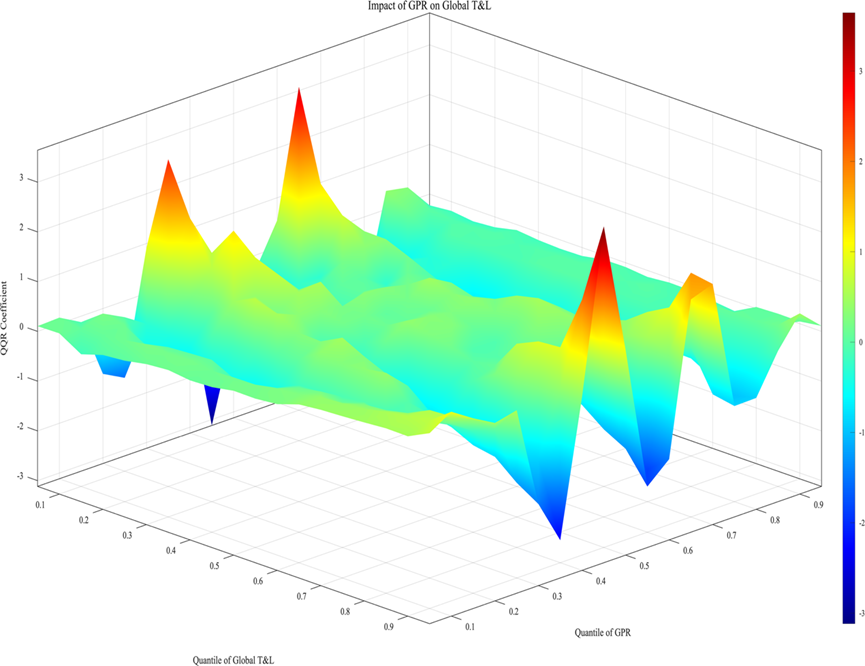

NEW PUBLICATION: This study investigates the impact of geopolitical risk (GPR) on global Travel & Leisure (T&L) stock returns using a Multivariate Quantile-on-Quantile Regression (MQQR) approach. Focusing on global, American, European, and Asian perspectives, we examine how GPR influences cross-market connectedness under different market conditions. Results reveal that the T&L sector exhibits a “fear and desire” pattern: highly sensitive during market panics but resilient in periods of optimism. Regionally, American and European markets amplify global risk, whereas Asian markets act as relative insulators. We further combine quantile-based vector autoregressions (QVAR) with complementary OLS estimates to assess whether GPR functions as a systematic driver of interest regime. GPR exerts a statistically significant dampening effect on systematic return spillovers, yet primarily in extreme market states, while its influence is muted under normal conditions. These findings underscore the need for policymakers and financial regulators to integrate GPR indicators into sector-specific stress testing and early warning frameworks.

You can quote this article as:

Sun, K., Chi,. J., Tao, M., Saadaoui, J. (2025). What are the Implications of Geopolitical Risks on Travel and Leisure Firms? Accepted in Finance Research Letters, Open Access thanks to a grant from Paris 8 University and funded by the Paris Lumières University Group funded by the French National Centre for Scientific Research, University Paris Nanterre, and Paris 8 University.