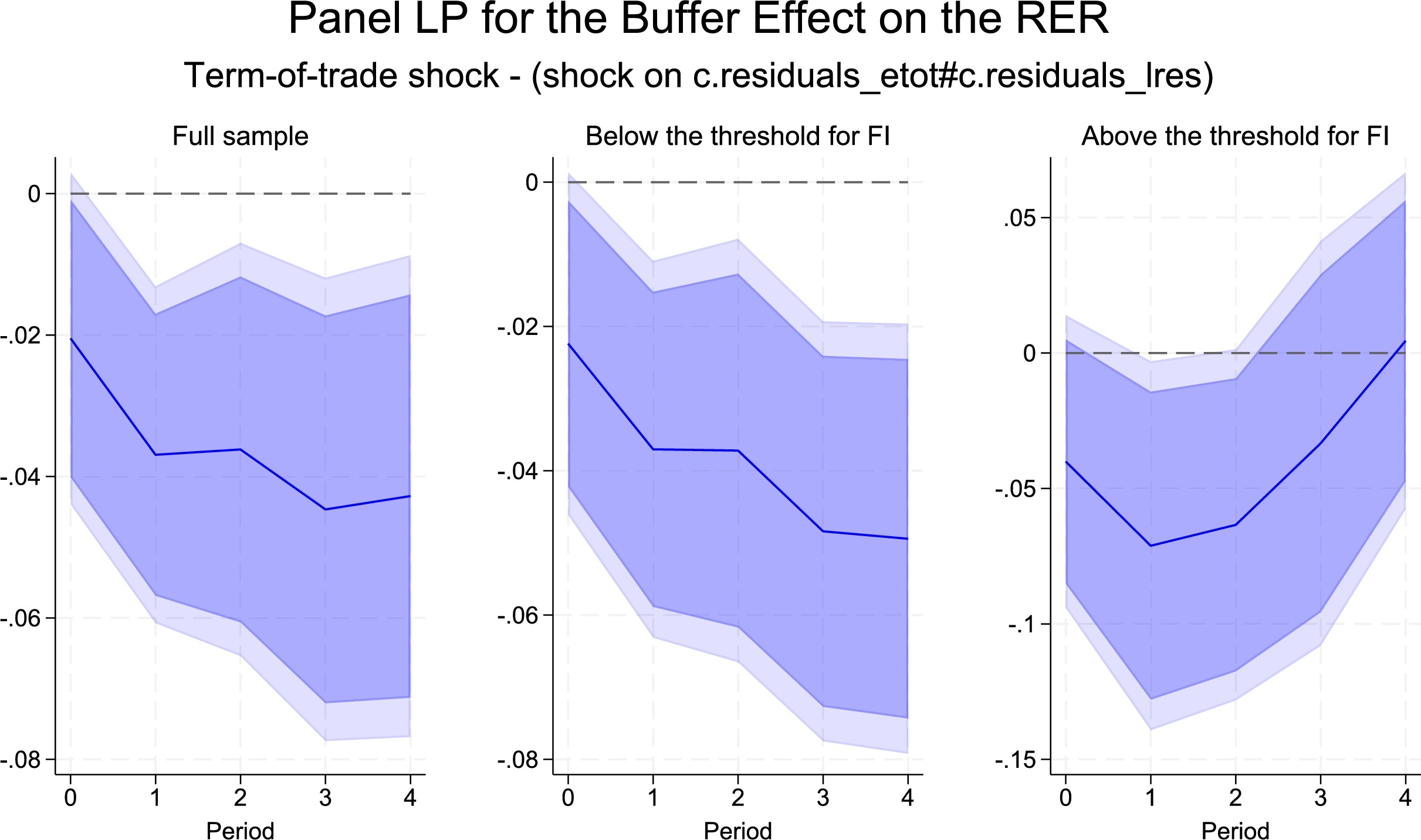

Exchange Rates, Reserves, and Financial Integration

Finally, the paper: “Real Exchange Rate and International Reserves in the Era of Financial Integration” (with Joshua Aizenman, Sy-Hoa Ho, Toan Huynh, and Gazi Uddin) appeared in the Journal of International Money and Finance. In particular, he reexamines some classical links from international macroeconomic theory. The author finds that financial integration changes the state-dependent links between countries’ real exchange rates and international reserves.

As always, the general message is one of conditionality, where familiar mechanisms offer insights, although the applicability of these insights to reality will depend on the surrounding environment of finance and institutions.

DOI: j.jimonfin.2024.103014.

GitHub for replication: https://github.com/JamelSaadaoui/.

A Pedagogical Takeaway

Through all of these featured works, one theme keeps appearing:

Canonical macroeconomic mechanisms are useful guides, but they are not universal.

Their empirical relevance depends on institutional strength, geopolitical dynamics, and market structure.

From a learning perspective, this suggests three practical lessons:

- Test mechanisms conditionally. The relevant question is not whether a mechanism holds on average, but when and why it holds.

- Treat institutions and (geo)politics as core macro variables. They shape adjustment paths rather than merely shifting levels.

- Reinterpret geopolitical risk. In many strategic contexts, it operates as a structural force influencing persistence and regimes, not just volatility.

These conclusions are intentionally modest. Yet they carry significant implications for how macroeconomics interprets crises, recoveries, and adjustment in a world increasingly shaped by geopolitical fragmentation and institutional divergence.