The US has announced the toughest sanctions yet on Russian tankers. As stated by Reuters:

“Many of those tankers have been used to ship oil to India and China as a price cap imposed by the Group of Seven countries in 2022 has shifted trade in Russian oil from Europe to Asia. Some tankers have shipped both Russian and Iranian oil.”

This can be understood has a negative supply shock for global oil (at the condition that the OPEC will not offset this reduction in supply and that the market has not overreacted):

“Still, sources in Russian oil trade and Indian refining said the sanctions will cause severe disruption of Russian oil exports to its major buyers, India and China.

Global oil prices jumped more than 3% ahead of the Treasury announcement, with Brent crude nearing $80 a barrel, as a document mapping out the sanctions circulated among traders in Europe and Asia.”

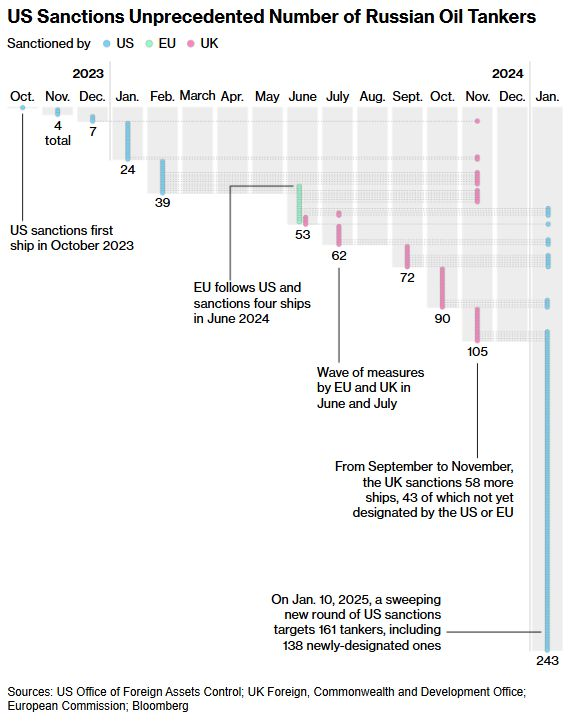

The following timeline, provided by Bloomberg, gives an overview of sanctions on Russian oil tankers:

Mohr and Trebesch provide an excellent survey about the future developments of the literature in this area:

“We review the literature on geoeconomics, defined as the field of study that links economics and geopolitics (power rivalry). We describe what geoeconomics is and which questions it addresses, focusing on five main subfields. First, the use of geoeconomic policy tools such as sanctions and embargoes. Second, the geopolitics of international trade, especially work on coercion and fragmentation. Third, research on the geopolitics of international finance, which focuses on currency dominance and state-directed capital flows. Fourth, the literature on geopolitical risk and its spillovers to the domestic economy, e.g., on investments, credit, and inflation. Fifth, the economics of war, in particular research on trade and war and on military production. As geopolitical tensions grow, we expect the field to grow substantially in the coming years.”

You can also be interested in this special issue of the European Journal of Political Economy that tackles several issues mentioned in the survey:

“In an era of shifting alliances and global uncertainty, understanding the multifaceted nature of political risk is paramount, particularly in the European context. In these 10 articles, this special issue of the European Journal of Political Economy explores this crucial issue by examining how different forms of political risk shape economic outcomes across the continent. The research presented here offers a comprehensive look at the interplay between geopolitics, financial markets, media narratives and political sentiment, providing valuable insights for policymakers and investors alike.”