In this post, I will clarify the interpretation of triple interaction term in Stata. I will leverage a previous blog that clarifies the use of lincom, nlcom, and margins in Stata. Let me recommend you to read the blog below before reading this one.

// Equivalence between lincom, nlcom and margins

// Three-way interaction term

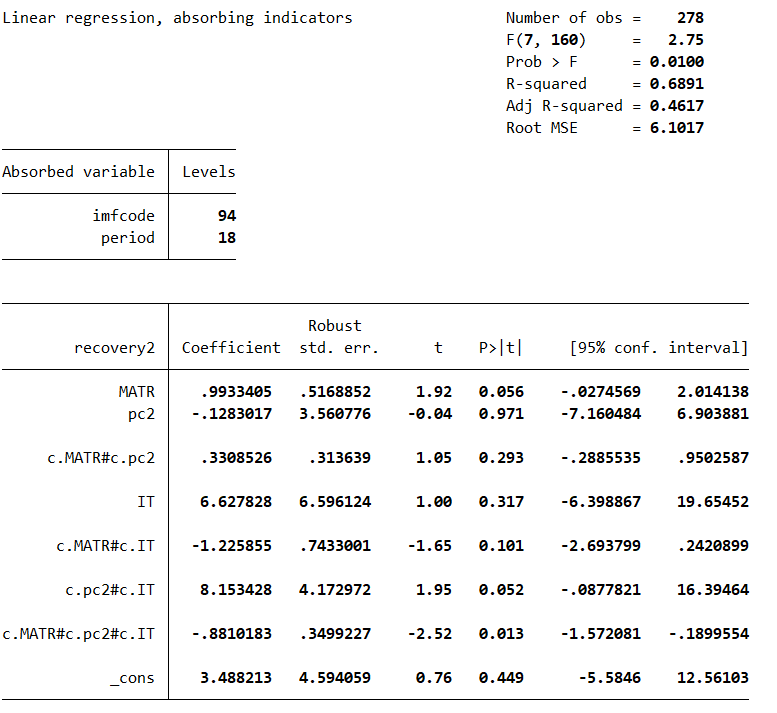

areg recovery2 c.MATR##c.pc2##c.IT if RGDP_p!=0 & period>2002, ///

absorb(imfcode period) rob

areg recovery2 c.MATR##c.pc2##c.IT if RGDP_p!=0 & period>2002, ///

absorb(imfcode period) rob coeflegend

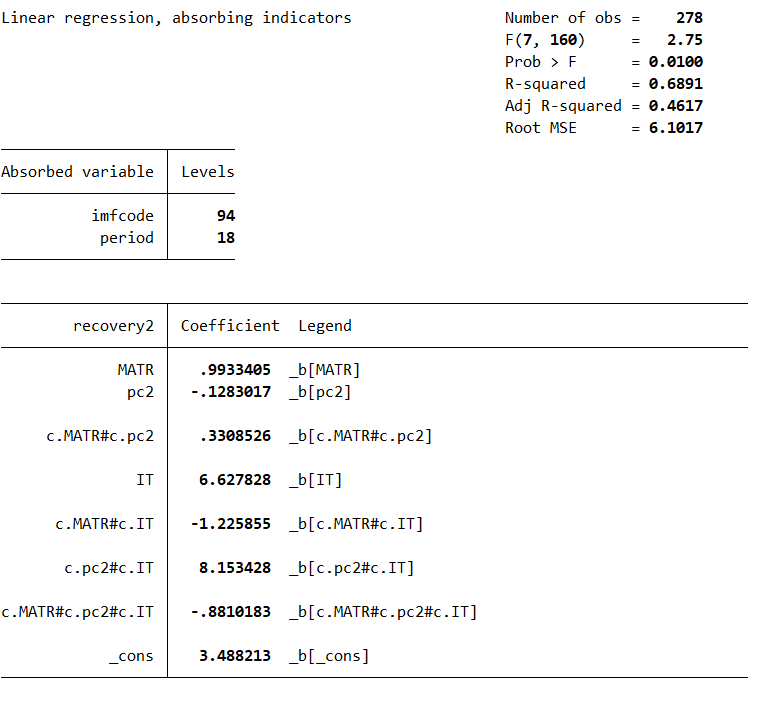

With the coeflegend option, I can see the names of the coefficients:

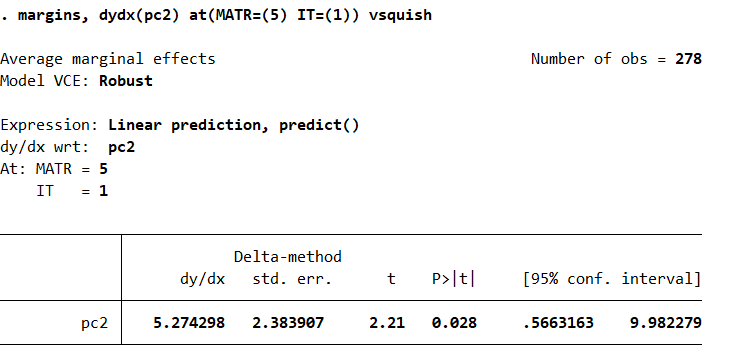

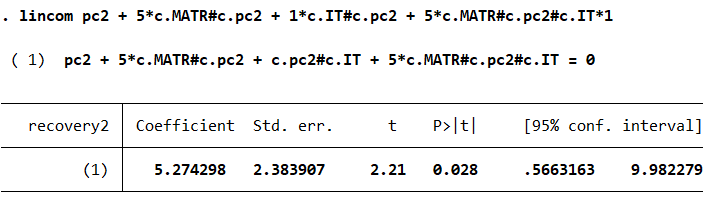

Using margin, lincom or nlcom, I can look at the effect of an improvement of the second component of the ICRG political risk variable for a low level of trade restrictions, say 5, and inflation targeters, the IT dummy will be equal to one in that case. The three commands below are equivalent:

margins, dydx(pc2) at(MATR=(5) IT=(1)) vsquish

lincom pc2 + 5*c.MATR#c.pc2 + 1*c.IT#c.pc2 + 5*c.MATR#c.pc2#c.IT*1

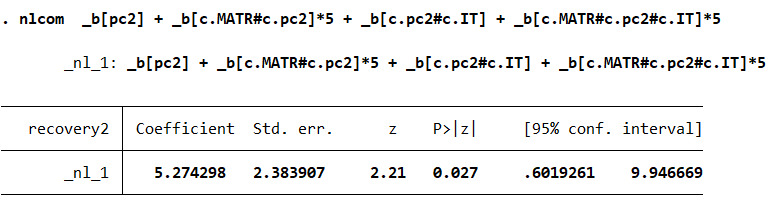

nlcom _b[pc2] + _b[c.MATR#c.pc2]*5 + _b[c.pc2#c.IT] + _b[c.MATR#c.pc2#c.IT]*5Let us start with margin:

We continue with lincom:

Finally, with nlcom, where the approximation with the delta method gives slightly different results:

It seems that, conditional to the inflation targeting status, a better institutional development matters for the strength of the recovery 8 quarters after the start of a recession.