Today, let me echo a post written by Nicholas Wall, Head of Global FX Strategy, Global Fixed Income Currency & Commodities at J.P. Morgan. We have a lot of repricing of Asian currencies against the USD, as noted by Robin Wigglesworth from the Financial Times. You can take a look at this one from The Economist about the higher volatility on the Forex.

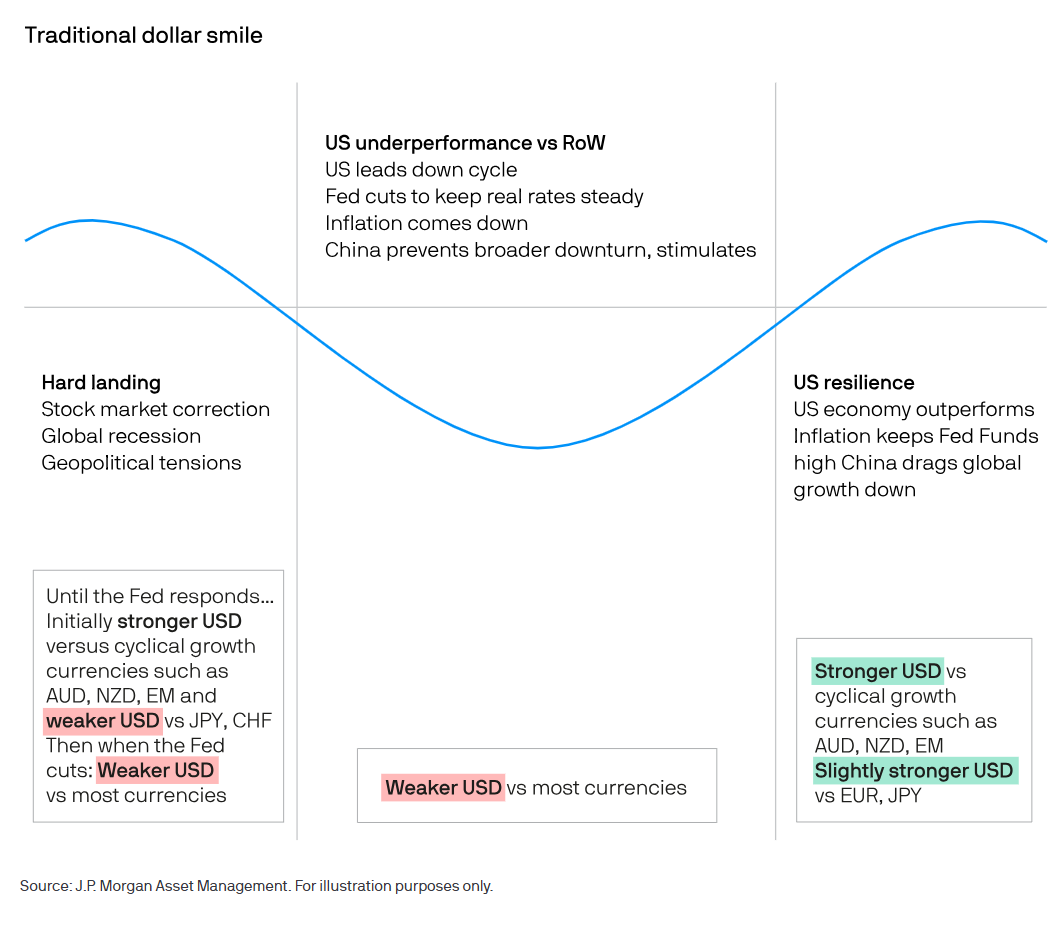

In the traditional USD smile framework during a first phase of hard landing during a global recession, for example, the USD is stronger vs. AUD, NZD, and EM currencies and weaker vs. JPY and CHF (which are considered as safer). Then, during the second phase, the Fed cut and the USD underperforms vs. most currencies. In the third phase, the US economy is resilient and outperforms inflation. The Fed Funds remain high, and the USD is stronger vs. AUD, NZD, and EM currencies and slightly higher in the cases of the safer currencies, namely the JPY and CHF.

The difference with the smile framework is that the net international investment position (NIIP) of the US has deteriorated a lot since the global financial crises (GFC).

From Wall’s blog: “In our framework, we believe that capital flows since the Global Financial Crisis and the current high cost of hedging USD assets for non-US investors would see the USD weaken in a “left-hand side” scenario. We therefore believe the new US dollar smile resembles more of a smirk.”

In this context, the first phase will make the dollar smile resemble a dollar smirk scenario. The landscape of capital flow since the GFC and the cost of hedging the currency risk will explain why the dollar may not act as a safe heaven in the occurrence of a global recession.