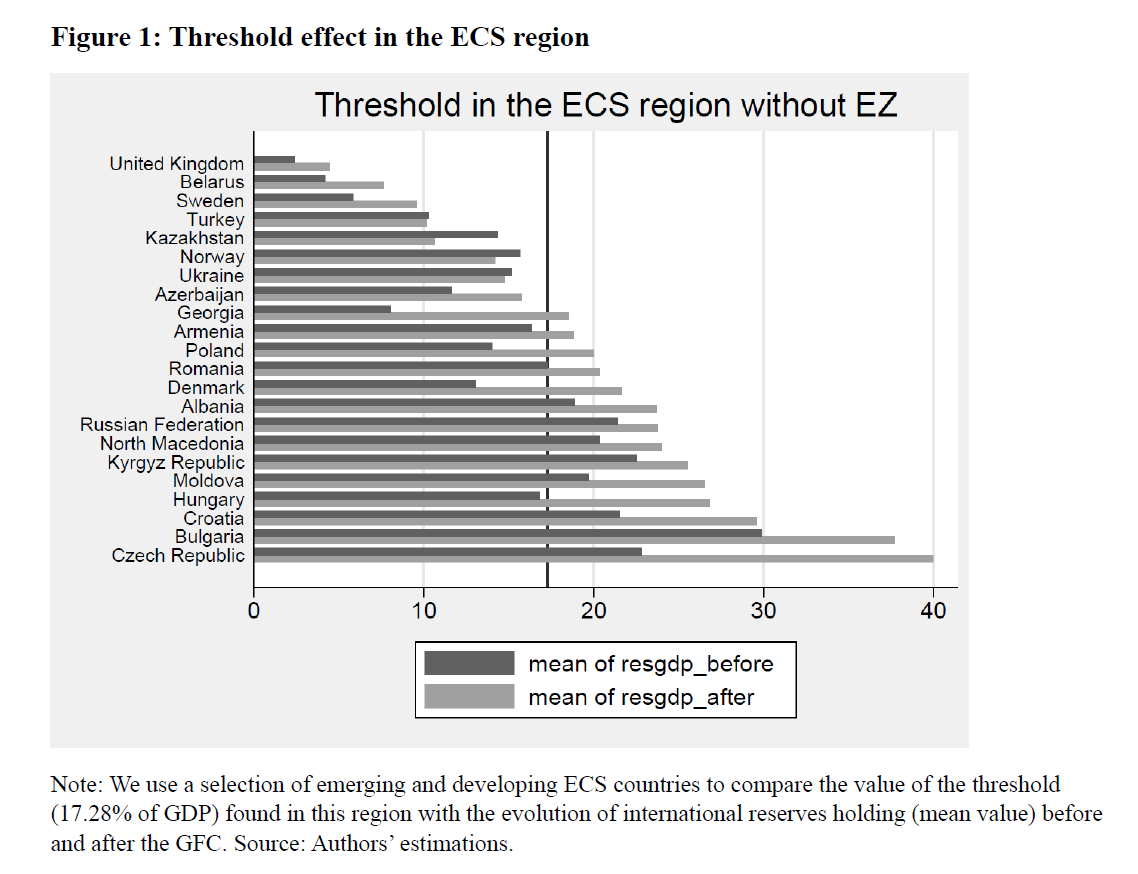

NEW WORKING PAPER: This study examines the impact of international reserves on real exchange rate (RER) stability in the Europe and Central Asia (ECS) region, focusing on how financial development levels affect this relationship. Using panel threshold regression, the analysis reveals that international reserves significantly stabilize RER when reserves exceed 17.28% of GDP, especially in countries with underdeveloped financial systems. The findings suggest that reserves play a more critical role in less developed financial markets, providing insights for policymakers on optimal reserve management and financial development strategies in emerging economies.

You are welcome to download, share, or comment on the following working paper:

- Jamel Saadaoui (29 August 2024), Financial Development, International Reserves, and Real Exchange Rate Dynamics: Insights from the Europe and Central Asia Region. SSRN Working Paper 49412023.

2 Comments

[…] Financial Development, International Reserves, and Real Exchange Rate Dynamics: Insights from the Eu… […]

[…] Some countries at the euro area periphery, like Bulgaria, Bosnia and Herzegovina, North Macedonia, and, Romania hold a large share of reserves in euro. The lack of financial depth may explain why they hold so much reserves, especially after the euro crisis, see this paper. […]