Let me draw your attention to this piece written by Tomasz Wieladek for The Economist:

In this piece, Tomasz Wieladek argues that the pandemic recession was particular because it is a rare case of a Friedman type recession.

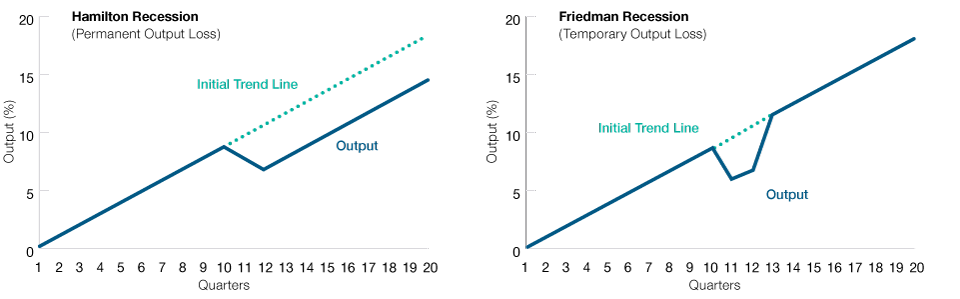

The first kind of recession, named after James Hamilton who first modeled it in 1989 (https://www.jstor.org/stable/1912559), describes a situation where the pre-crisis trend for economic growth is never reached after the inception of the crisis. Typical economic recessions are associated with permanent loss of income.

The second kind of recession, postulated in modern terms in 1993 by Milton Friedman (https://doi.org/10.1111/j.1465-7295.1993.tb00874.x), can be illustrated by the following metaphor: “like a guitar string, the harder an economy is “plucked down”, the stronger it should come back up” (source of the metaphor by Emanuel Kohlscheen, Richhild Moessner and

Daniel M. Rees (2023): https://www.bis.org/publ/work1076.pdf). No permanent loss of income in this case.

As often in Economics, this is an empirical question on that we have observed and what we are currently observing. Between 1960 and 2001, almost all the recessions were Hamilton-type recessions, as shown by Valerie Cerra and Sweta Saxena in 2008 (https://www.aeaweb.org/articles?id=10.1257/aer.98.1.439). However, Tomasz Wieladek argues that we have observed a rare case of Friedman-type recession.

Why is it important? In a “Friedmanesque” recession, the supply side of the economy is left unscarred (contrary to a “Hamiltonesque” recession). Thus, standard recipes after a recession will not work in the same way. It could explain (a) why the US economy was so resilient in the face of monetary tightening, (b) why unemployment rates have not increased significantly in the US, and (c) why we have assisted to an “immaculate disinflation” (https://edition.cnn.com/2023/09/06/economy/immaculate-disinflation-meaning/index.html).

If the supply side of the economy has been left unscarred by the pandemic, the demand can grow faster during the recovery phase, so supply can expand with time and inflation can be tamed without an increase in unemployment. Here, a strong growth is not a sign of excess demand and future inflation, but rather “a sign of the supply accommodating demand”, as underlined by Tomasz Wieladek. Policy makers should consider the type of recession in order to (a) not trigger an unnecessary recession and (b) having inflation running below target.