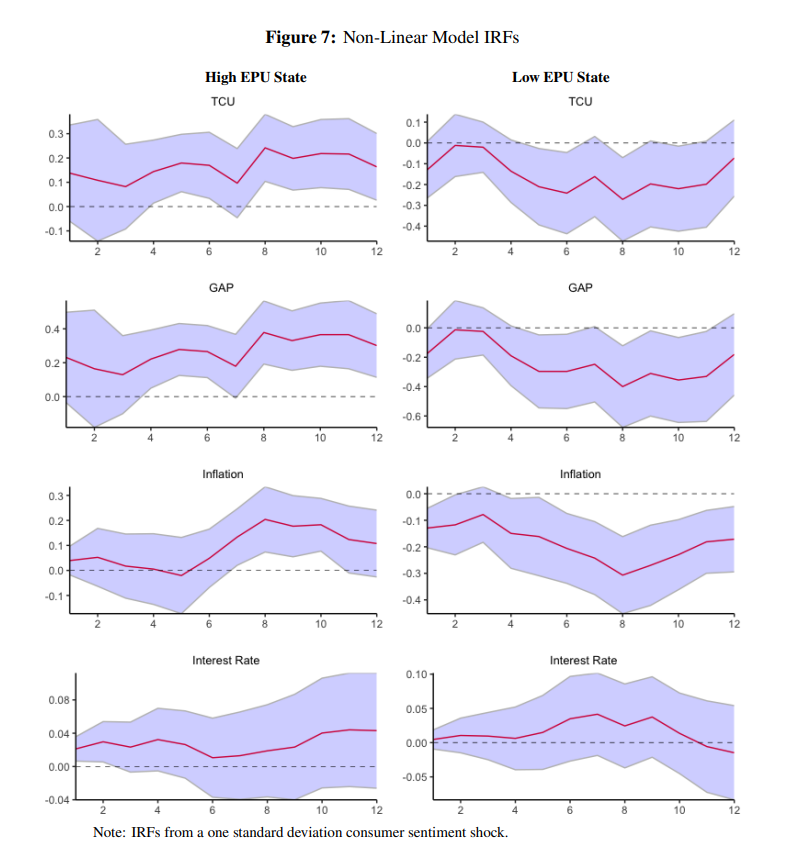

NEW WORKING PAPER: This paper investigates the impact of consumer confidence shocks on economic conditions. We estimate consumer confidence innovations using a Generalized Method of Moments (GMM) and a Vector Autoregressive (VAR) approach, controlling for economic policy uncertainty (EPU) and news sentiment. These shocks are incorporated into a VAR model with Local Projections (LP) as external variables. Empirical findings reveal that sentiment shocks have non-trivial effects during high uncertainty periods. Additionally, the delayed response of output to consumer confidence shocks during low uncertainty periods suggests that capital utilization plays a critical role in amplifying sentiment effects, as fewer resources remain idle.

You are welcome to download, share, or comment on the following working paper:

- Ginn, W., & Saadaoui, J. (2025). Are Consumer Sentiment Shocks State-Dependent? Available at SSRN 5278402.