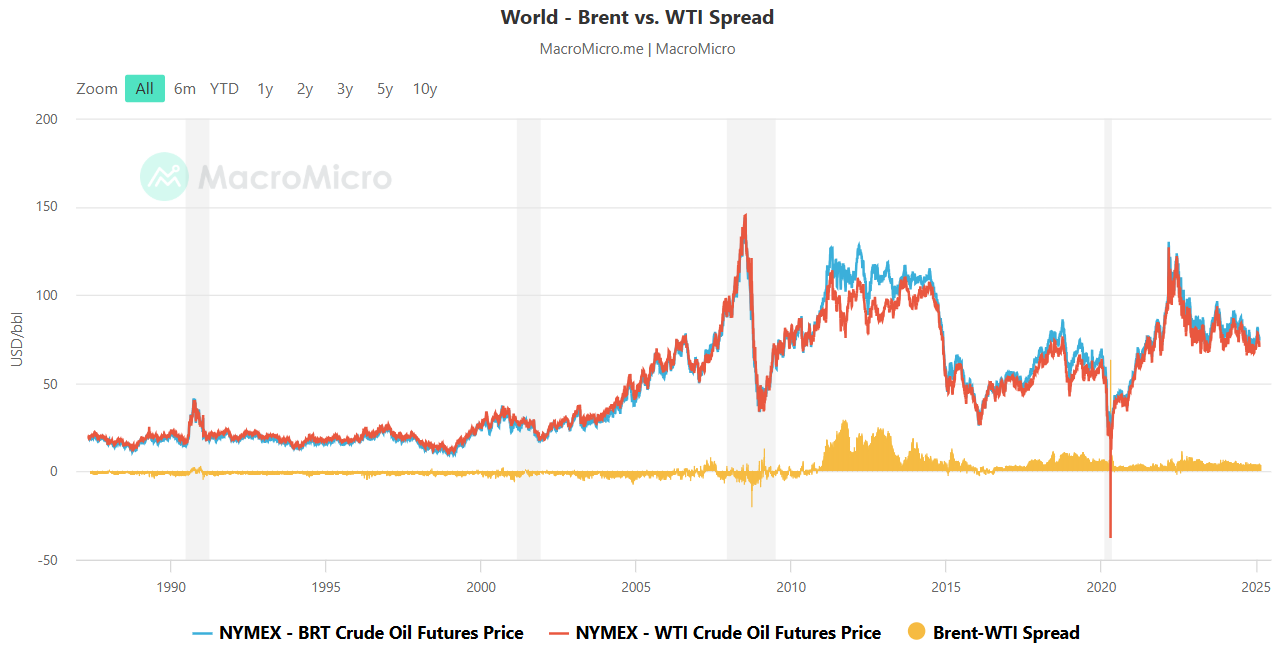

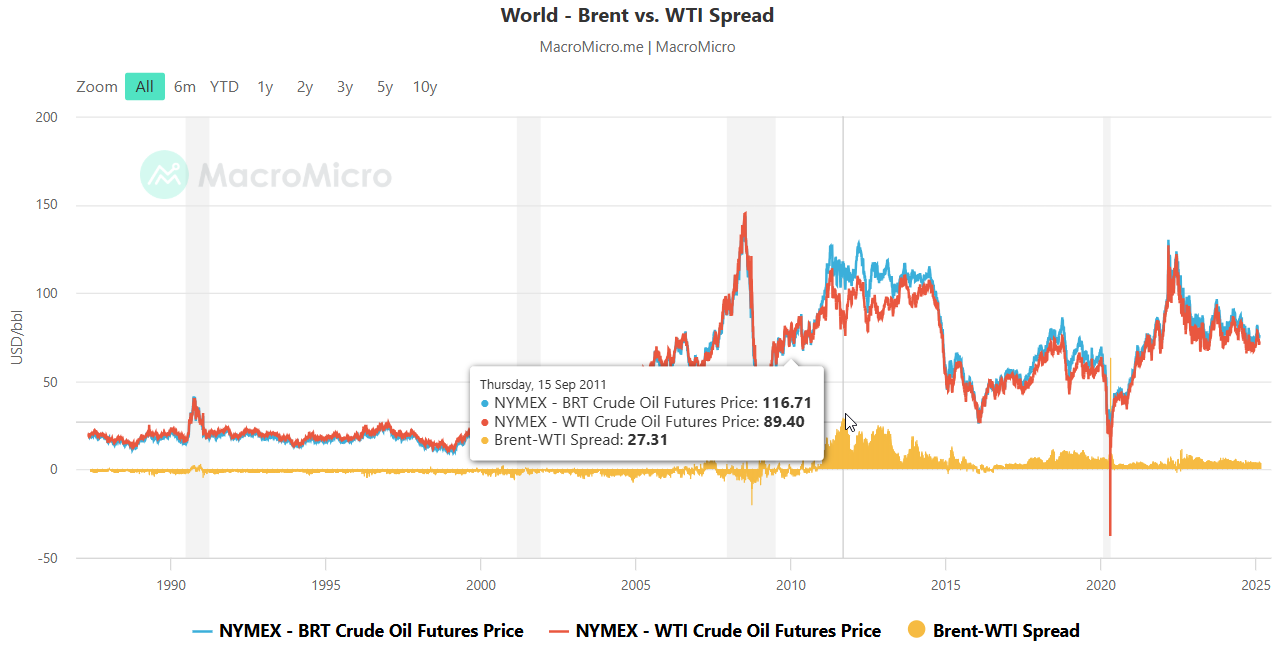

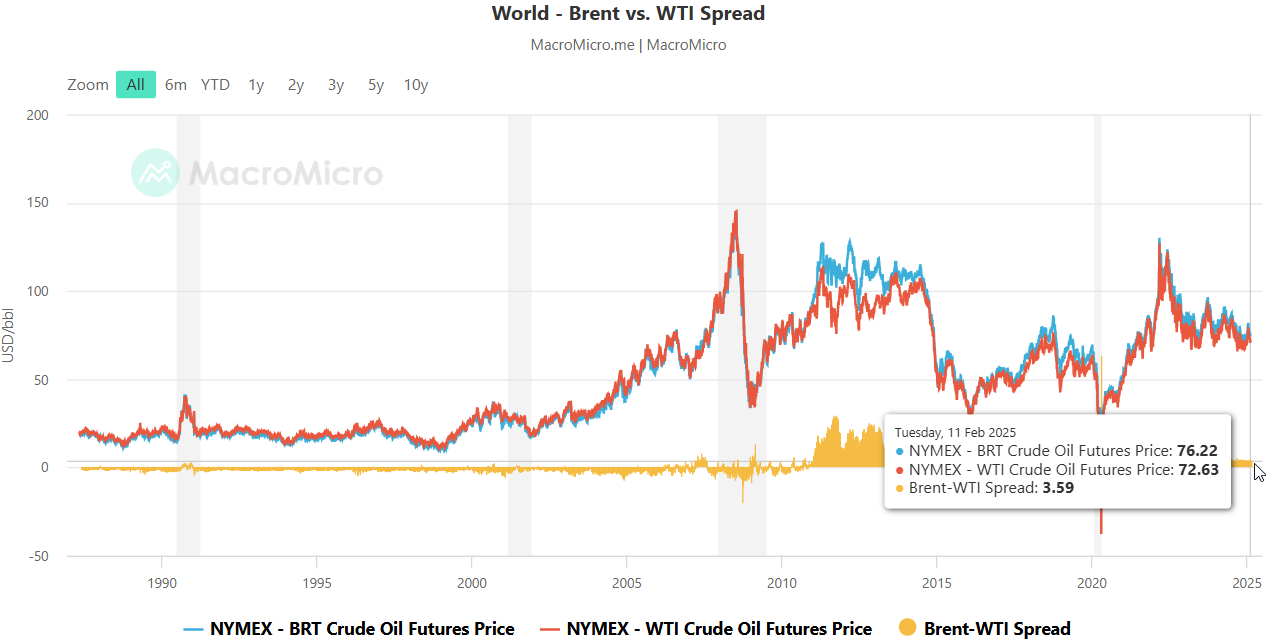

The Brent-WTI spread has known important evolutions after 2010. While it is well known by practitioners, market participants and academics, it may be useful to recall this point.

From the MacroMicro website: “Brent (BRT) and West Texas Intermediate (WTI) crude oil are the two most widely used benchmarks for crude oil prices, reflecting different segments of the global oil market. BRT serves as an indicator of supply and demand of the global oil market, while WTI primarily represents the U.S. market.

WTI is of higher quality than Brent. From 1987 to 2010, the price difference between the two futures was typically negative. However, the spread widened after the U.S. increased shale oil production and implemented an oil export ban. This led to an oversupply in the U.S. market, combined with market speculation, causing a decline in WTI prices and the widened spread thereof.”