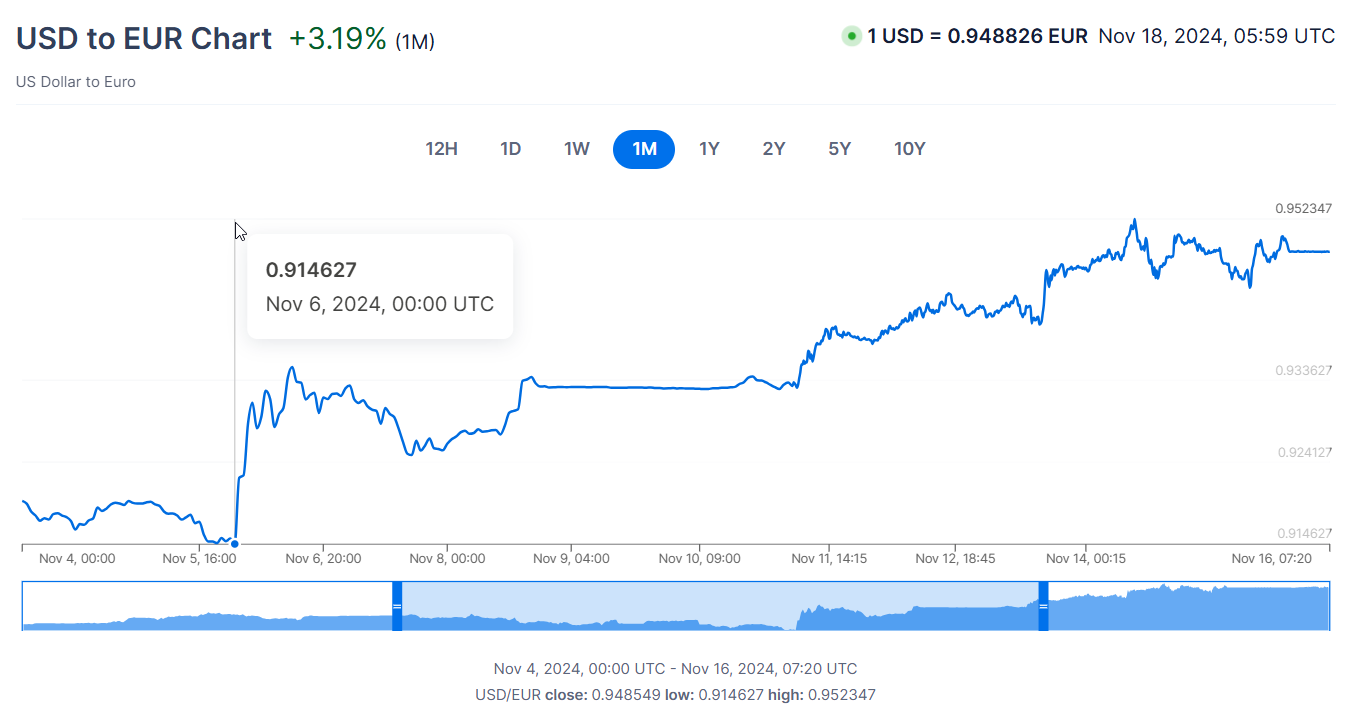

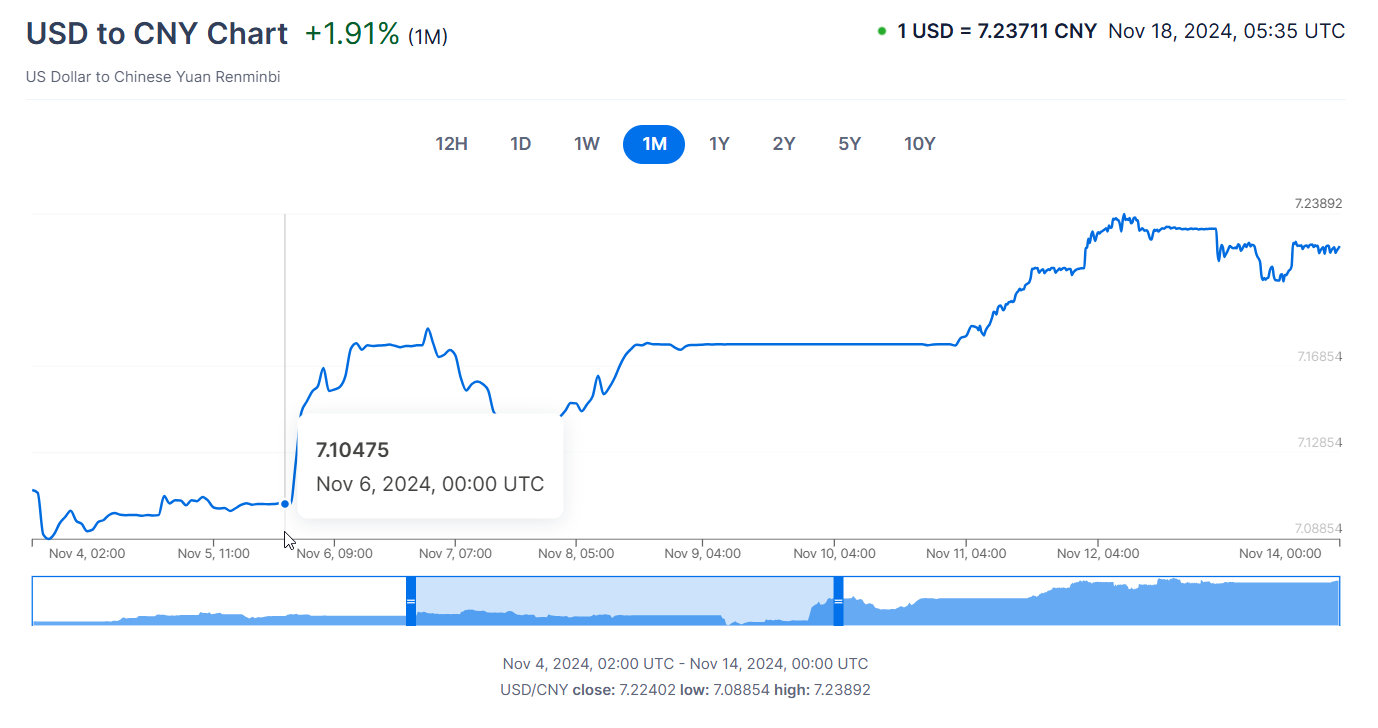

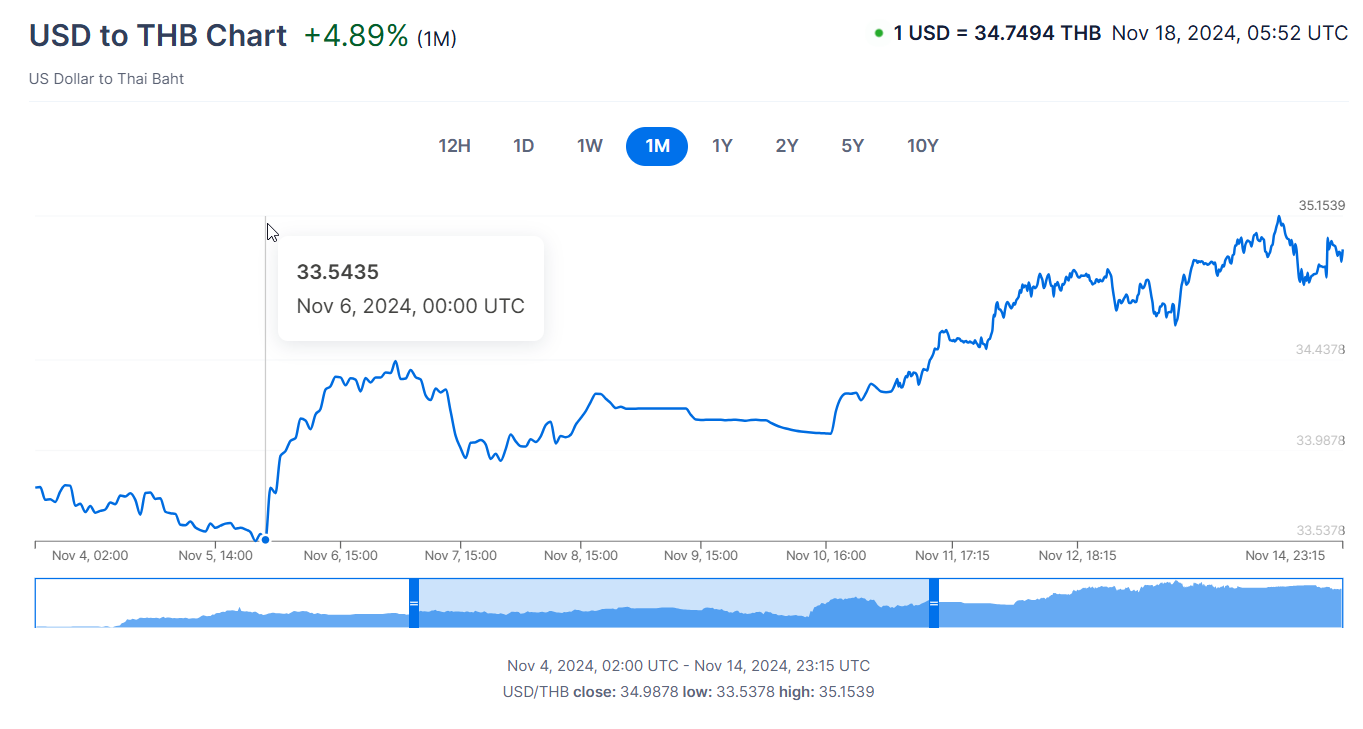

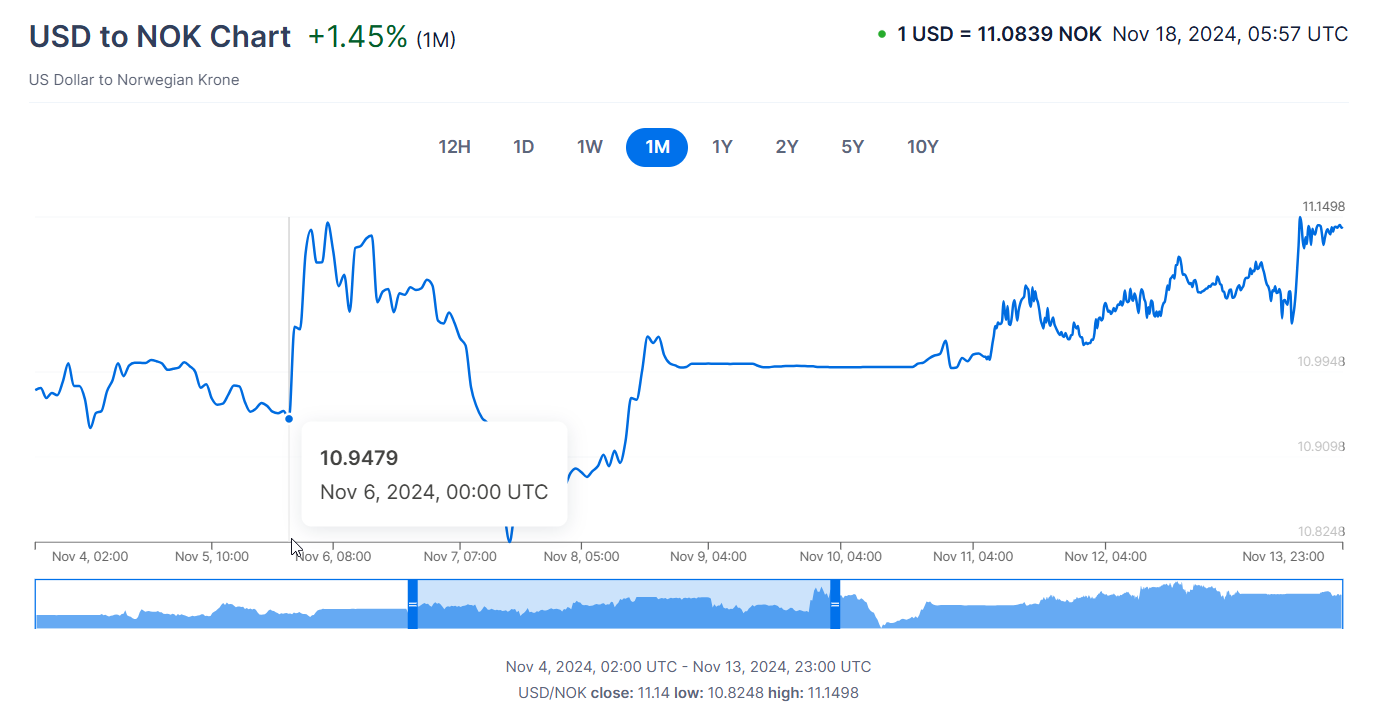

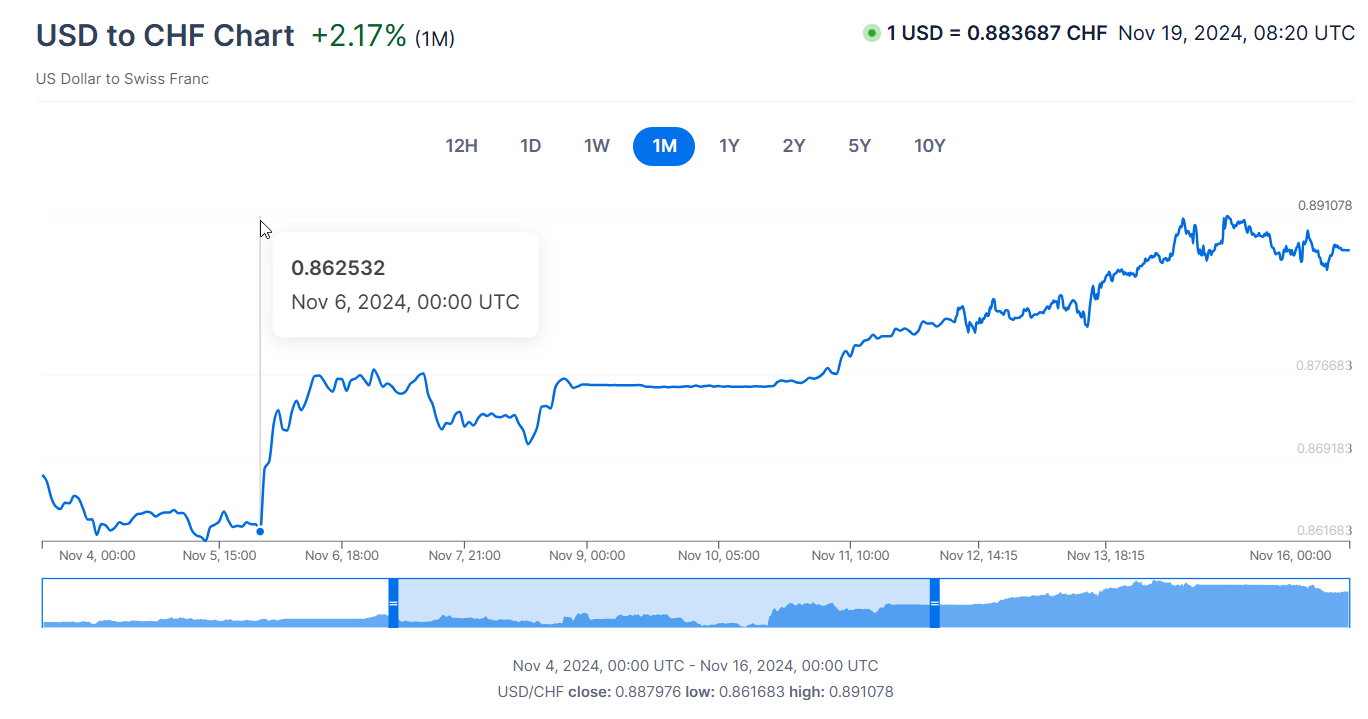

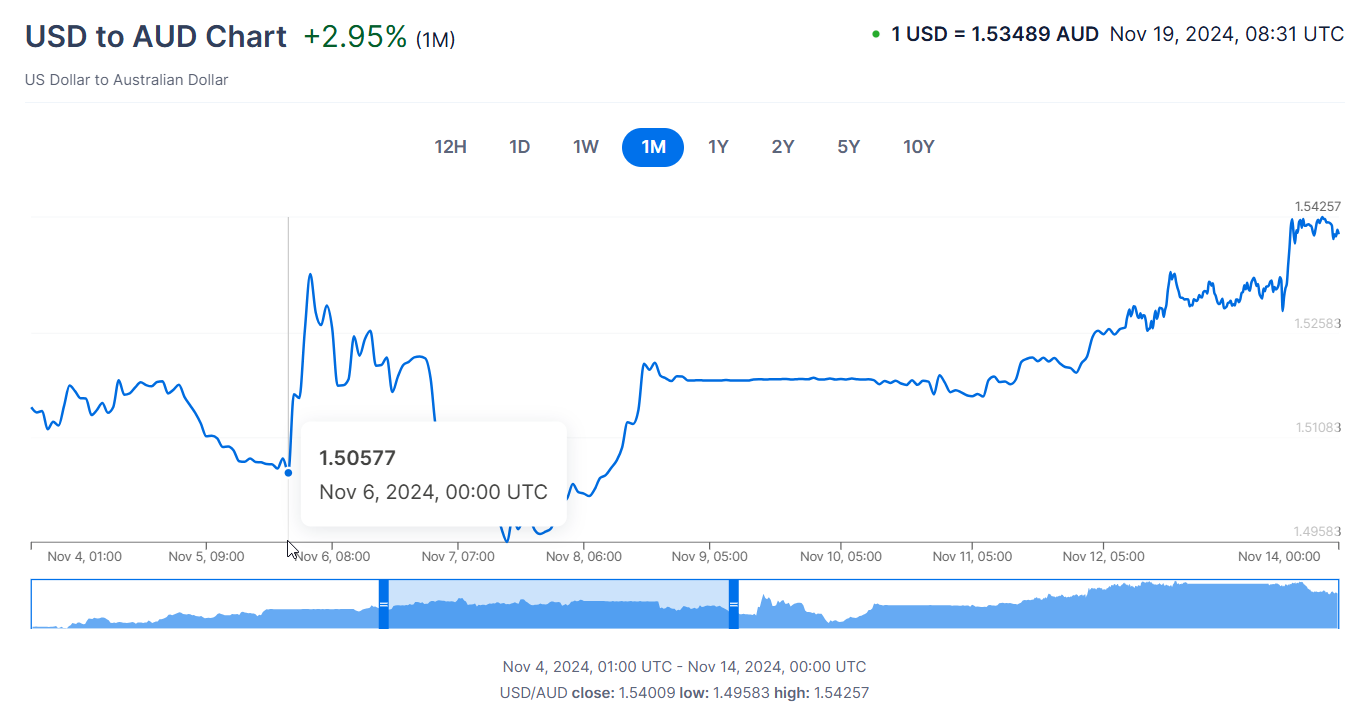

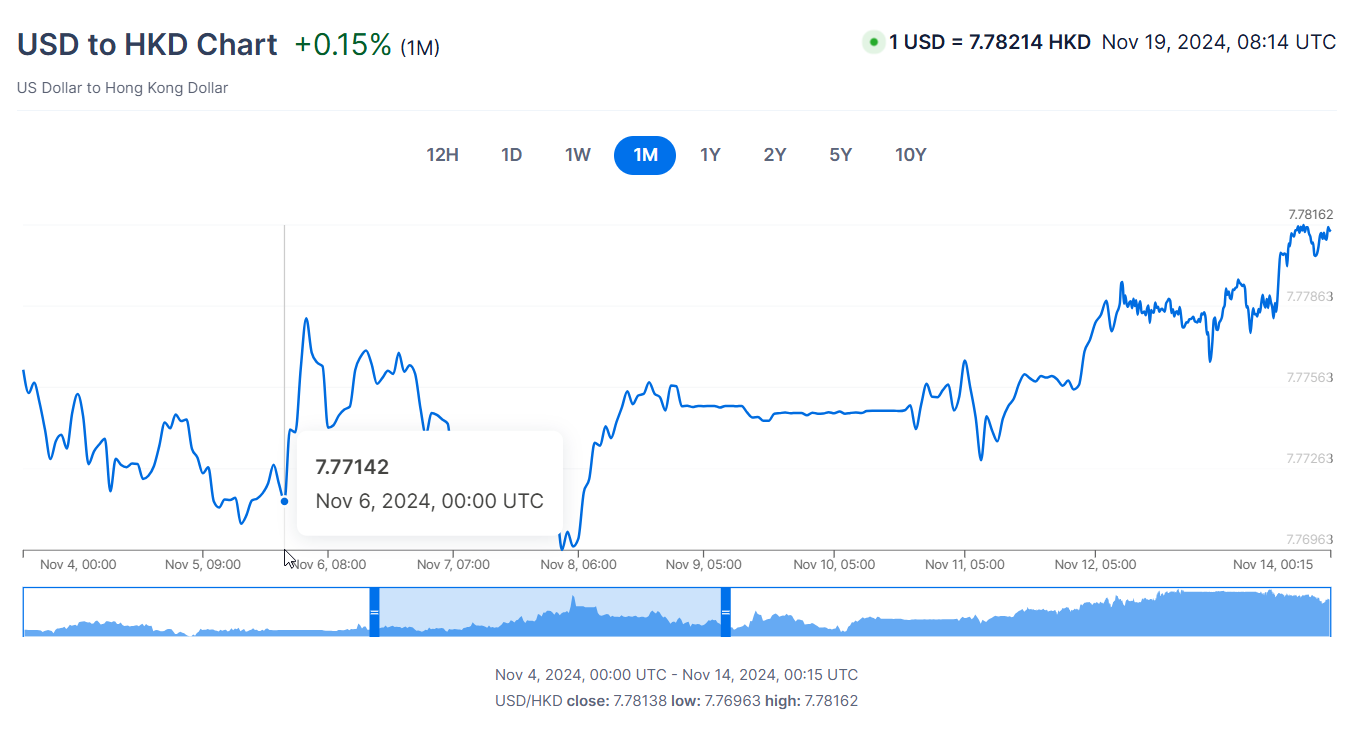

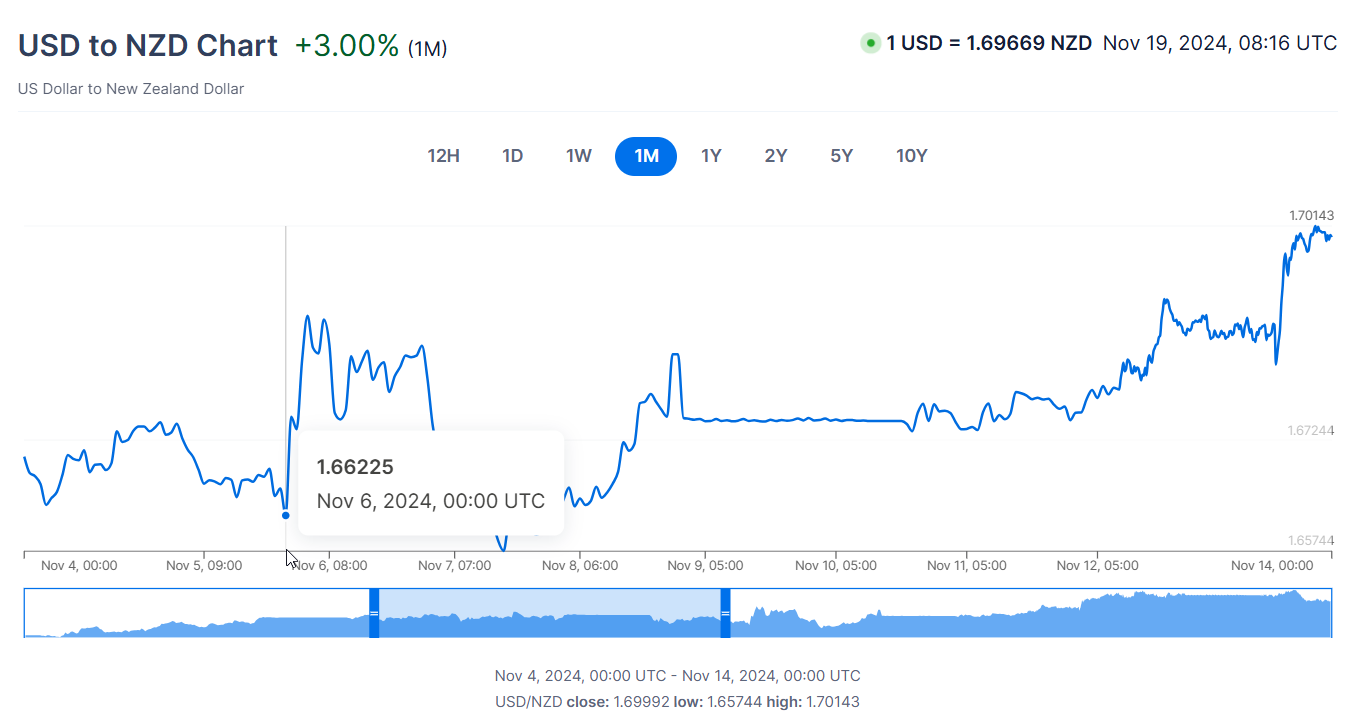

In our last research, Joshua Aizenman and I examine the behavior of exchange rates after the 2024 US Presidential election. Our identification strategy for the causality relies on the reaction of exchange rates after the path of victory appeared certain at November 6 UTC 0:00. The reaction on the foreign exchange market was so strong in a few hours, that it left very few doubts about the identification strategy. If the election of Donald Trump was anticipated, the FOREX would have priced this information before November 6 UTC 0:00 UTC and the exchange rate should have started to depreciate before midnight. It is not the case. For the euro area, 1 USD was equal to 0.914627 EUR at November 6 UTC 0:00 UTC and started to depreciate only after midnight.

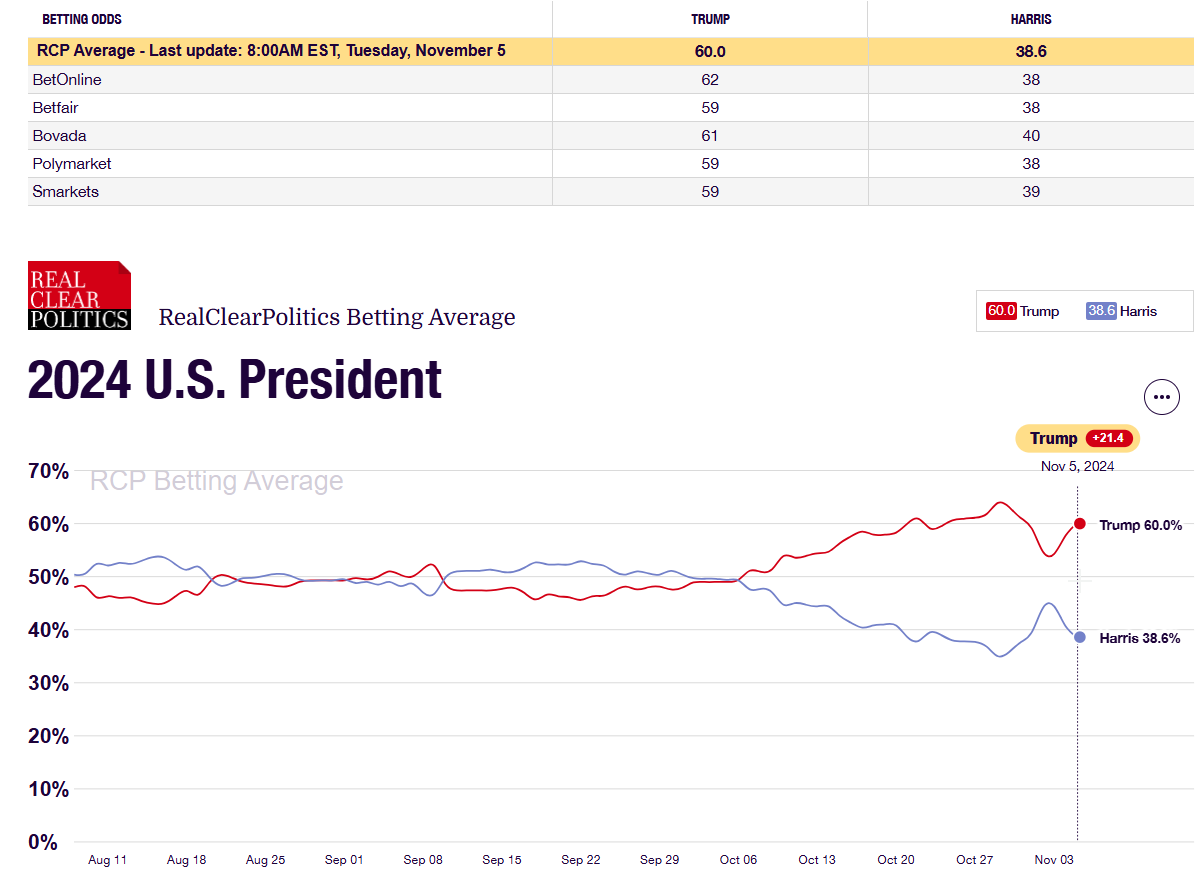

Besides, Joshua underlined that this news shock is a rise in the probability of having Trump as a president from about 50% to 100%, with the extra recognition that the US Senate flips to Trump. If you look at the betting odds, see below, the shock is a rise of the probability from 60% to 100%, still significant enough to move all non-fixed exchange rates.

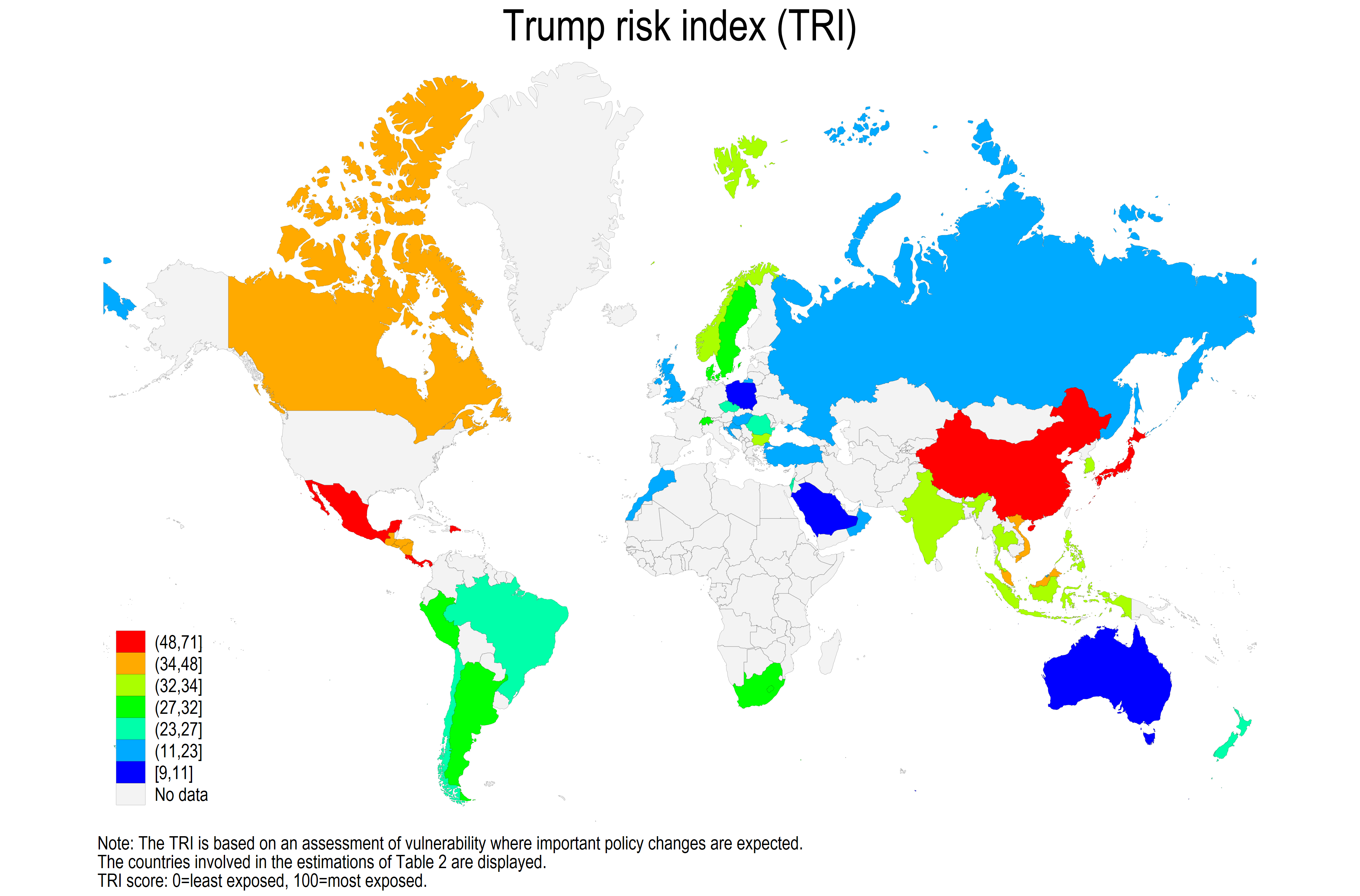

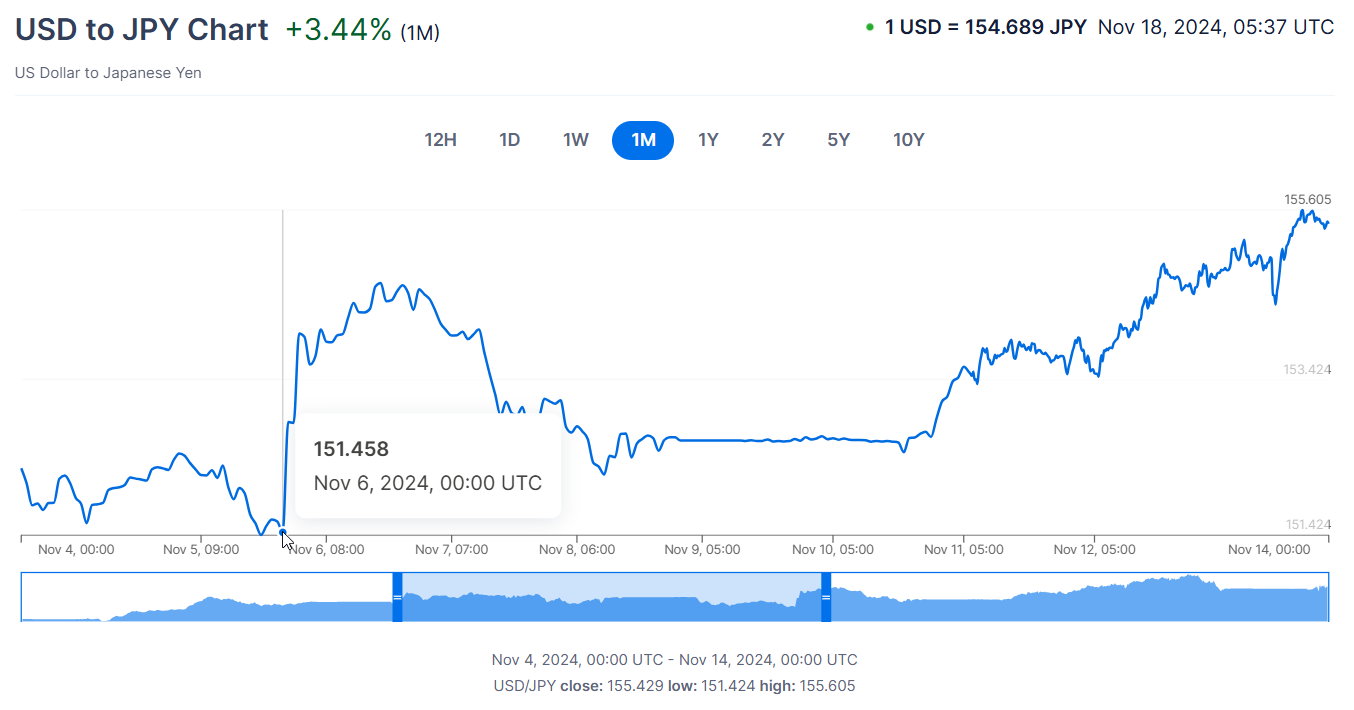

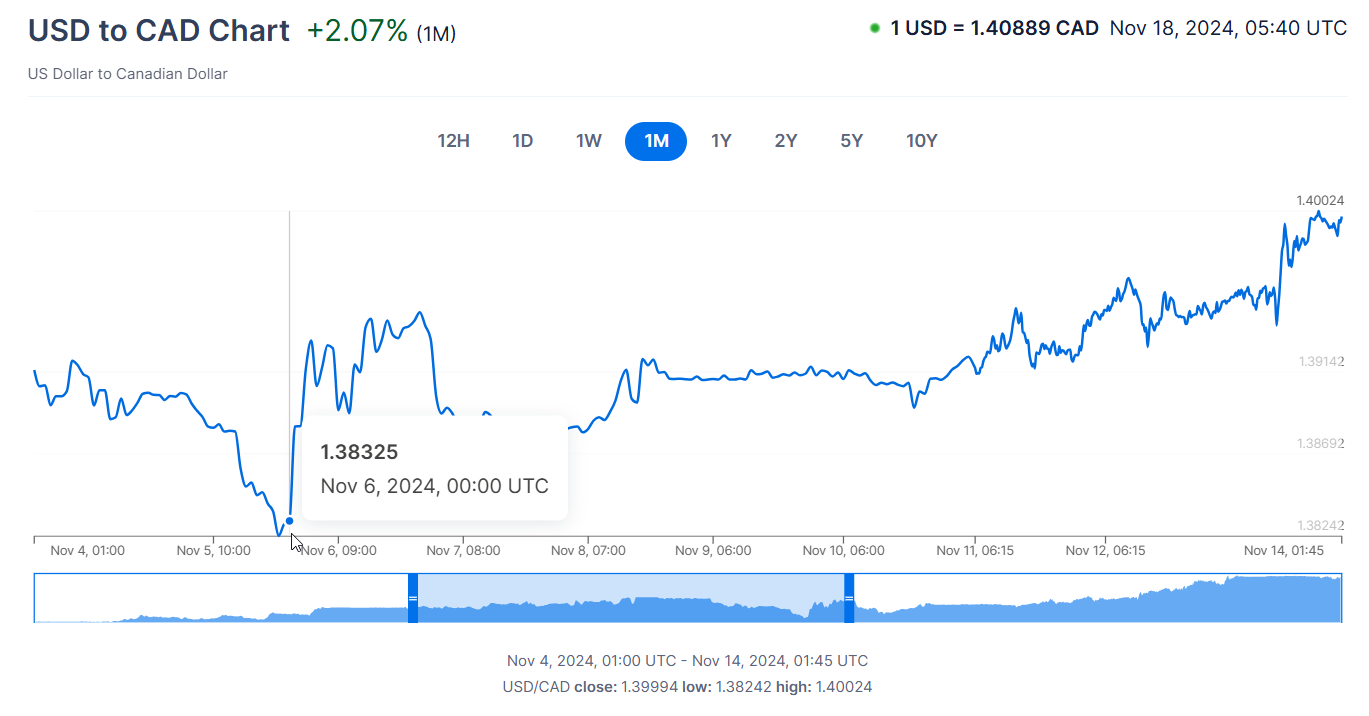

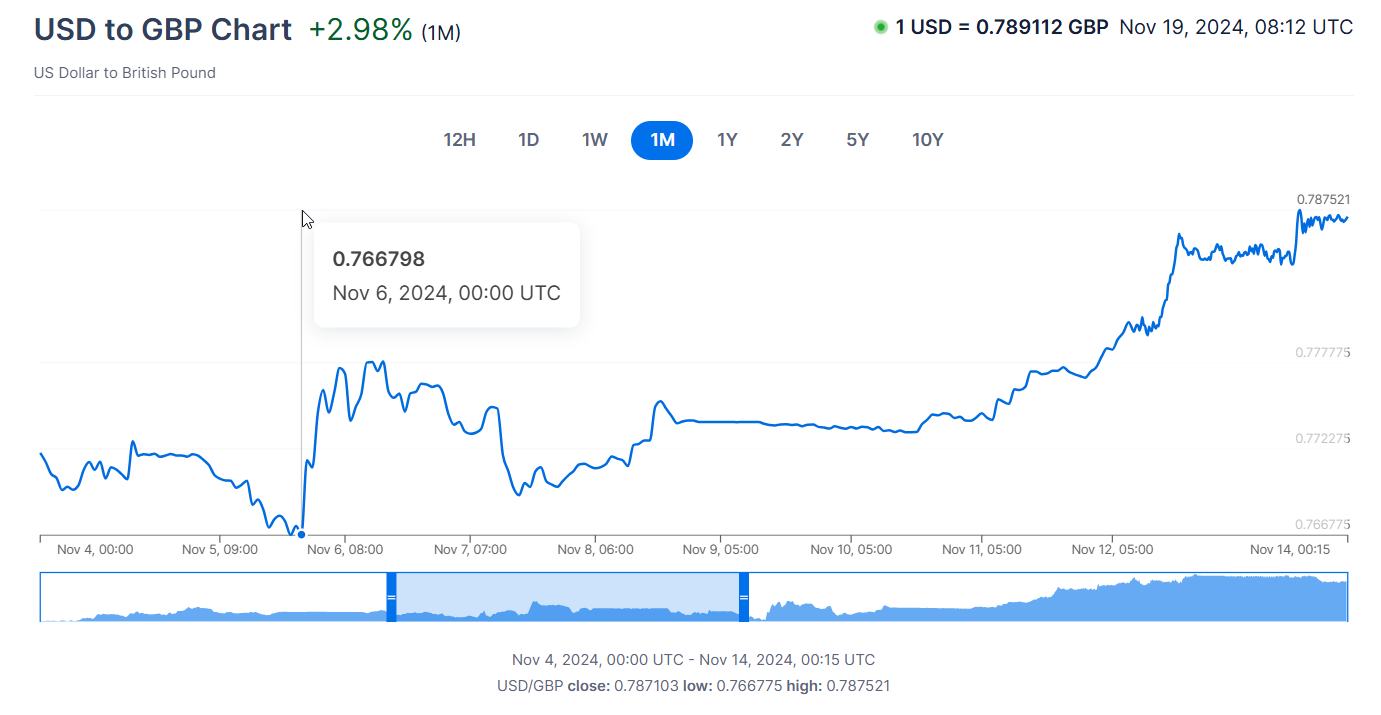

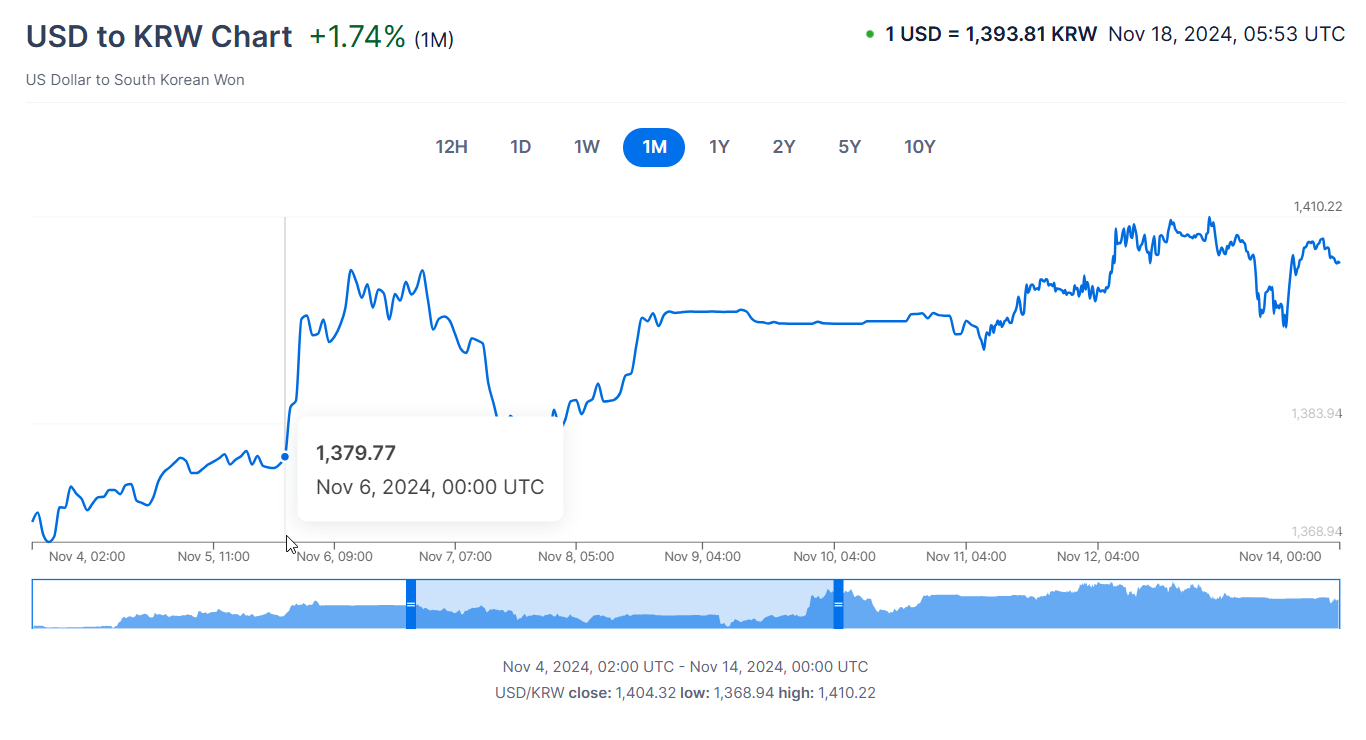

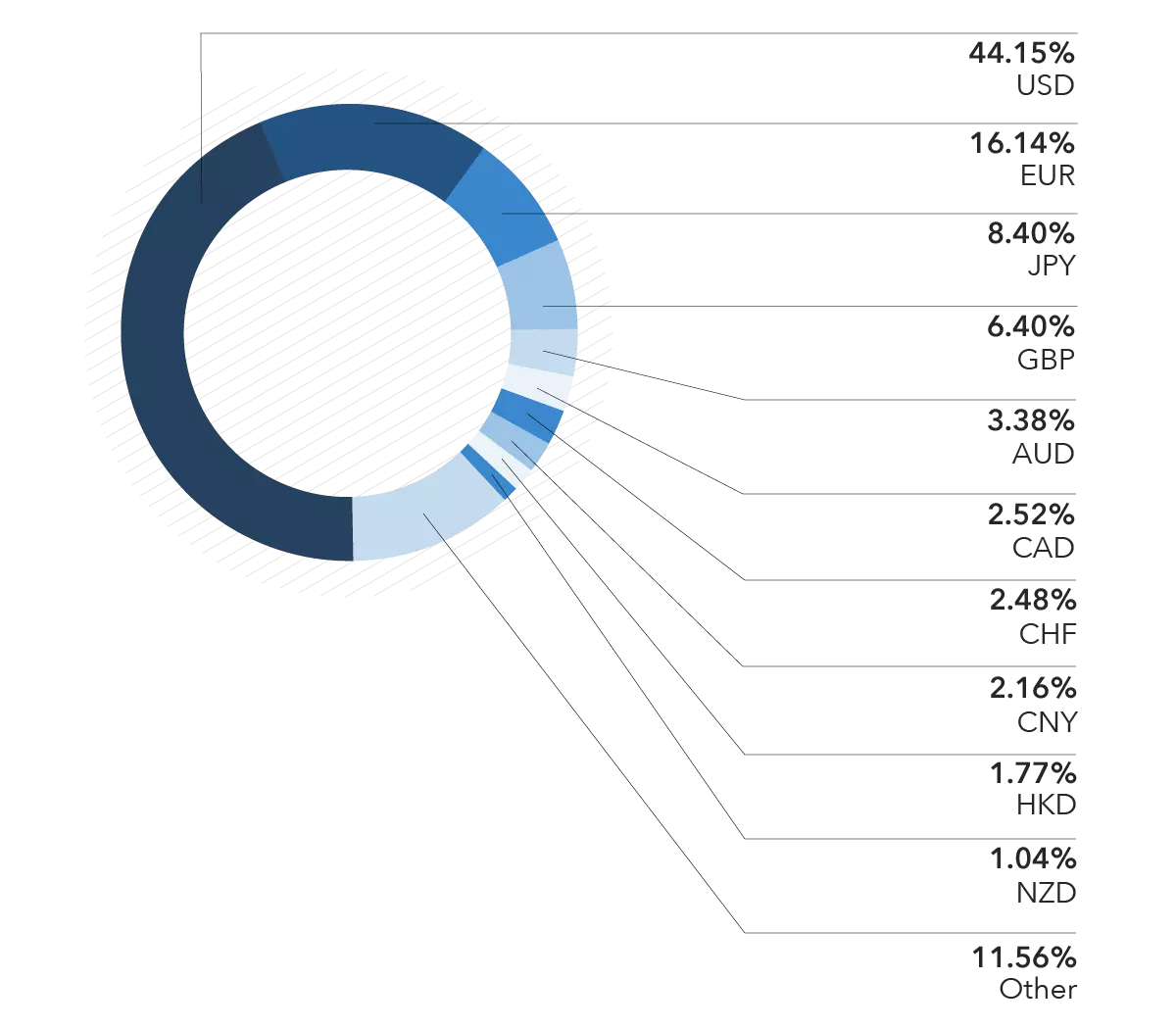

This behavior was, indeed, observed on all non-fixed exchange rates, providing a very strong support to our high-frequency identification strategy, ranked below by size importance and exposure to policy changes. I also add the most traded currencies at the end.

We can add the following 4 currencies to have an overview on the most traded currencies:

The working paper is available in a previous post:

1 Comment

[…] High-Frequency Behavior of Exchange Rates After the 2024 US Presidential Election […]