In this new version of this paper, written with Yifei Cai, we find evidence of time-varying scapegoating:

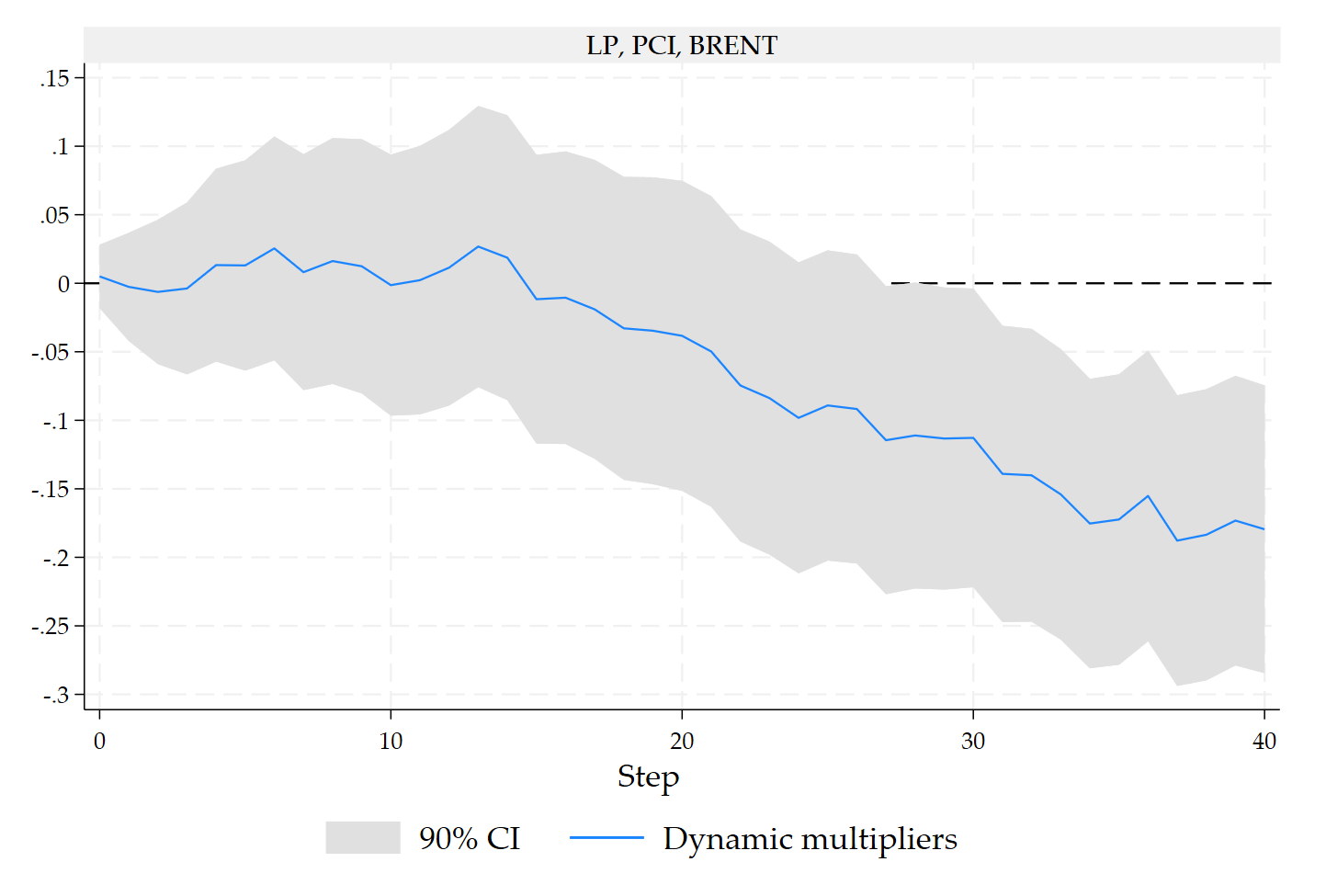

The shocks in US Partisan Conflict provoke a decrease of the global oil price in the medium run. From the paper: “Under the scapegoating hypothesis, a 1-point rise in US partisan conflict leads to an approximately 0.3-point increase in US-China tension. It also resulted in a medium-term decrease in global crude oil prices by 0.2 U.S. dollars per barrel. These effects are sizable, since the average monthly variation of global crude oil prices is around 0.14 U.S. dollars per barrel.“

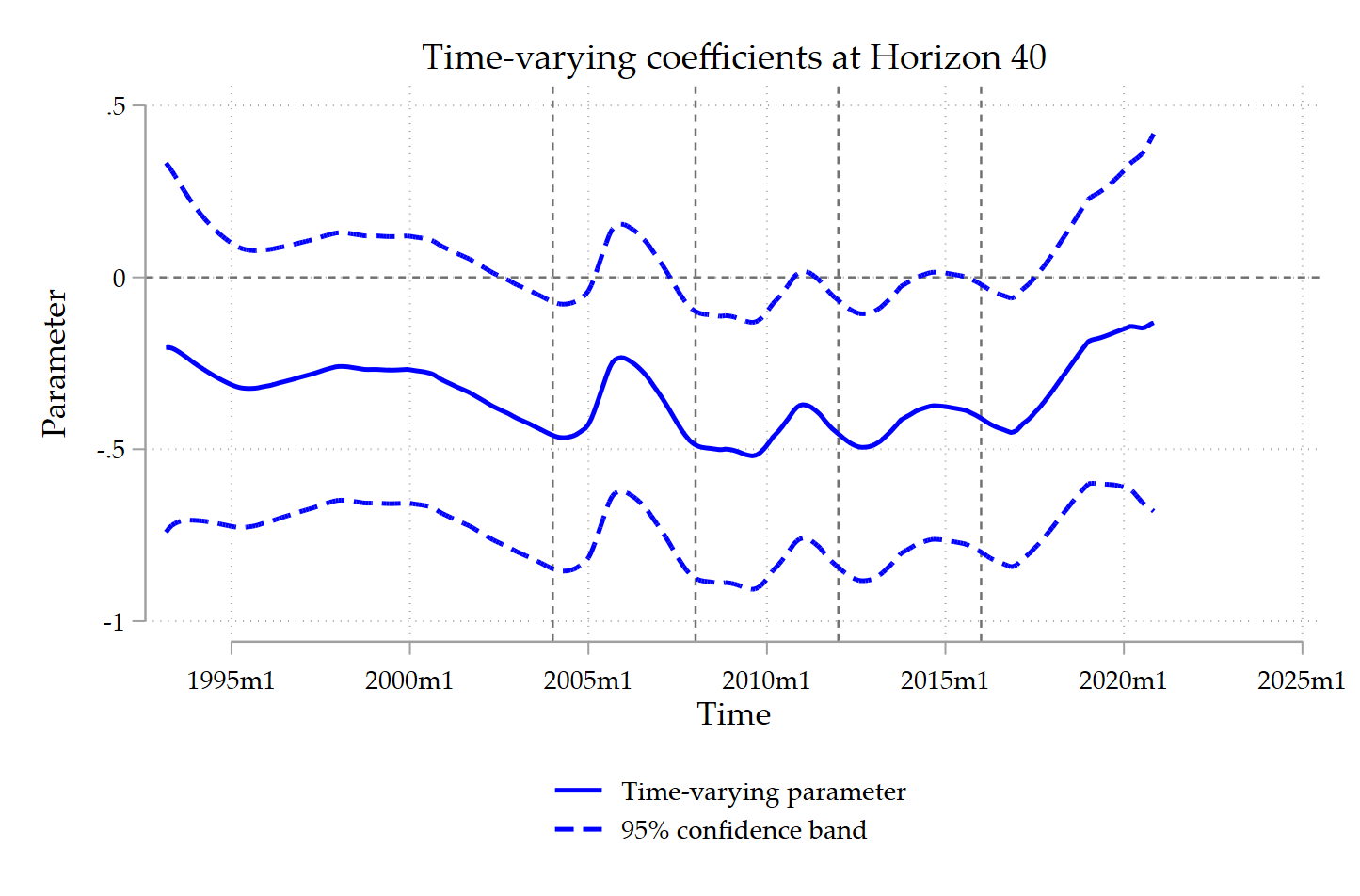

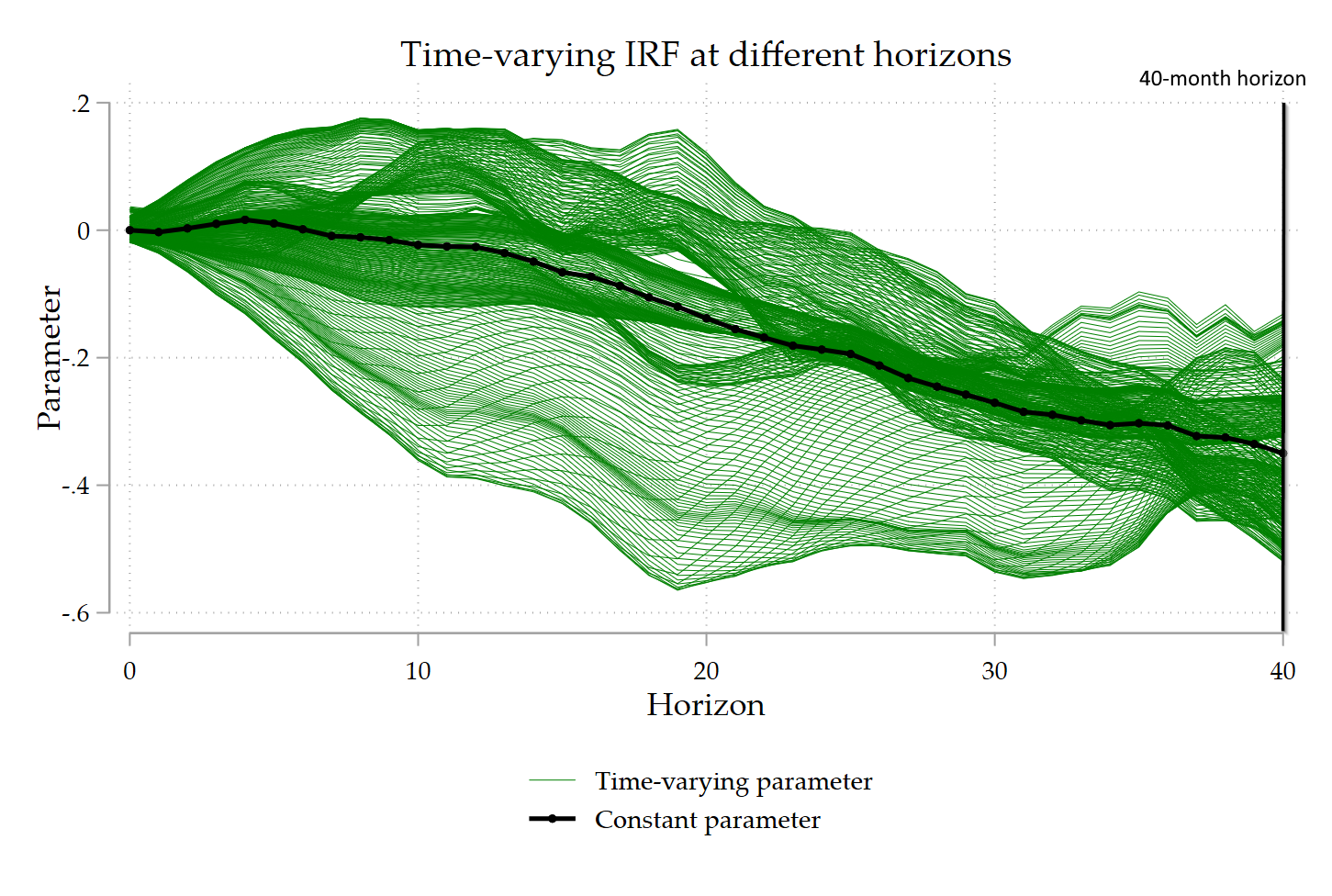

This average effect seems to display some time-varying effects:

Let us focus on the 40-month horizon, from the paper: “At the 40-month horizon, the Brent price reaction to US partisan conflict is stronger and significant at the 5 percent level before US elections and after the first election of Donald Trump.” I highlight the beginning of the year during an election year.