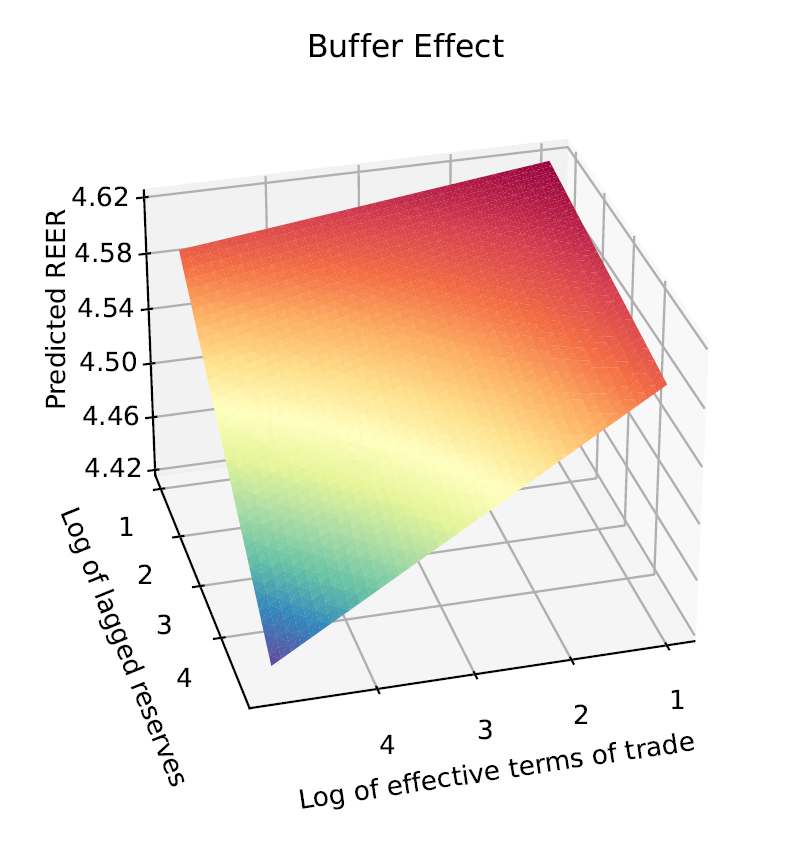

NEW WORKING PAPER: The global financial crisis has brought increased attention to the consequences of international reserves holdings. In an era of high financial integration, we investigate the relationship between the real exchange rate and international reserves using nonlinear regressions and panel threshold regressions over 110 countries from 2001 to 2020. We find the buffer effect of international reserves is more pronounced in Europe and Central Asia above a threshold of 17% of international reserves over GDP. Our study shows the level of financial-institution development plays an essential role in explaining the buffer effect of international reserves. Countries with a low development of their financial institutions may manage the international reserves as a shield to deal with the negative consequences of terms-of-trade shocks on the real exchange rate. We also find the buffer effect is stronger in countries with intermediate levels of financial openness.

You are welcome to download, share or comment the following working paper:

- Joshua Aizenman, Sy-Hoa Ho, Luu Duc Toan Huynh, Jamel Saadaoui, Gazi Salah Uddin (2023), Real Exchange Rate and International Reserves in the Era of Financial Integration. NBER Working Paper Series, 30891, https://www.nber.org/papers/w30891

1 Comment

[…] Real Exchange Rate and International Reserves in the Era of Financial Integration […]