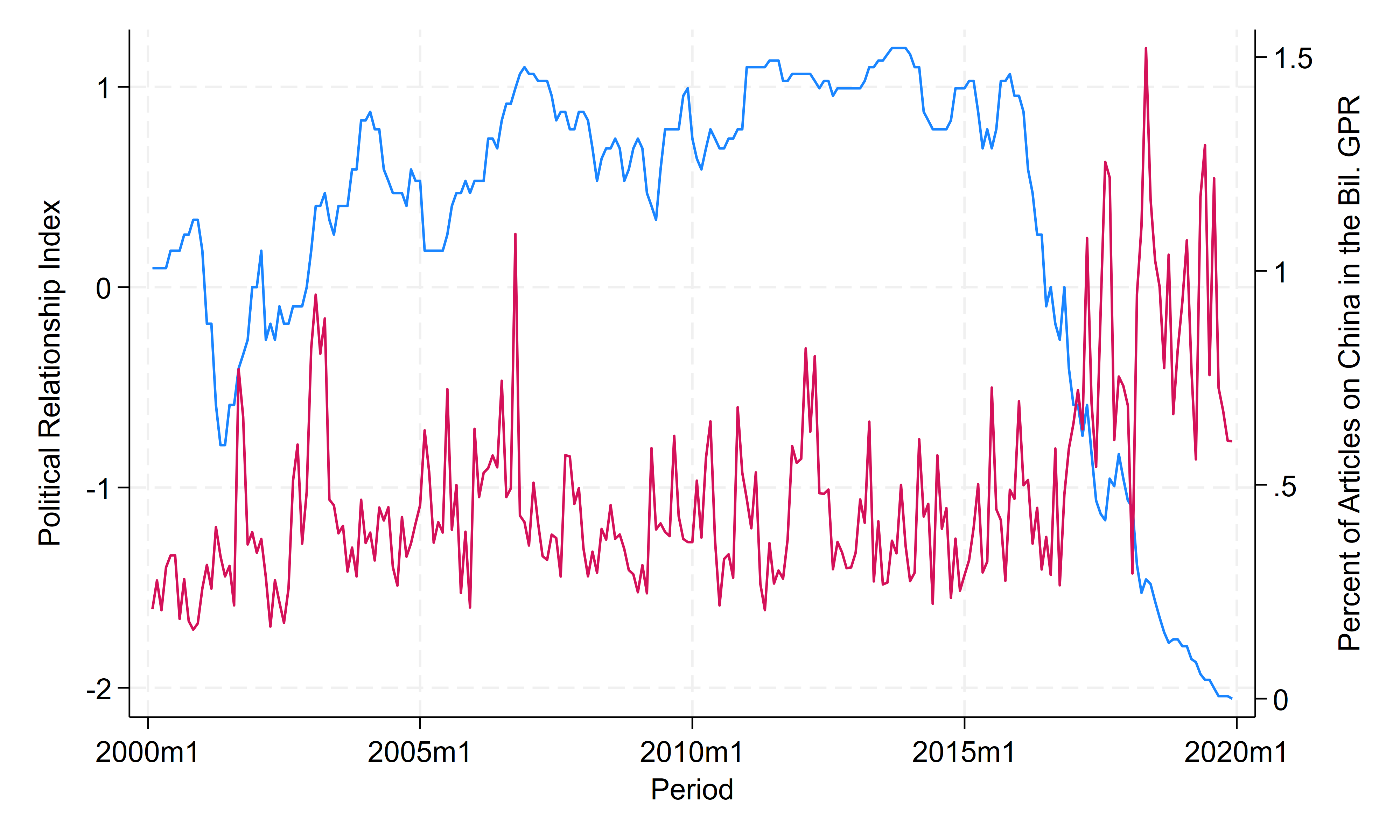

NEW WORKING PAPER: This paper assesses the effect of US-China political relationships and geopolitical risks on oil prices. To this end, we consider two quantitative measures — the Political Relationship Index and the Geopolitical Risk Index — and rely on structural VAR and local projections methodologies. Our findings show that improved US-China relationships, as well as higher geopolitical risks, drive up the price of oil. Positive shocks on the political relationship index are associated with optimistic expectations regarding economic activity, whereas positive shocks on the geopolitical risk index reflect fears of supply disruption. Political tensions and geopolitical risks are thus complementary factors, the former being linked to the demand side and the latter to the supply side.

You are welcome to download, share or comment the following working paper:

- Valérie Mignon, Jamel Saadaoui, How Political Tensions and Geopolitical Risks Impact Oil Prices? (May 23, 2023). BETA Working Paper 2023-15: https://dx.doi.org/10.2139/ssrn.4456924.

Leave a Reply