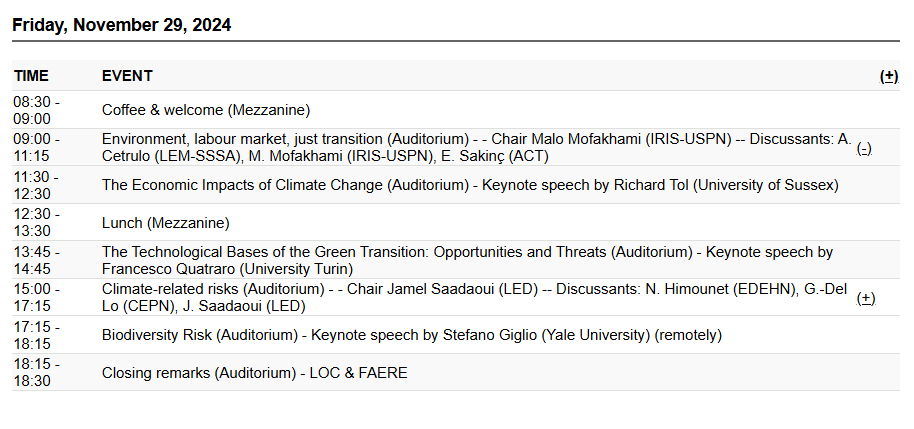

Tomorrow, Friday 29 November, I will be very pleased to chair the “Climate-related risks” session during the 14th JT of the French Association of Environmental and Resources Economists: https://jt-faere-epr24.sciencesconf.org/.

I will present my recent joint work with John Beirne, Donghyun Park and Gazi Salah Uddin: ADB Economics Working paper 748.

Our causal identification relies on the fact that government bond yields and sovereign ratings on foreign currency debt do not influence changes in the ND-GAIN vulnerability scores at any horizon.

Key results:

▶️ Political stability reduces the fiscal impact of climate vulnerability risks

▶️ Financial development also limits the climate risk premium

▶️ The most vulnerable economies face the largest climate-related fiscal risks

▶️ Religious tensions are the most impactful form of political instability

▶️ Stable politics and strong markets together mitigate fiscal risks