As we recall in a recent article, written with Valérie Mignon, oil production facilities may be military objectives during a war or a conflict:

Mignon, V., & Saadaoui, J. (2024). How do political tensions and geopolitical risks impact oil prices? Energy Economics, 129, 107219.

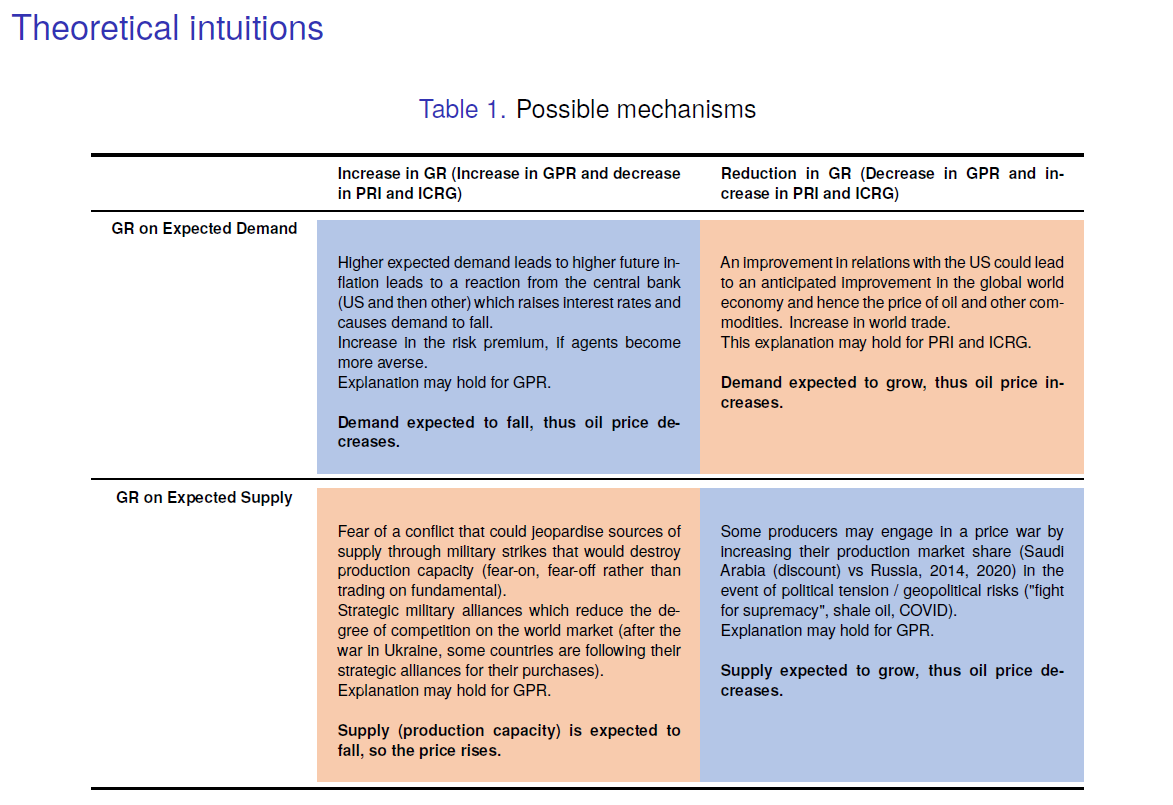

We noted that it could produce upward pressures on oil prices due to pessimistic expectations on future supply capacities (see the second row and the first column):

On 13 March, Ukraine targeted Russian oil refineries with drones:

https://www.bloomberg.com/news/articles/2024-03-20/

“Russia’s average daily oil refining rate fell to the lowest weekly level in ten months after a flurry of Ukrainian drone attacks hit several major facilities. Refiners processed 5.03 million barrels a day of crude from March 14 to 20, according to a person with knowledge of industry data. That’s down more than 400,000 barrels a day from the average for the first 13 days of the month, according to Bloomberg calculations based on historical data”

https://www.bloomberg.com/news/articles/2024-03-22/

According to our work, this may exert upward pressures on oil prices, both due to supply shortages and to expected future supply shortages.

Edit on January 20, 2025:

As underlined by Lutz Kilian, the effects of these news on the global supply has to be assessed in the light that these strikes on refineries do not reduce the availability of Russian oil for exports. It is not a positive shock to the risk of a global oil supply disruption, which explains the lack of a price response.

1 Comment

[…] energy transition: Examining the impact of geopolitical risk on the price of critical minerals Geopolitical risk and oil prices: When refining capacities are targeted Do geopolitical risk shocks only have indirect effects on the oil […]