NEW WORKING PAPER: This paper investigates nonlinearities in the inflation-growth-uncertainty relationship in Chinese provinces over the period 1992 to 2017 using nonlinear models and dynamic panel threshold models. We find that for the full sample period (1992-2017), inflation rates exceeding 9.7% are associated with a positive growth effect (β2 = 0.03). Below this threshold, the correlation is insignificant. Since inflation rates above 9.7% were mainly observed in the early to mid-1990s, we restrict the sample to 1999-2017. In this period, the inflation threshold lowers to approximately 5.1%. Moreover, the relationship between inflation and growth shifts across the two regimes: below 5%, inflation is positively associated with growth (β1 = 0.01), while above 5%, the effect turns negative and statistically insignificant. We further explore whether the effect of inflation on growth could be affected by uncertainty at the provincial level. For that purpose, we combine two recent uncertainty indices for the Chinese economy that are based on Chinese newspapers. We find that inflation only has a positive effect on growth for low-levels of uncertainty. For high-levels of uncertainty, the effect of inflation on growth turns negative and statistically insignificant.

You are welcome to download, share, or comment on the following working paper:

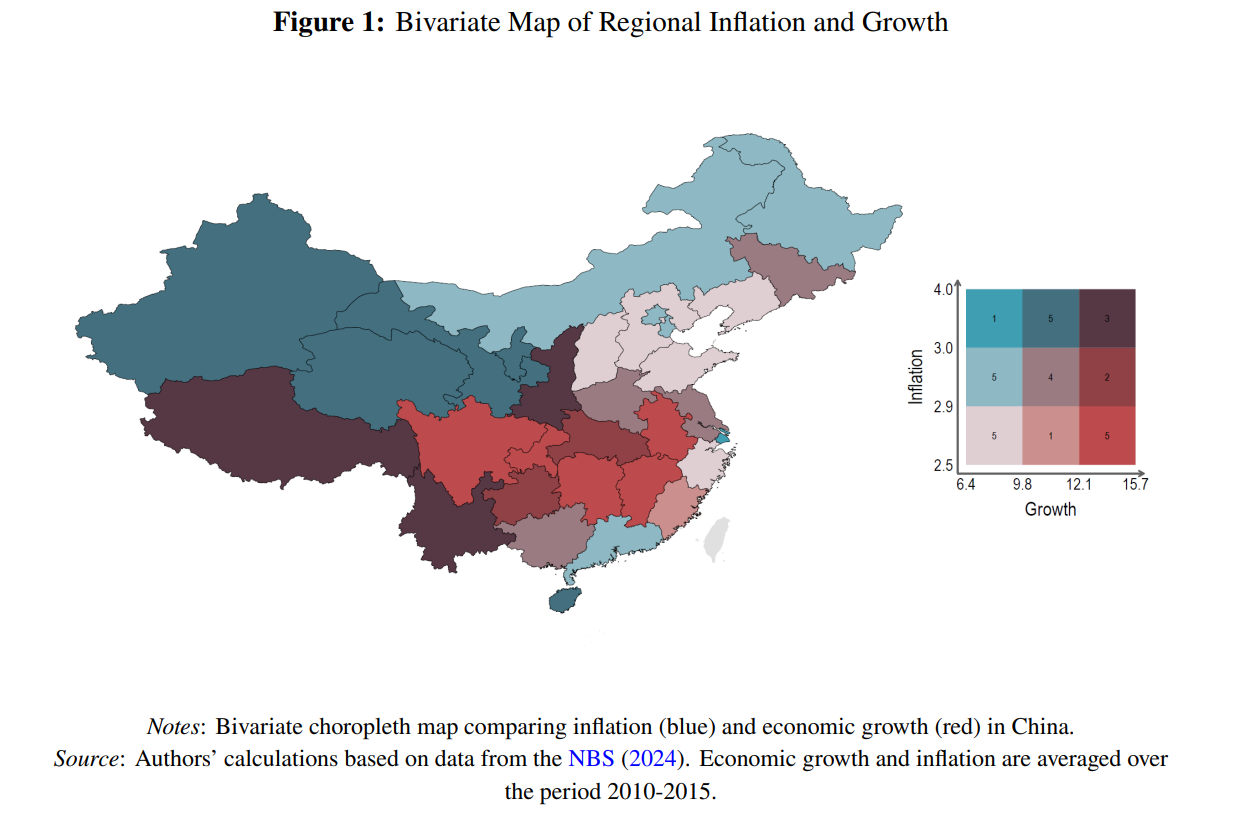

- Glawe, L., Saadaoui, J., & Xu, C. (2024). Nonlinearities in the Inflation-Growth Relationship and the Role of Uncertainty: Evidence from China’s Provinces. Available at SSRN 5067849.