Over the past years, I have worked on a broad set of papers on geopolitical risk, macroeconomic dynamics, and international economics. If I had to identify one paper as my flagship contribution, it would be the one built around bilateral geopolitical turning points.

The core idea is simple but demanding: instead of relying on smooth risk indices or endogenous policy changes, the paper identifies unexpected geopolitical events, namely, sharp turning points in bilateral relations, that are plausibly exogenous to macroeconomic and financial fundamentals. These events provide a clean shock that can be traced through the economy using local projections and structural identification logic.

What makes this contribution particularly valuable, in my view, is not only the results, but the identification strategy itself. By focusing on genuinely unexpected geopolitical shifts, the paper isolates a causal object that is interpretable at every horizon and reusable across contexts, like macroeconomic activity, trade, investment, commodity prices, and financial markets. In an environment where reforms and institutional changes are often deeply endogenous, this approach helps clarify what geopolitical risk actually does to the economy, rather than what it merely correlates with.

The working paper is available on SSRN:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5366829

This paper is part of a broader research agenda on geopolitical risk and the global economy, including work on:

– Bilateral geopolitical relations and macroeconomic activity

– Geopolitical risk and investment dynamics

– Geopolitical tensions, trade, and global value chains

– Geopolitical shocks and commodity prices (notably energy markets)

– Geopolitics, uncertainty, and macro-financial transmission

– Political economy dimensions of international risk and vulnerability

Together, these papers aim to improve identification, interpretation, and policy relevance in the empirical analysis of geopolitical risk.

Stay tuned for new projects in 2026 🤠

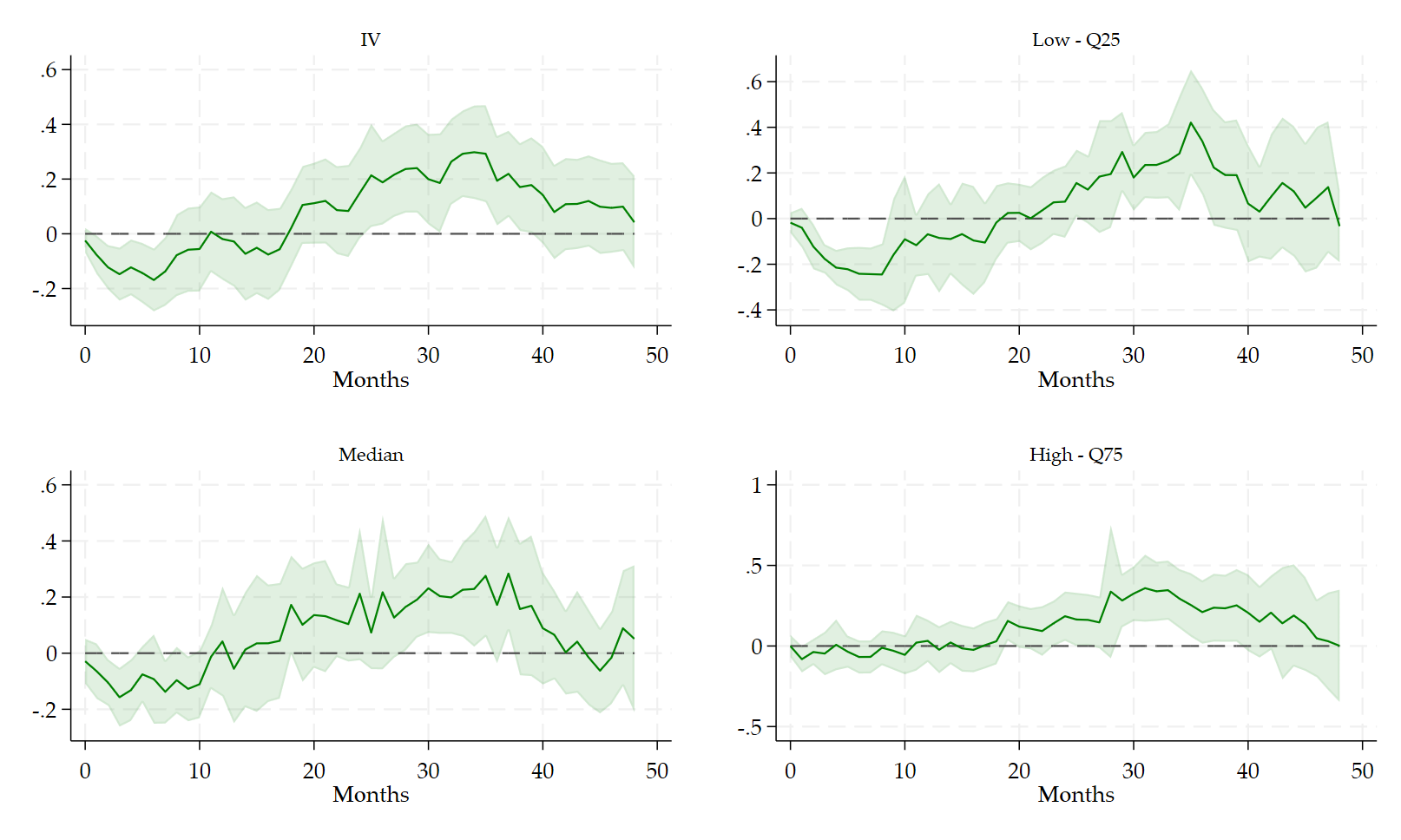

One picture from the paper:

Note: IV-LP quantile local projections estimates. The shock is a positive unit shock on the PRI. This positive shock corresponds to an improvement in the relationship between the US and China. 90% confidence intervals.