Even with more flexible economies, internal adjustment will always be slower than it would be if countries had their own exchange rate.

Mario Draghi (2015).

The title of this post has been inspired by the excellent book of Surjit S. Bhalla.

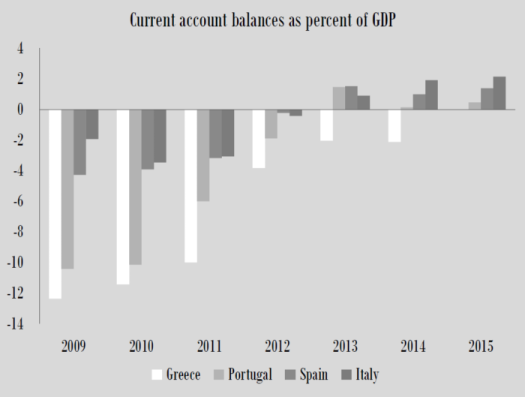

From the onset of the euro crisis to the Brexit vote, we have witnessed impressive reductions of current account imbalances in peripheral countries of the euro area. These reductions can be the result of either a compression of internal demand or an improvement in external competitiveness. In this paper, we compute exchange rate misalignments within the euro area to assess whether peripheral countries have managed to improve their external competitiveness. After controlling for the reduction of business cycle synchronization within the EMU, we find that peripheral countries have managed to reduce their exchange rate misalignments thanks to internal devaluations. To some extent, these favourable evolutions reflect improvements in external competitiveness. Nevertheless, these gains could only be temporary if peripheral countries do not improve their non-price competitiveness, their trade structures and their international specializations in the long run.

These reductions could correspond to real improvements of external competitiveness or to huge compressions of internal demand.

Feel free to download, share or comment the following preprint:

Jamel Saadaoui. Internal Devaluations and Equilibrium Exchange Rates: new evidences and perspectives for the EMU, Applied Economics, 2018, https://doi.org/10.1080/00036846.2018.1486019.

Leave a Reply