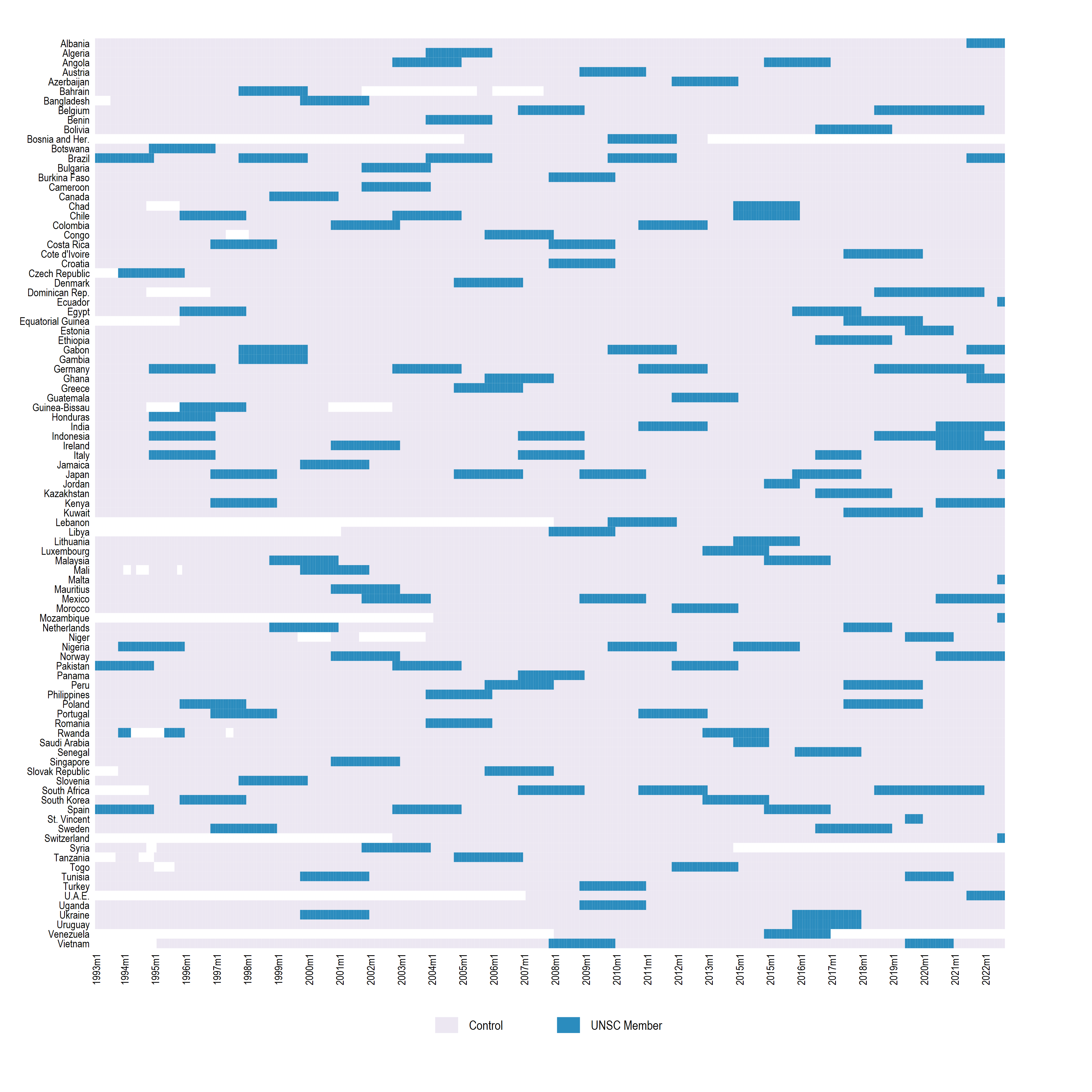

NEW WORKING PAPER: This research investigates the intricate dynamics between the catalytic effect of projects financed by international institutions and geopolitical interests. Through the construction of a monthly database, we first examine the impact of the approval of a project financed by one out of five international institutions on the global macroeconomic situation on non-permanent members of the United Nations Security Council (UNSC). More precisely, we study the potential catalytic effect of the International Monetary Fund, the World Bank, the Asian Development Bank, the European Investment Bank and the Asian Infrastructure Investment Bank. We underline the existence of a catalytic effect in non-permanent members of the UNSC that can significantly impact national macroeconomic situations in a positive or negative way. Second, we contribute to the literature by emphasizing the importance of the country’s geopolitical preferences in the existence and nature of the catalytic effect. We measure these geopolitical preferences through the distance between one country’s ideal point in the United Nations General Assembly and the ideal points of UNSC permanent members session after session.

You are welcome to download, share, or comment on the following working paper:

- Hugo Oriola, Jamel Saadaoui (31 May 2024), How do geopolitical interests affect financial markets reaction to international institution projects? SSRN Working Paper: https://dx.doi.org/10.2139/ssrn.4849861.