Allow me to share with this very nice blog by Felipe Camargo:

https://fcamargo.substack.com/p/applied-linear-algebra-in-economics-0a7

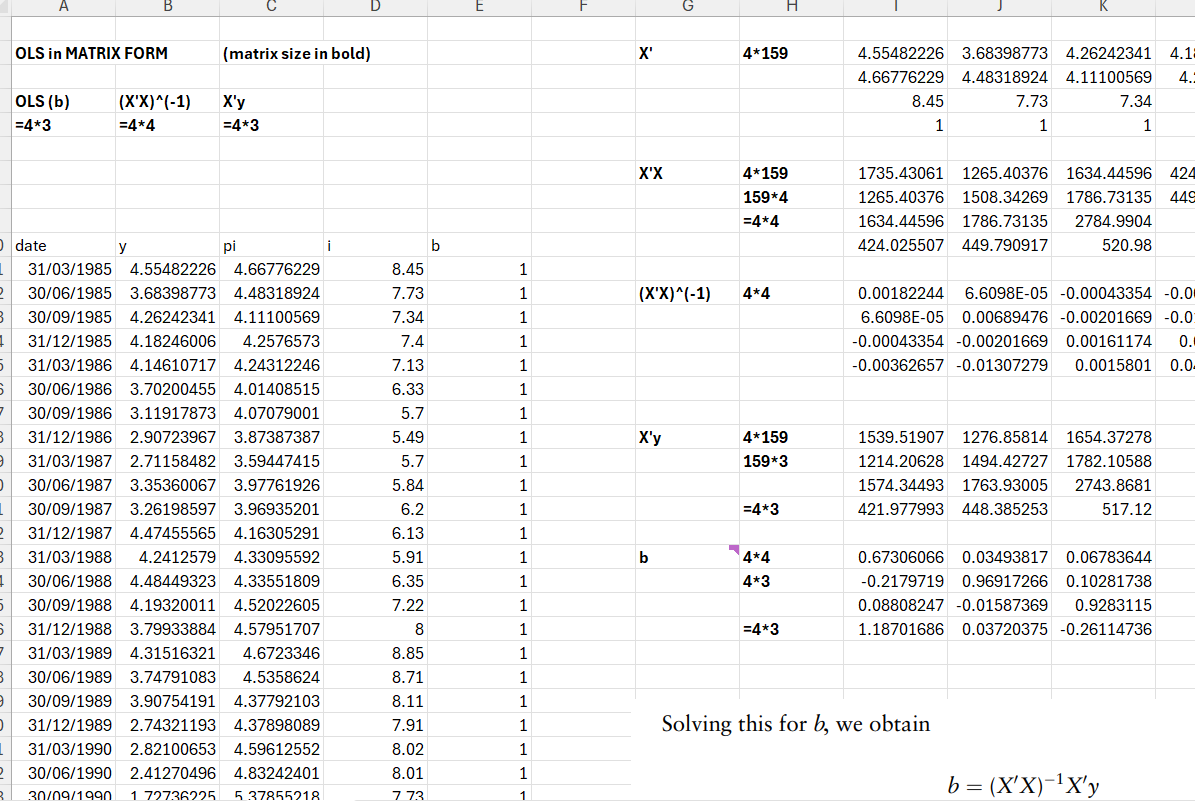

He gives a very nice example on how to identify a shock in VAR model and why it is important. He also provides a good example in Excel. First, I added a sheet to understand the algebra of the first matrix to estimate the VAR.

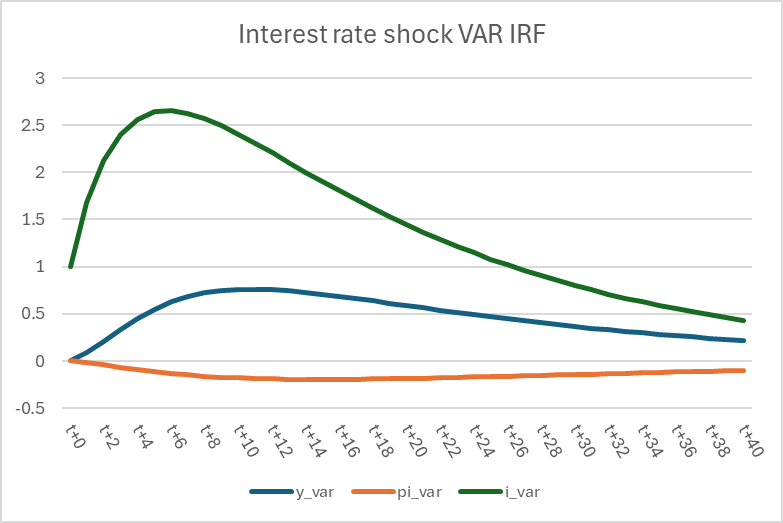

Second, I added a second sheet to estimate the VAR impulse response functions:

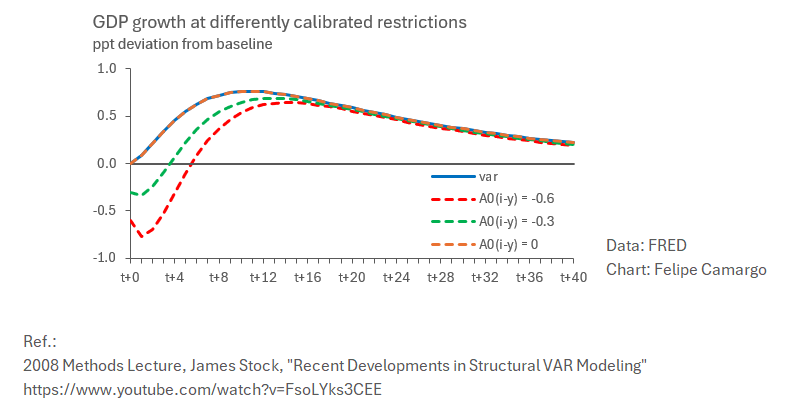

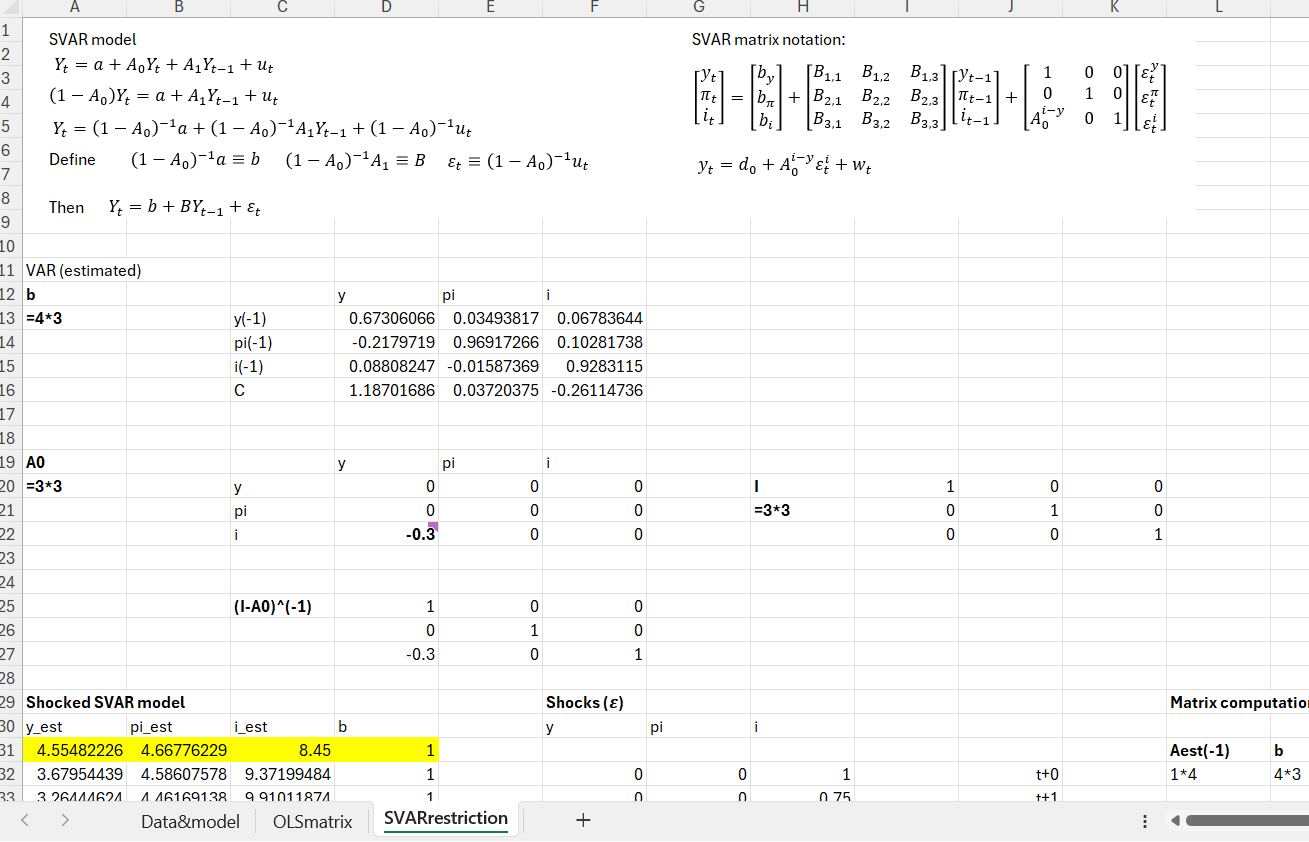

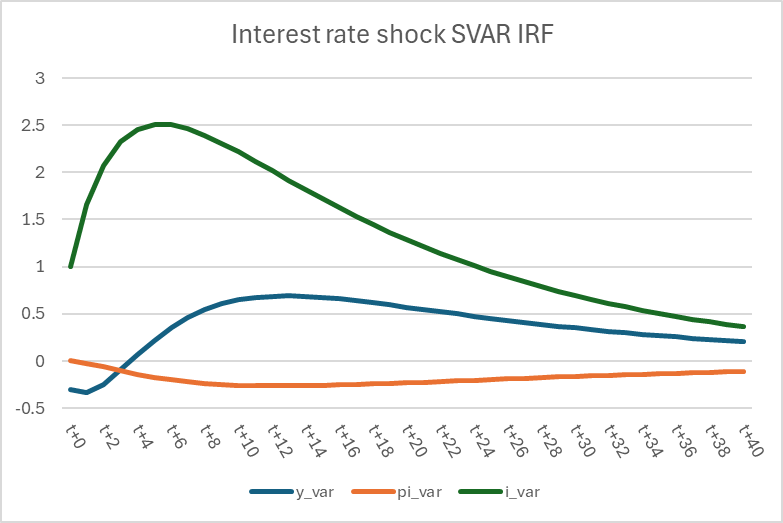

Then, I added a sheet to explain how to explain and estimate the Structural VAR (SVAR). You can see that the matrix inversion is an essential step when you have restrictions (it may explain the success of local projections). You can see the effect of the restriction on the initial reaction GDP:

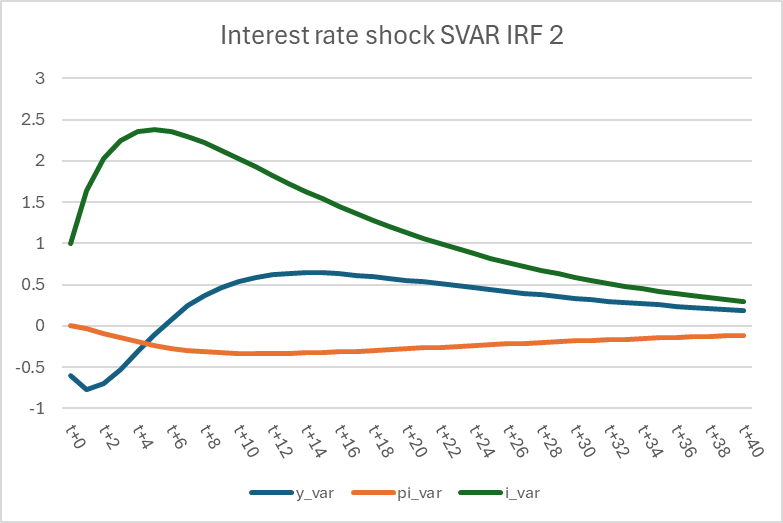

Finally, I change the restriction in the SVAR from -0.3 to -0.6 in a new sheet. As you can see that the contemporaneous reaction of GDP changes from -0.3 to -0.6:

Before leaving, I recommend reading the attached OLS Matrix Algebra file. The files are available below. Enjoy!