Allow me to share this piece by The Economist about Tin, a critical mineral that is enjoying a boom:

They also underline that Tin has a small market size compared to other critical mineral and is sensitive to non-technical risk: “The overall market size is tiny: some 380,000 tonnes of tin were refined last year, compared with 26m of copper, another important industrial ingredient. Three countries—China, Indonesia and Peru—accounted for 74% of global output, meaning subsequent supply disruptions have had an outsize impact. In mid-March Alphamin, a firm that operates a large mine in the Democratic Republic of Congo (DRC), suspended production because of attacks by insurgents.”

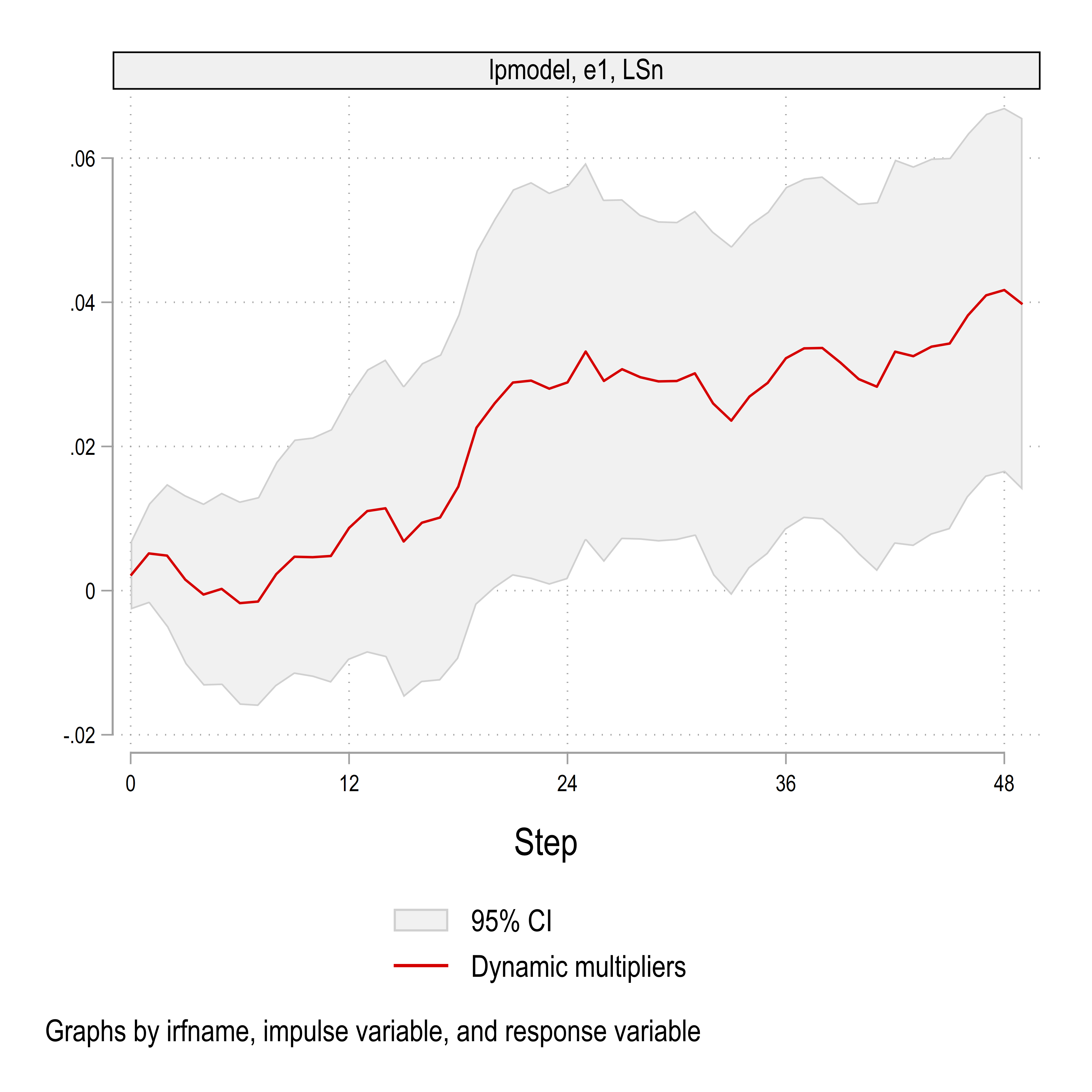

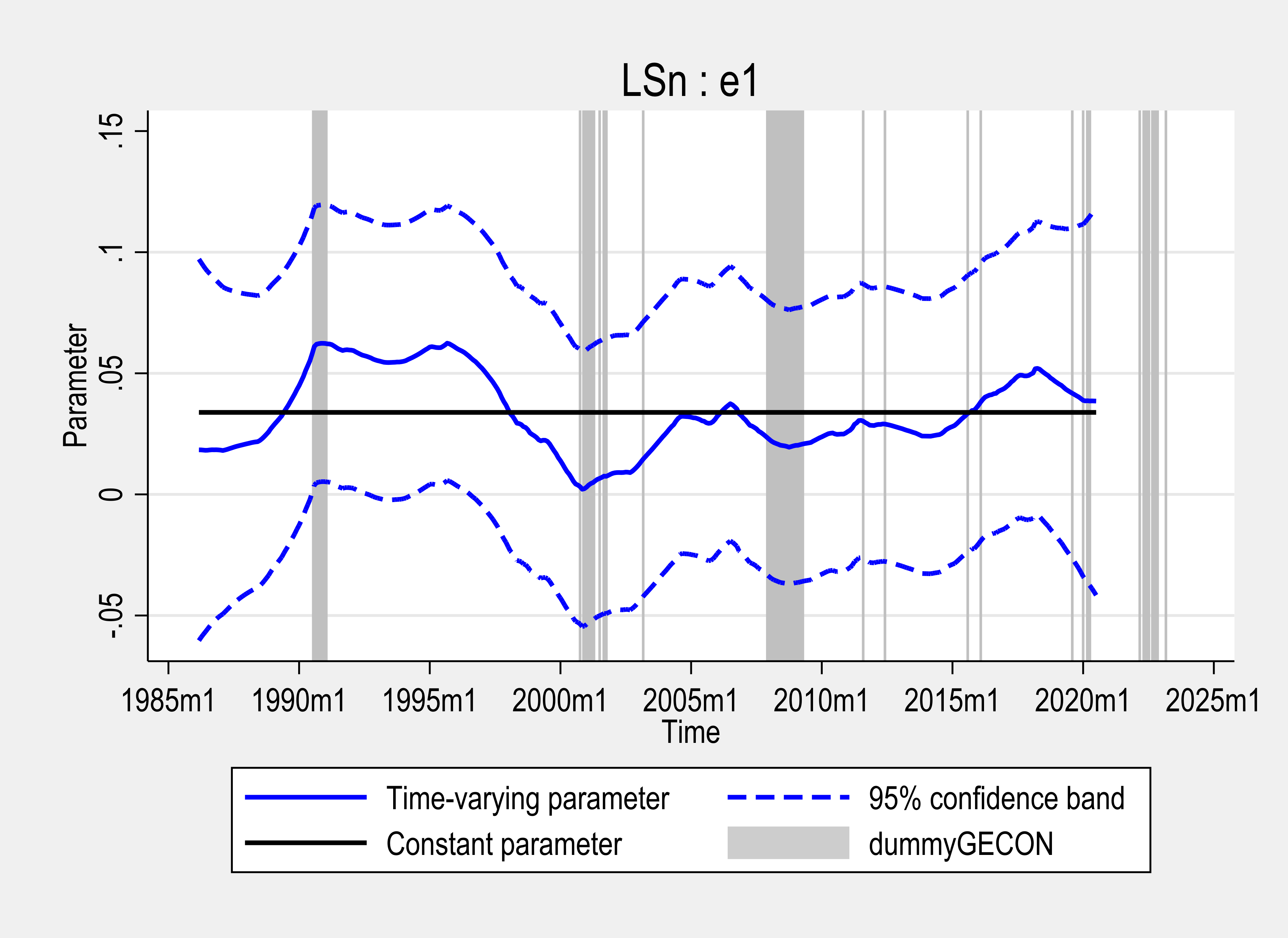

In a recent publication in Energy Economics, we found that geopolitical risk will drive up the price of several critical minerals, especially during episodes of heightened geopolitical tensions.

The elasticity of tin prices to geopolitical threats is around 4 percent after 48 months:

During the Gulf War, we find a spike around 6 percent for the 48-month elasticity of Tin to geopolitical threats:

Before leaving, you can find more EconMacro content about critical mineral by following this link.