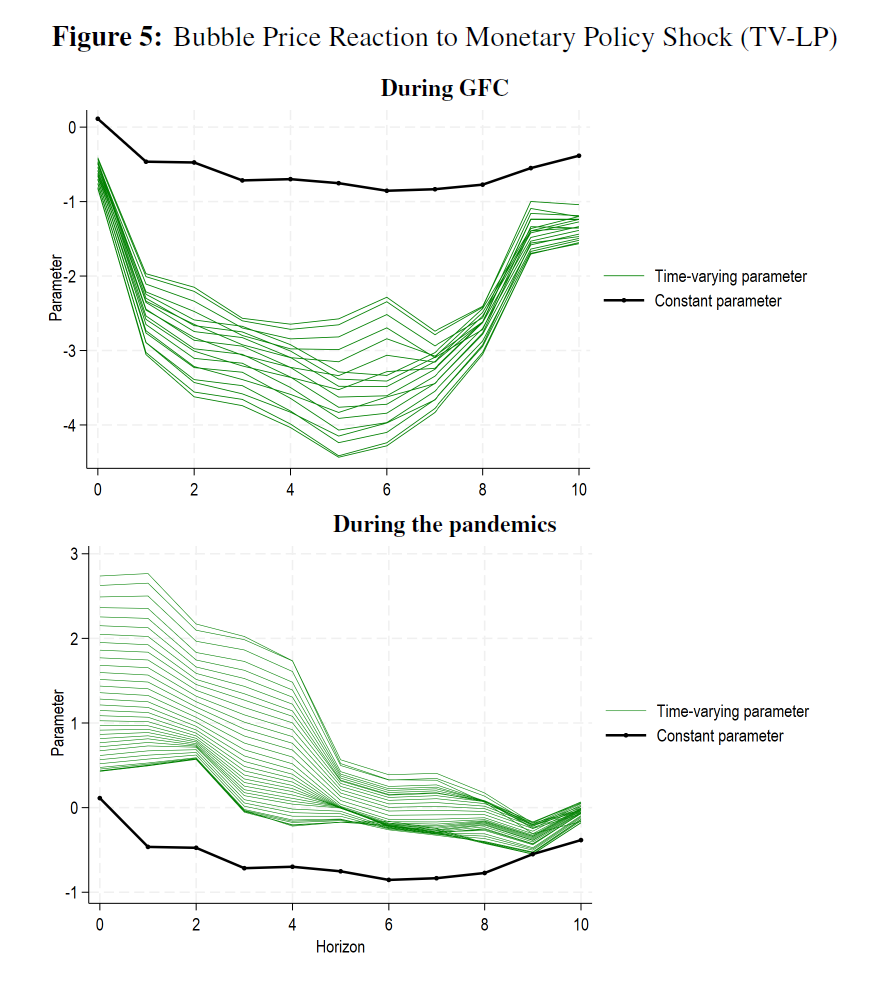

NEW WORKING PAPER: This paper examines how U.S. monetary policy shocks influence asset price bubbles under different inflation regimes. Using data from 1998-2023, we show that the transmission of policy is neither constant nor time-invariant. Standard local projection (LP) estimates suggest modest average effects, but including the COVID-19 period reveals that these relationships weaken. Employing time-varying local projections (TVP-LP), we document sharp shifts in transmission during the Global Financial Crisis and the pandemic, motivating a nonlinear approach. Nonlinear VAR-LP estimates uncover clear asymmetries: in high-inflation states, monetary tightening deflates bubbles by raising financing costs and constraining risk-taking; in low-inflation states, the same shocks amplify bubbles by raising expected inflation, narrowing credit spreads, and boosting equity returns. We interpret this inversion as evidence of a state-contingent speculative signaling channel, whereby tightening is perceived as a signal of stronger demand or implicit accommodation, encouraging further speculation. This mechanism highlights that safeguarding financial stability requires more than interest rate adjustments alone—it demands explicit attention to the inflationary environment and investor perceptions.

You are welcome to download, share, or comment on the following working paper:

- Ginn, W., Saadaoui, J., Salachas, E. (2025). Stock Price Bubbles, Inflation and Monetary Surprises (September 21, 2025). Available at SSRN: 5513359.