To allow national fiscal stabilizers to work, governments must be able to borrow at an affordable cost in times of economic stress. A strong fiscal framework is indispensable to achieve this, and protects countries from contagion. But the crisis experience suggests that, in times of extreme market tensions, even a sound initial fiscal position may not offer absolute protection from spillovers.

Mario Draghi (2015).

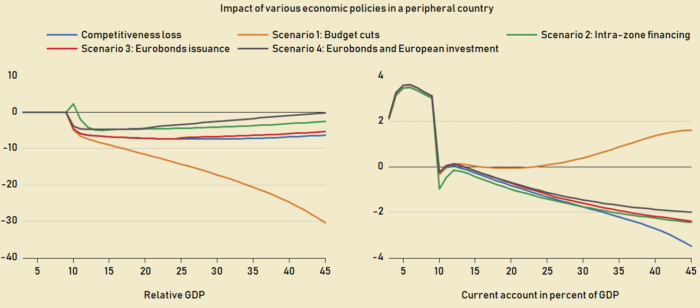

NEW PUBLICATION: The euro crisis sheds light on the nature of alternative adjustment mechanisms in the EMU. This article examines the exchange rate misalignments within the euro zone, using a FEER approach. To explore the consequences of these misalignments, we use an open economy SFC model with endogenous interest rates and Eurobonds. Facing a competitiveness loss in southern countries due to misalignments, three sets of alternative economic policy are investigated: a policy‐mix based on tax rebates to improve competitiveness; an increase in intra‐European financing by banks of northern countries; and an issuance of Eurobonds to pool European sovereign debt.

To maintain social and political cohesion, competitiveness gains should not come at the price of huge losses in terms of GDP.

Vincent Duwicquet, Jacques Mazier, Jamel Saadaoui. Dealing with the consequences of exchange rate misalignments for macroeconomic adjustments in the EMU, Metroeconomica, 2018, 10.1111/meca.12211

Leave a Reply