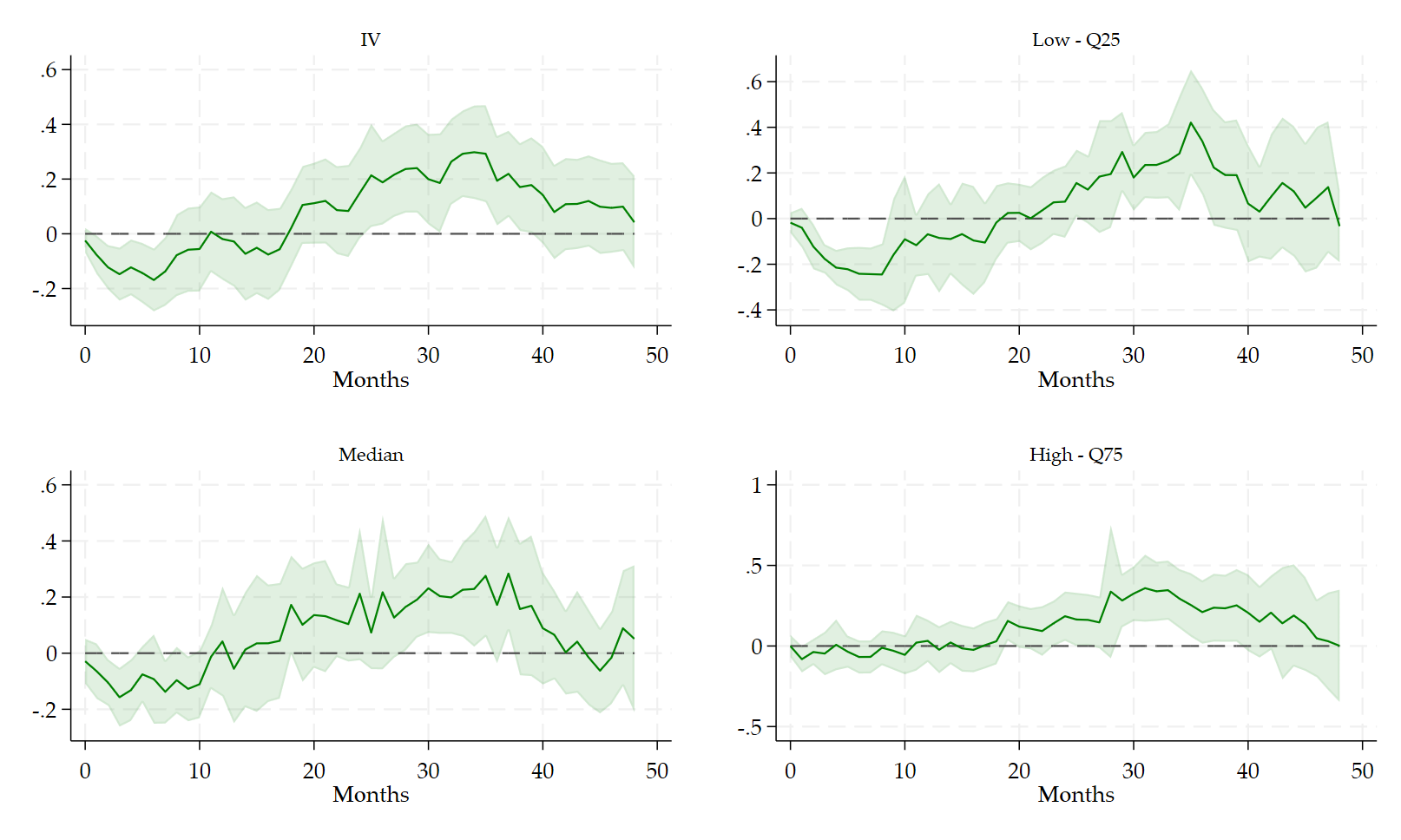

NEW WORKING PAPER: I investigate the dynamic causal impact of geopolitical relationships between the US and China, two major players in the oil markets. Following previous work on the causal impact of geopolitical tensions on oil prices, I introduce a new instrument, the second difference of the Political Relationship Index (PRI), to address endogeneity. This instrument captures the sudden changes in the geopolitical dynamics that are not anticipated by the markets and economic agents. Relying on Instrumental Variable-Local Projections (IV-LP), I confirm that the oil prices react to exogenous innovations in geopolitical relations between the US and China. Following an improvement in the relations, the oil prices decline (i.e., the elasticity is around -0.2% after 6 months) in the short run and increase in the medium term (i.e., the elasticity is around 0.3% after 32 months). This pattern is further confirmed using quantile IV-LP. We document for the first time an important asymmetric response of the oil price conditional to its level in the wake of exogenous shocks in the political relation between the US and China. When the price of oil is low, the short-run reaction is stronger. Besides, when the price of oil is high, the medium-run reaction is stronger.

You are welcome to download, share, or comment on the following working paper:

- Saadaoui, J. (2025). Geopolitical Turning Points and Oil Price Responses: An IV-LP Approach. Available at SSRN: 5366829.

Note: IV-LP quantile local projections estimates. The shock is a positive unit shock on the PRI. This positive shock corresponds to an improvement in the relationship between the US and China. 90% confidence intervals.