Let me draw your attention to this Journal of Economic Literature’s article that surveys all the measures that are used to evaluate uncertainty in Economics and in Finance: https://www.aeaweb.org/articles?id=10.1257/jel.20211645. A must-read for everyone interested in economics.

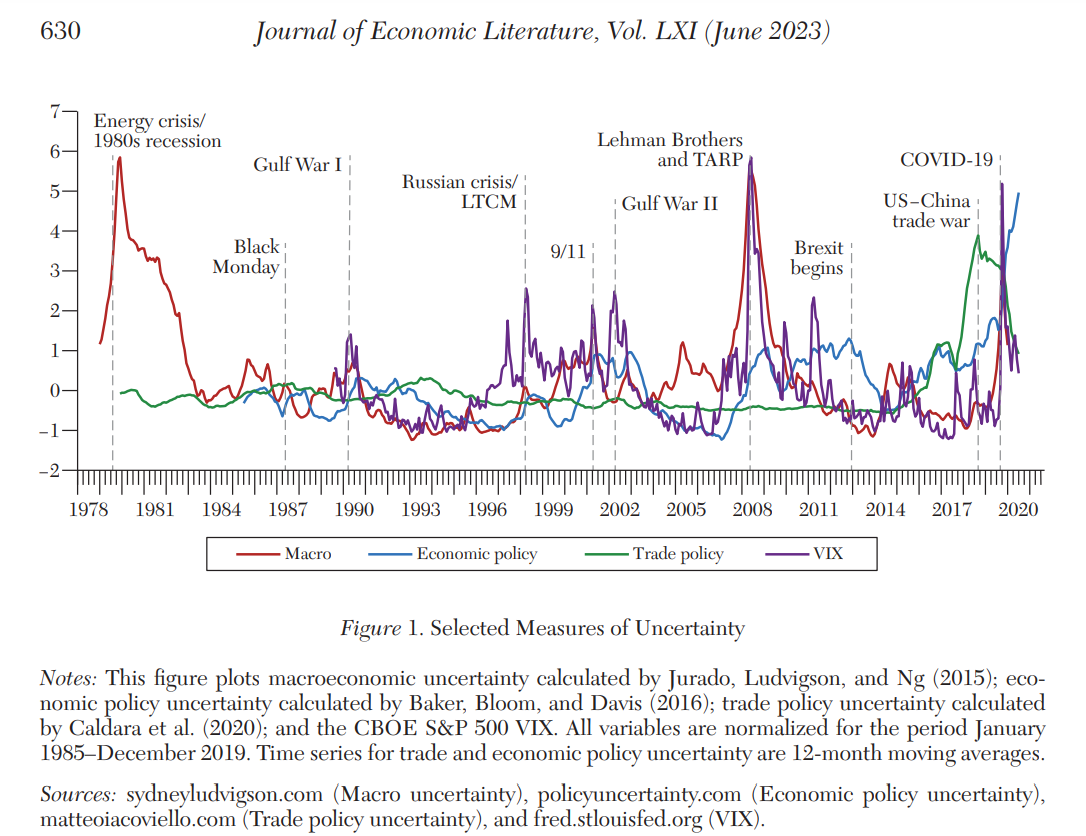

Abstract: This paper provides a comprehensive survey of existing measures of uncertainty, risk, and volatility, noting their conceptual distinctions. It summarizes how they are constructed, their relative advantages in usage, and their effects on financial market and economic outcomes. The measures are divided into four categories based on the construction methodology: news-based, survey-based, econometric-based, and market-based measures. While heightened uncertainty is typically associated with negative real and financial outcomes, the magnitude of these effects and the interpretation of transmission channels crucially depend on identification considerations.

Citation: Cascaldi-Garcia, Danilo, Cisil Sarisoy, Juan M. Londono, Bo Sun, Deepa D. Datta, Thiago Ferreira, Olesya Grishchenko, Mohammad R. Jahan-Parvar, Francesca Loria, Sai Ma, Marius Rodriguez, Ilknur Zer, and John Rogers. 2023. “What Is Certain about Uncertainty?” Journal of Economic Literature, 61 (2): 624-54.

DOI: 10.1257/jel.20211645