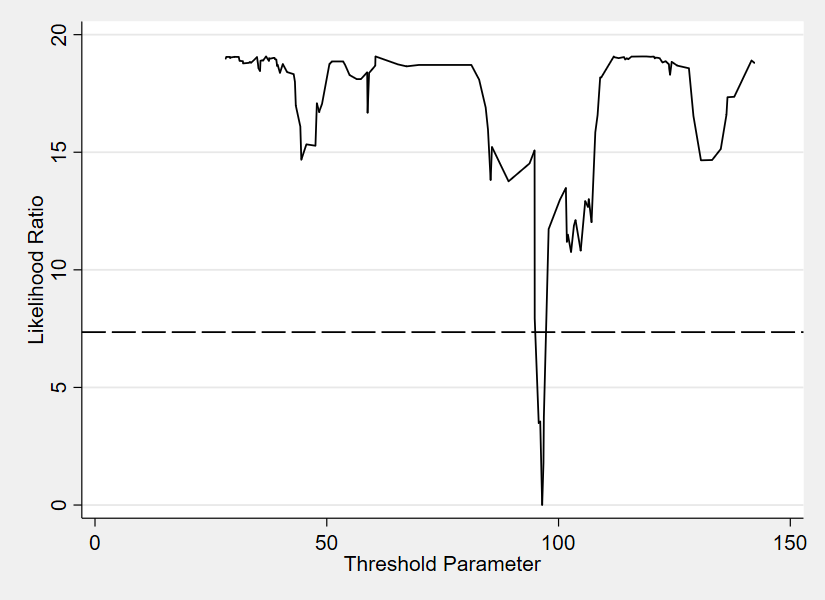

NEW WORKING PAPER: While it is widely recognized that the development of a sound financial system may contribute to foster economic growth, the relation between economic growth and financial activities is complex. In this perspective, our contribution investigates the existence of threshold effects in the relationship between economic growth and bank credit. Our sample of ASEAN countries is examined over the period spanning from 1993 to 2019. We use the approach of Kremer et al. (2013) to estimate threshold effects in a dynamic panel where a group of explanatory variables can be endogenous. Our results do not confirm the vanishing effect of finance on economic growth. We found a threshold of 96.5% (significant at the 5% level) for the credit-to-GDP ratio, the threshold variable. In the short run, for observations inferior or equal to the threshold, the positive effect of bank credit expansion on economic growth is around 0.08 (significant at the 1% level). Whereas, for observations superior to the threshold, the positive effect of bank credit expansion on economic growth is around 0.02 (significant at the 1% level). The role of exporting firms is essential in ASEAN countries, as they are more export-oriented than other regions in the world economy. Our results may indicate that the beneficiary of the credit (firms versus households), the structural features (export-led growth), and the regional heterogeneity have to be considered in empirical investigations of threshold effects in the relation between economic growth and bank credit. This empirical evidence may help to formulate sound policy recommendations.

Feel free to download, share or comment the following working paper:

- Sy-Hoa Ho, Jamel Saadaoui. Bank Credit and Economic Growth: A Dynamic Threshold Panel Model for ASEAN Countries. BETA Working Paper 2021-24 (2021). Available at SSRN: https://ssrn.com/abstract=3861675.