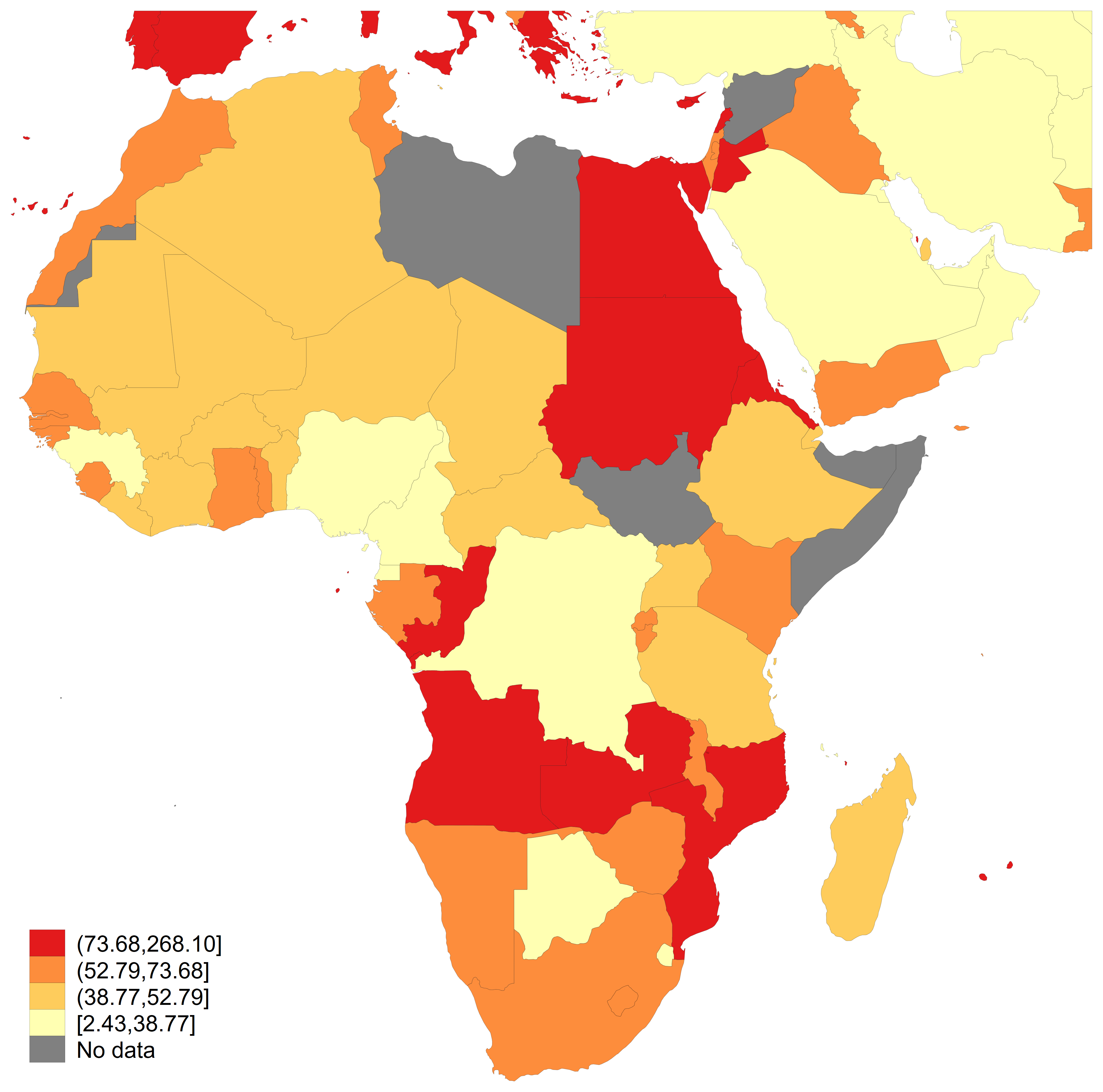

NEW WORKING PAPER: The paper adds to the literature on the issue of public debt in African economies, by investigating the role foreign exchange reserves play in improving the level of indebtedness, and as a buffer of the negative effect of exchange rate depreciation while considering the exchange rate policy. Our results show a direct link between the level of foreign currency reserves and that of external debt in Africa. Particularly, we demonstrate that higher foreign currency reserves tend to decrease the public debt stock to GDP. This effect is even more significant when countries go through high exchange rate depreciation episodes (10% or higher). This impact, however, is not homogenous among country groups, as only countries with a floating exchange regime tend to benefit from this buffer effect compared to anchored regimes. In a time when most African economies face severe exchange rate depreciation episodes following the U.S. monetary tightening policy, central bankers and policy makers need to consider a plethora of policy issues including interventions in the FX market to mitigate depreciations and maintain a sustainable public debt stock.

You are welcome to download, share, or comment on the following working paper:

- Issiaka Coulibaly, Blaise Gnimassoun, Jamel Saadaoui, Hamza Mighri (18 December 2023), International reserves, currency depreciation and public debt: new evidence of buffer effects in Africa, BETA Working Paper 2023-43: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4664347.

Leave a Reply