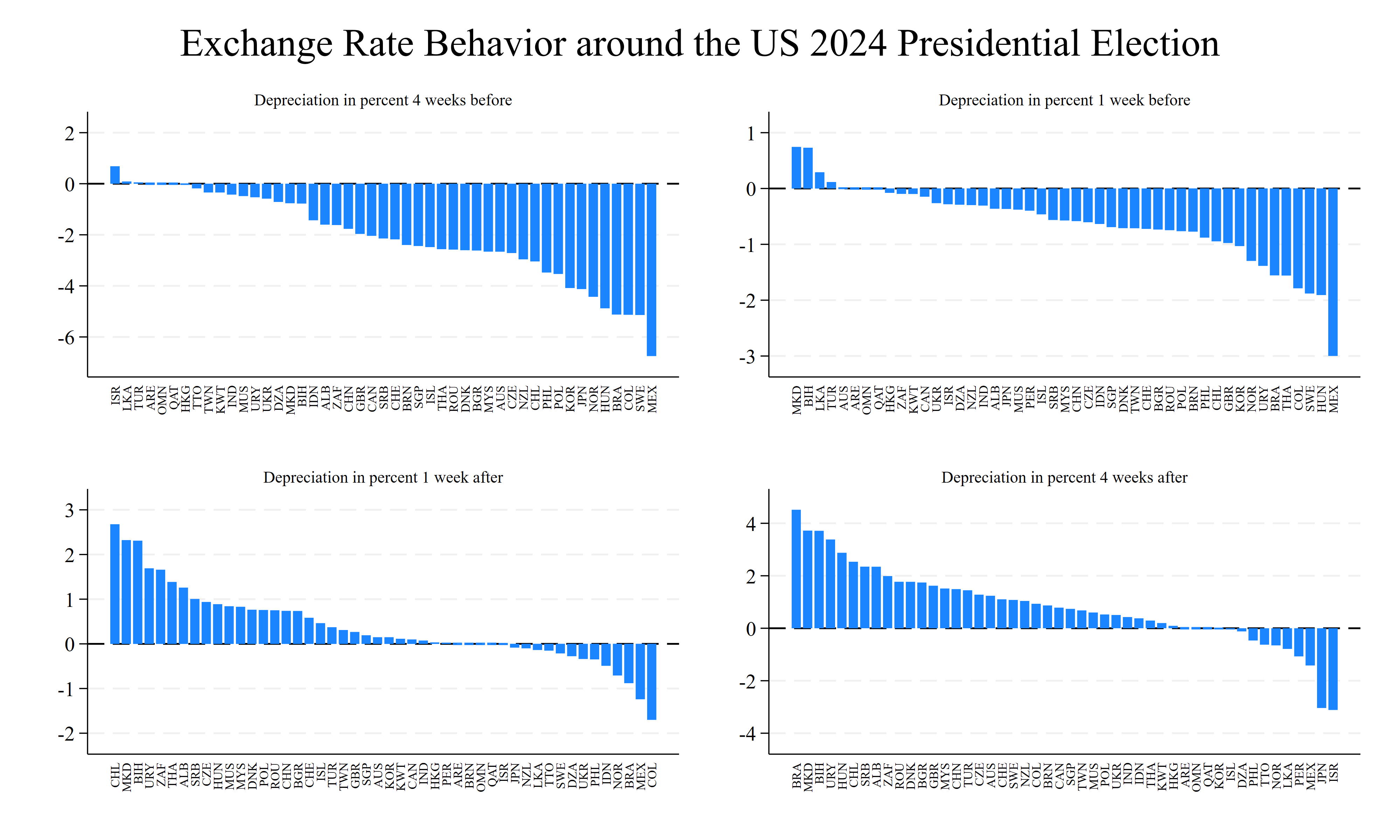

After Yesterday’s post on how to get access to daily data for exchange rate from the BIS using Python. Here, I add a Stata code snippet to investigate the behavior of the daily exchange rates around the US 2024 Presidential Election.

graph bar DXR if date==23657 & DXR!=0 & DXR!=., ///

over(imfcode, label(angle(90) labsize(vsmall)) ///

gap(25) sort(1) descending) ///

yti("") yline(0) ///

ti("Depreciation in percent 4 weeks before", ///

size(small)) ///

name(G1, replace)

graph bar DXR if date==23678 & DXR!=0 & DXR!=., ///

over(imfcode, label(angle(90) labsize(vsmall)) ///

gap(25) sort(1) descending) ///

yti("") yline(0) ///

ti("Depreciation in percent 1 week before", ///

size(small)) ///

name(G2, replace)

graph bar DXR if date==23692 & DXR!=0 & DXR!=., ///

over(imfcode, label(angle(90) labsize(vsmall)) ///

gap(25) sort(1) descending) ///

yti("") yline(0) ///

ti("Depreciation in percent 1 week after", ///

size(small)) ///

name(G3, replace)

graph bar DXR if date==23713 & DXR!=0 & DXR!=., ///

over(imfcode, label(angle(90) labsize(vsmall)) ///

gap(25) sort(1) descending) ///

yti("") yline(0) ///

ti("Depreciation in percent 4 weeks after", ///

size(small)) ///

name(G4, replace)

graph combine G1 G2 G3 G4, ti("Exchange Rate Behavior around the US 2024 Presidential Election") ///

scale(0.95) row(2)

We can clearly see that the exchange rates all around the world were appreciating against the US dollar before the election of Donald J. Trump. After the election, the exchange rates almost all around the world started to depreciate against the US dollar.

With Joshua Aizenman, we explore this question more in detail in the following NBER working paper: